This Overnight News Could Spark Buying Friday – Buy Some Calls Near the Close Today

Posted 9:30 AM ET - The market is treading water near the all-time high and major events that pose uncertainty are being resolved. Today England is holding elections and we will know the results overnight. If Boris Johnson gains support (expected) a Brexit deal is likely. Much of this news is already priced into the market and we are waiting to see if new tariffs will be imposed on China this Sunday.

Rhetoric between the US and China has been testy, but positive. You know from my comments that I'm very skeptical about a US/China trade truce. In my opinion the most likely scenario is that the deadline will be postponed and the talks will continue. The market impact will be neutral.

Both sides want to remain strong and they want to preserve investor confidence. One way to achieve that is to keep negotiating for another year. Economic growth in the US/China has been solid so current tariffs are not impacting activity.

The USMCA is the most important trade deal and its significance has been grossly under-reported by the press.

Yesterday's FOMC statement was benign. They are likely to maintain current policy through 2020.

Domestic economic data points have been good and the calendar is light.

Politicians will extend the budget to avoid a government shutdown during the holidays.

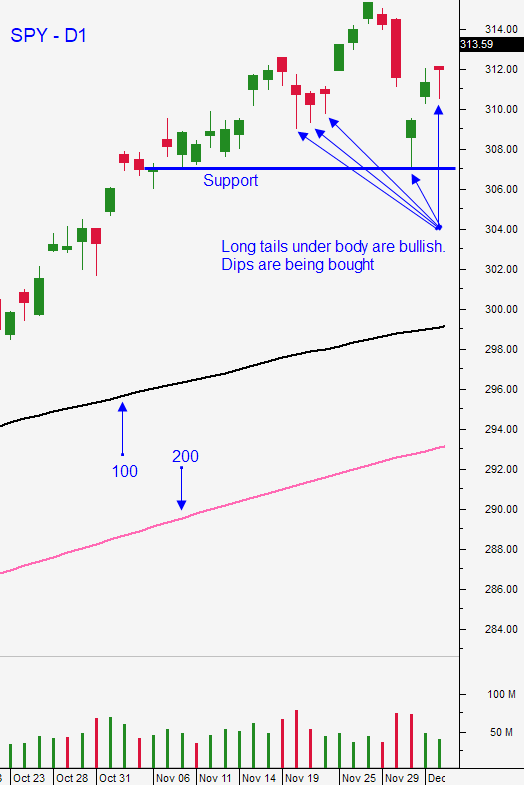

In short, market uncertainty is decreasing. Economic data points are good, earnings are good, the Fed is on hold, the USMCA will be passed and new tariffs on China will be delayed. Provided that Boris Johnson gains support, a Brexit deal is very likely. These outcomes are largely priced into the market. The next catalyst is time. Stocks need to grow into their current valuations and they are likely to tread water at this level. Any dip is a buying opportunity.

Swing traders are long a half position of SPY. I don't want to buy calls because the move will be very gradual and calls will be fighting time decay. If there is a nice move higher we don't know when it will come and we won't have to worry about it by simply being long SPY. You should also be selling out of the money bullish put spreads. The scenario I've outlined is perfect for this options trading strategy. You can distance yourself from the action and take advantage of time decay. Option premiums are small and implied volatility is at a 52-week low (VXX). That means that you have to go too close to the money to generate a decent credit on stocks that are flat. Option Stalker is helping us find stocks with momentum and heavy volume. These stocks are ideal candidates for selling out of the money bullish put spreads. I highlighted some excellent candidates in last night's Swing Trading Video.

TRY OUR RESEARCH FREE FOR THE DAY AND GET THE WEEKLY SWING TRADING VIDEO NOW!

Day traders need to be cautious. Intraday volatility has collapsed and the daily ranges are tight. Wait for the bid to be tested this morning and watch for support. Spend the first 30 minutes finding stocks with heavy volume and relative strength. Heavy Buying, Relative Strength 30, and PopBull are my go to Option Stalker searches. Trim your size and your trade count in this low probability, sideways market.

I may buy some calls to hold overnight. I believe that if Boris Johnson has a convincing win the market will rally overnight.

.

.

Daily Bulletin Continues...