Market Could Challenge the High Today – Big News After the Open – Add To Longs

Posted 9:30 AM ET - The market is within striking distance of the all-time high and it is waiting for major news events to play out this week. The S&P 500 rallied 10 points before the open on news that Nancy Pelosi was going to hold a USMCA press conference at 10:00 AM Eastern time. US/China trade negotiations are continuing "around the clock" according to White House economic advisor Larry Kudlow. Comments from the trade negotiators suggest that the US is unlikely to impose extra tariffs on $160 billion worth of Chinese goods on Sunday.

The overnight news is market friendly. I'm expecting a nice rally off of the USMCA press conference and we should test the all-time high. This trade deal has the potential to boost GDP by 1% next year.

China is likely to increase agricultural purchases with or without a trade truce. Their 4.5% Spike in CPI is largely related to the boycott of US agricultural products and that is the highest level since 2012. If the trade negotiations are as intense as we have been led to believe, the tariff hike will be postponed if they can't reach a deal by Sunday. I don't see this headline as a drag on the market into year-end.

The FOMC statement tomorrow should be benign. The Fed is content with current policy and the strong jobs report last Friday will keep them on the sidelines. The US Treasury is adding a lot of liquidity during the holidays to avoid a spike in overnight interest rates like we saw in September.

The US has to extend its budget in the next two weeks. Democrats are “losing face” with voters because of the impeachment hearings and I don’t believe they want to be blamed for a government shutdown. The budget will be extended for at least a few months.

England will hold its elections this week and Boris Johnson should gain support. That will result in a Brexit agreement and it will reduce market uncertainty.

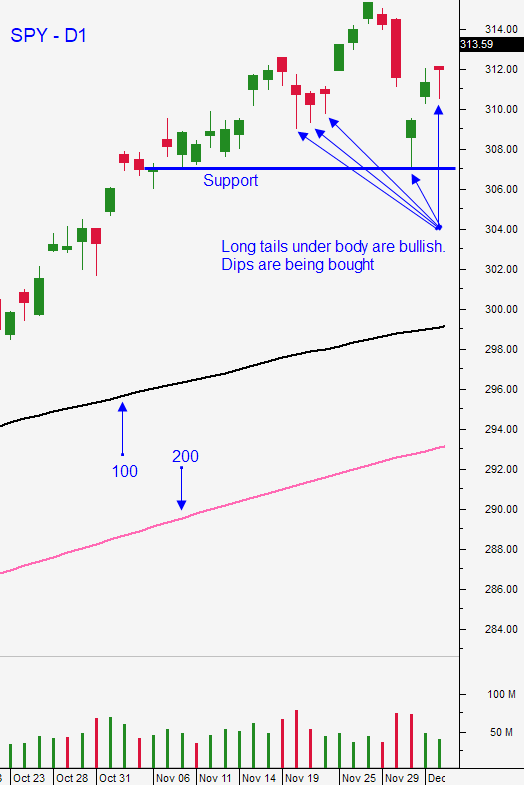

Swing traders should buy a half position of SPY on the open today. I feel the downside risks into year-end are minimal and that stocks will float higher on light volume. Set a target of SPY $317.80. If we get there today we will take profits. Enter more bullish put spreads this morning. I like stocks with heavy volume, relative strength and strong technical support. Sell your bullish put spreads below technical support and buy them back if that support is breached. Option Stalker searches like PopBull and Strong after Earnings are finding excellent candidates for this strategy. Stocks are fairly rich (forward P/E of 17.5) and I don't want to get overly aggressive. That is why we are only taking a half position and SPY.

Day traders should look for strong stocks early. Cyclical stocks and industrials will like the USMCA news. I don't like over-nighting these stocks. The trade truce has not been signed and economic growth in Europe has been soft. I'm expecting positive comments from Nancy Pelosi and the market should rally on light volume. My favorite Option Stalker searches have been Heavy Buying, Relative Strength 30 and PopBull.

Add to your long positions this morning.

.

.

Daily Bulletin Continues...