This Is the Type of Option Trade I Am Looking For – Market Will Grind Higher

Posted 9:30 AM ET - This morning the S&P 500 is poised to make another new all-time high. The dark clouds have parted and seasonal strength/momentum will fuel a gradual grind higher the next two weeks. Trading volume will start to drop off after this week and I don't see any speed bumps. We are perfectly positioned for this move.

Details of the US/China Phase 1 deal have been revealed. China will purchase approximately $200 billion worth of American-made goods and it will crack down on intellectual property theft. It will also deepen access to its financial markets and it will suspend additional tariffs on US goods that were to be implemented on December 15th. This potential trade war has been resolved.

USMCA is likely to be passed in the next few weeks. To put this into perspective, the US exports approximately $300 billion to Mexico and $360 billion to Canada each year. This trade deal dwarfs the US/China trade truce.

Brexit it is likely to happen before year-end and after his landslide victory, Boris Johnson is pushing for a deal before Christmas.

The FOMC statement was dovish and accommodative Fed policy is not likely to change in 2020.

Economic data points have been solid. This morning China's industrial production grew 6.2% (5% expected) and retail sales were up 8% (7.6% expected).

Stock valuations are at the upper end of their range and they will provide a stiff headwind. Big market rallies will attract profit-taking at this level.

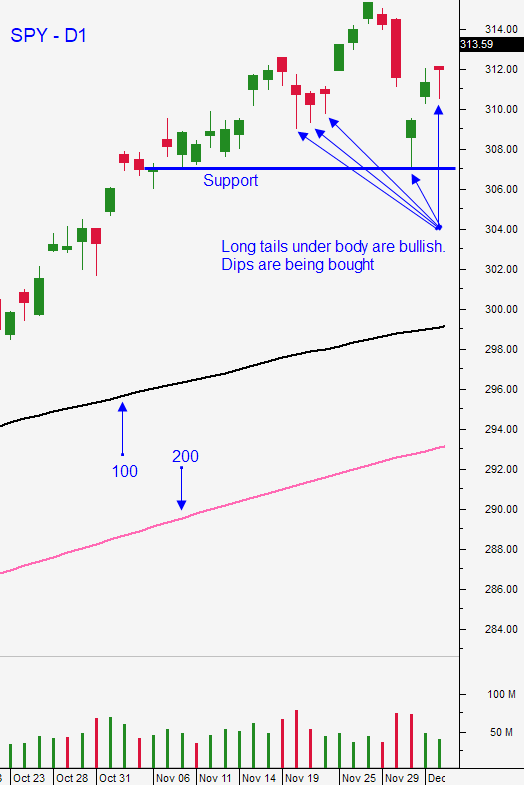

Swing traders are long a half position of SPY at $313.80. We will hold the position without a stop or a target. You should have a nice basket of bullish put spreads that are working in your favor. Option Stalker searches are making it easy defined attractive stocks. Look for upward momentum and strong technical support. Heavy volume and relative strength are key ingredients. Last night I posted a video of the type of pattern I'm looking for. Look for a gradual market grind higher without many surprises. Pullbacks will be shallow and brief. Bullish put spreads allow us to distance ourselves from the action and to take advantage of time decay.

CLICK HERE TO GET THE FREE OPTION TRADE

Day traders need to tread cautiously on the open. The early gains are a little "fluffy" and the bid will be tested. Wait for the market to find support and buy stocks with relative strength. Trading volume will decrease with each passing day and intraday ranges will compress. Try to focus a little more on overnight bullish put spreads. The market will have small gaps higher each day. Swing trades (not day trades) will be your money makers until we get a nice market drop of more than 30 S&P 500 points.

Enjoy the ride.

.

.

Daily Bulletin Continues...