Here’s the Market Drop We Were Expecting – Take Profits When VXX Hits This Price

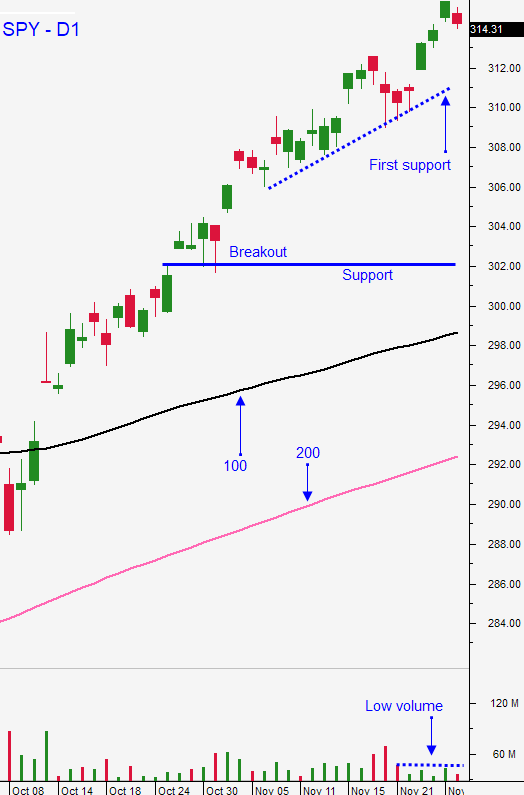

Posted 9:30 AM ET - Profit-taking Monday stripped away the gains from the last week. This morning the S&P 500 will challenge the uptrend line that started at the breakout in October. That first support level is at SPY $310. We are getting the dip we've been waiting for and our VXX position is performing.

President Trump said that it might be better if we wait for the 2020 elections before we sign a trade deal with China. Anti-China trade rhetoric is gaining traction with voters and the government is raking in billions of dollars in tax revenue. China is demanding that all tariffs be removed before a trade truce is considered. Trump will not "cave-in" and a deal is unlikely. US economic growth is strong and consumers are not paying higher prices for Chinese goods due to currency devaluation. Last week the president signed a bill supporting pro-democracy protests in Hong Kong and China promised to retaliate. By comparison the US exports four times more goods to Canada and Mexico. The USMCA is much more important than a trade truce with China.

China's economic growth is also stable so they will not be in a hurry to make a deal. China's food prices are jumping because of the US agricultural boycott so they are likely to increase purchases even if there is not a truce.

As I've been saying all year, a trade deal with China will not happen before the 2020 election. This speed bump will flush out bullish speculators and the dip will provide an excellent buying opportunity into year-end. We've been waiting patiently on the sidelines and we are about to be rewarded.

ISM manufacturing dropped to 48.1 yesterday. That was weaker than expected, but manufacturing only accounts for 20% of our economic activity. ADP, ISM services and the Unemployment Report will be more important.

Boris Johnson has a healthy lead in the polls and a victory in 10 days would lead to a Brexit agreement. This would reduce market uncertainty.

Swing traders are long VXX at $17.50. Place an order to sell at $20.00. We are going to scale in to a long SPY position on this market pullback. Place orders to buy the SPY at $307, $305, $302 and $300. Each leg will be a 1/4 position. We will adjust our orders as we go along, but I want to make sure we have some orders “working” in case we hit an air pocket. Bullish sentiment has been high and speculators are about to get flushed out. If trading programs kick in and we could see a nasty drop of more than 50 S&P points. Staying sidelined when the market was making new all-time highs was one of the hardest things to do. Instead of adjusting losing positions we will be scooping up opportunities. I am going to be using Option Stalker searches to find bullish put spreads. This speed bump won't last long and we need to be ready. Tomorrow night I will post my Weekly Swing Trading Video and the next round of bullish put spreads will generate nice returns through year-end.

GET THE WEEKLY SWING TRADING VIDEO AND ALL OF OUR RESEARCH FOR JUST $59/MONTH

Day traders should focus on the short side. Chinese stocks and cyclical stocks will be hit the hardest. I will be looking for stocks with relative weakness during the last week when the market was making a new high. The best candidates will have breached technical support on heavy volume and I will use the following Option Stalker criteria: Relative Weakness D1 + Sell Signal D1 + Heavy Volume D1 + Liquid Options. I may also add other variables to narrow the list. Bearish ADX on M30 would identify stocks that have been in a strong downtrend the last few days and I might also look for stocks that are below the 100-day moving average.

I will not be taking any bearish overnight positions because I view this dip as a buying opportunity. I will day trade from the short side and I will wait patiently for support knowing that my longer-term goal is to sell bullish put spreads.

The China trade truce will spark selling as we expected, but the USMCA is the real story into year-end. Don’t lose sight of that.

.

.

Daily Bulletin Continues...