The Dark Clouds Are Parting and Seasonal Strength Should Float the Market Higher

Posted 9:30 AM ET - PRE-OPEN MARKET COMMENTS FRIDAY - Boris Johnson won in a landslide victory and England will exit the EU by January 31st. Market uncertainty is decreasing and major issues are being resolved. Seasonal strength should float the market higher into year-end.

England is likely to exit the EU before January 31st. This will remove market uncertainty.

The White House said that it has a Phase 1 agreement with China and that the new tariffs scheduled for Sunday will be delayed. This dark cloud has parted.

Democrats took a USMCA victory lap this week and it will be signed. This trade deal is huge and it dwarfs the US/China trade truce.

The Fed is going to maintain its dovish policy throughout 2020 and rates will remain low. We learned this from the FOMC statement this week.

The government budget will be extended. Neither party wants to be blamed for a government shutdown during the holidays.

The U.S. Treasury has injected $500B into the banking system for the holidays. They want to avoid a spike in overnight interest rates like we saw in September.

Economic growth is strong and the unemployment rate is at a historic low.

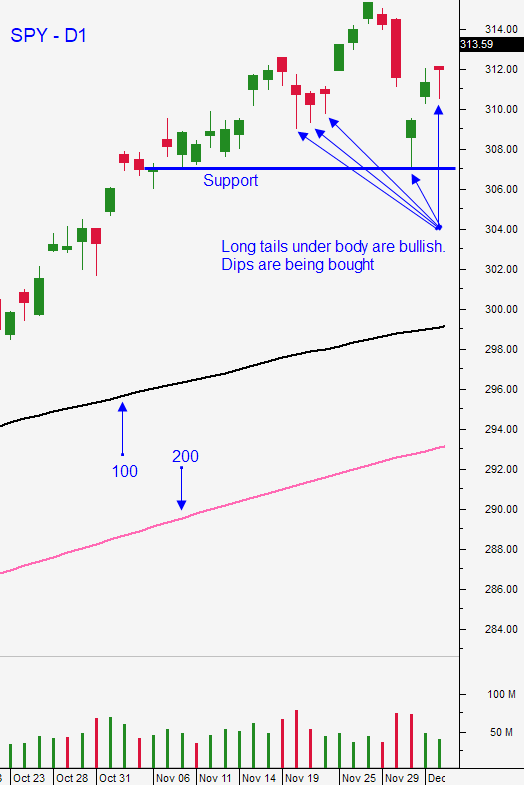

Stock valuations are fairly rich at a forward P/E of 17.5. This will provide a headwind and big spikes up will be tamed by profit-taking (just like we saw Thursday). Stocks will need time to grow into their valuations. Any market dip is a buying opportunity.

Swing traders are long a half position of SPY at $313.80. We are not going to have a stop. Place an order to buy the other half at $310. We will not have a limit since I believe the market will float higher into year-end. You should be selling out of the money bullish put spreads. Wednesday night I recorded my weekly Swing Trading Video and all of the candidates did well yesterday. This is where we sit back and enjoy the ride. Trading activity will start to wane as we get closer to Christmas. Time decay on our bullish put spreads will generate income and our SPY position will grind higher.

Day traders should wait for the bid to be tested this morning. The S&P 500 has been choppy before the open. The gains before the open have been erased. Let the market come in and wait for support. Search for stocks with heavy volume and relative strength. I will be looking for option lotto plays near the close on stocks that have weekly options. As always, heavy volume and relative strength are the keys to a good trade.

Uncertainty has been removed from the market and apart from rich stock valuations I don't see any speedbumps ahead.

.

.

Daily Bulletin Continues...