Market Will Float Higher – Sellers Boycott – Use This Option Trading Strategy

Posted 9:30 AM ET - Everything is coming up roses and the market will float higher into year-end. Global uncertainty has decreased in the last week and I don't see any speed bumps through year-end. Intraday volume and volatility has decreased dramatically making day trading difficult. Selectively sell out of the money bullish put spreads to generate income.

It's hard to imagine that we are a week away from Christmas Eve. Trading volume will decrease and the only way to make money is to have an overnight position. We can expect small gaps higher and a tight range the rest of the day. Yesterday was a classic example of the pattern we are likely to see.

Asset Managers are bidding for stock and we will see a "sellers boycott". No one wants to sell stock when the market is at an all-time high with momentum. Year-end rallies are great for asset management fees and performance bonuses.

A trade truce with China, a USMCA agreement, a likely Brexit deal and an accommodative Fed through 2020 will keep buyers engaged. All of this news has been released in the last week.

Stock valuations are a little high and large spikes will attract profit-taking. As long as the move is gradual, the market will continue to float higher.

The government needs a budget extension in the next few days, but that should not be a problem. Neither party wants a government shutdown during the holidays.

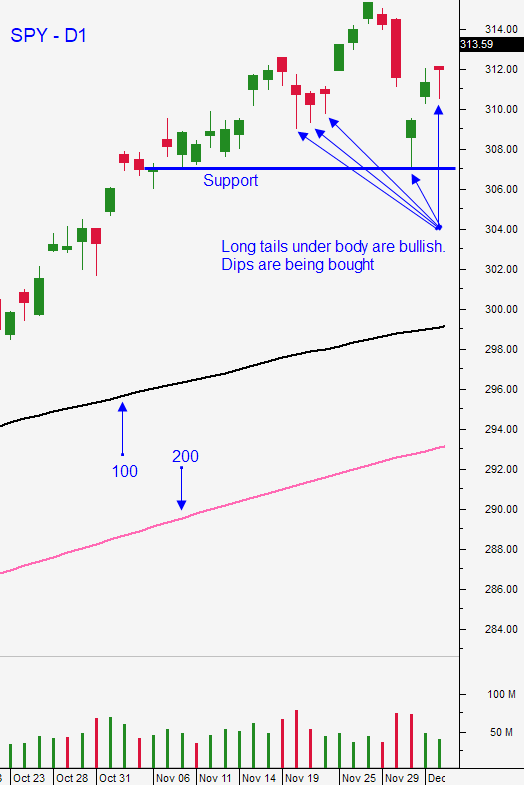

Swing traders are long a half position of SPY. Place an order to sell at SPY $324. We will hold without a stop. Swing traders should also have a nice basket of out of the money bullish put spreads that are generating income. This strategy allows us to take advantage of time decay and we can distance ourselves from the action. It's important to find stocks that have upward momentum and that have just broken through technical resistance. The short leg of the bullish put spreads should be below that technical support. I suggest rolling some of your December bullish put spreads that are trading for pennies out to January.

THIS IS THE TYPE OF BULLISH PUT SPREAD I AM LOOKING FOR

Day traders need to trim their size and activity. Intraday opportunities are few and far between. Heavy volume and momentum are key components. In the chat room I've been trying to identify attractive bullish put spreads for swing trading. We can expect overnight gaps higher and that is how you can make some money. If you are not long overnight you will miss the move. There are support levels on the SP Y at every one dollar increment ($319, $318, $317 and $316). I don't see any speed bumps and I don't see any catalysts to fuel a melt up.

Look for bullish put spreads and start rolling some of your positions into January.

.

.

Daily Bulletin Continues...