Here’s What To Expect From the FOMC Statement Today – Use This Option Strategy Now

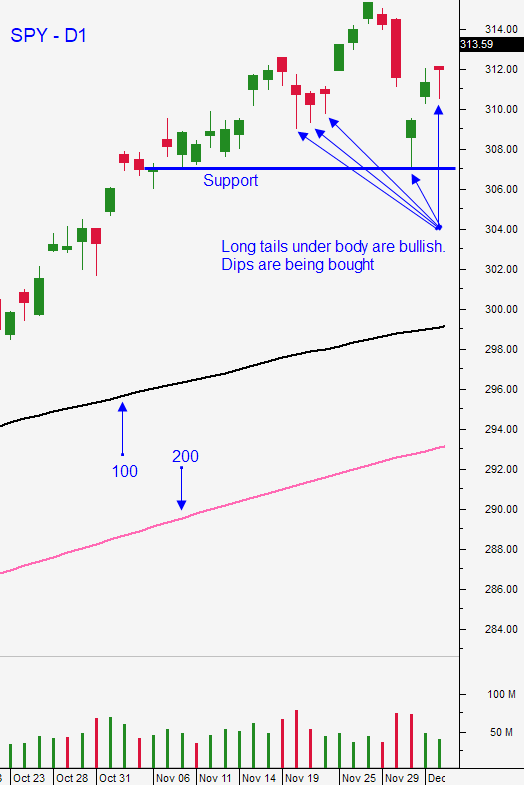

Posted 9:30 AM ET - The market is within striking distance of the all-time high. Seasonal strength and the likely passing of USMCA will keep buyers engaged. Uncertainty is decreasing and major events are being resolved. Look for stable price action with an upward bias. Sell bullish put spreads on dips.

The dollar value of US exports to Mexico and Canada is four times greater than it is for China and it is twice the size of US exports to Europe. USMCA is a huge trade agreement and it could boost 2020 GDP growth by 1%. Rumors suggested that a deal might happen, but now it looks likely.

A trade truce with China won't matter much. If the negotiations hit a roadblock the tariff deadline is likely to be extended. Any related dip is a buying opportunity. Both countries have solid economic growth and they are both raking in billions in tax revenues. US consumers are not feeling the pinch, but Chinese consumers are. Consumer prices in China rose 4.5% last month because of the US agricultural boycott.

From a political viewpoint, Trump is not eager to sign a deal. The anti-China rhetoric is playing well with voters. Democrats can't argue that this trade war is hurting US economic growth when the unemployment rate is at historic lows. However, they could bash him for being weak if he removes most of the tariffs.

Trump recently signed a bill supporting pro-democracy protesters in Hong Kong and he will be signing another bill supporting Muslims in China shortly. That will strike a nerve and we can expect backlash. China said that it will remove all foreign hardware from its government offices in the next three years. Trump's economic advisor Larry Kudlow could not confirm that the new tariffs will not go into effect this Sunday. We've been led to believe that negotiations are taking place around the clock and that progress is being made. We will know in the next few days. My suspicion is that the tariffs will be postponed and the negotiations will continue.

Boris Johnson's lead in the polls is decreasing and the election tomorrow could be close. If he gains support a Brexit agreement is likely to be passed before January 31st. This would remove market uncertainty.

The FOMC statement will be released this afternoon. There should not be any surprises and I am not expecting much of a reaction. The Fed is happy with current policy and it would take a series of weak economic reports to change that.

The budget will be extended before Christmas. Neither party wants to be blamed for government shutdown when the elections are less than a year away.

Swing traders are long a half position of SPY at $313.80 (yesterday’s open). Use a closing stop of $307. Swing traders should be selling out of the money bullish put spreads with more than half of the target position allocated – keep scaling in. Find strong stocks with heavy volume that are breaking through horizontal resistance and that have relative strength. These are the key variables we are using in Option Stalker searches. PopBull and Strong after Earnings are two of my favorite searches and I will be highlighting some new stocks in tonight’s Swing Trading Video. The key is to sell out of the money bullish put spreads below technical support.

Day traders need to use heavy volume in every search. The market has no momentum and the stock has to do it all on its own. Try to find a few stocks early in the day using these Option Stalker searches: Heavy Buying, Relative Strength 30 and Bull Run. The action will die down after two hours of trading. Unfortunately, I'm not expecting much movement after the FOMC statement.

The election results in England won't be known during market hours tomorrow, but a convincing Boris Johnson win could spark buying Friday.

.

.

Daily Bulletin Continues...