Still Bullish But Looking For Day Trading Shorts If the Market Is Flat

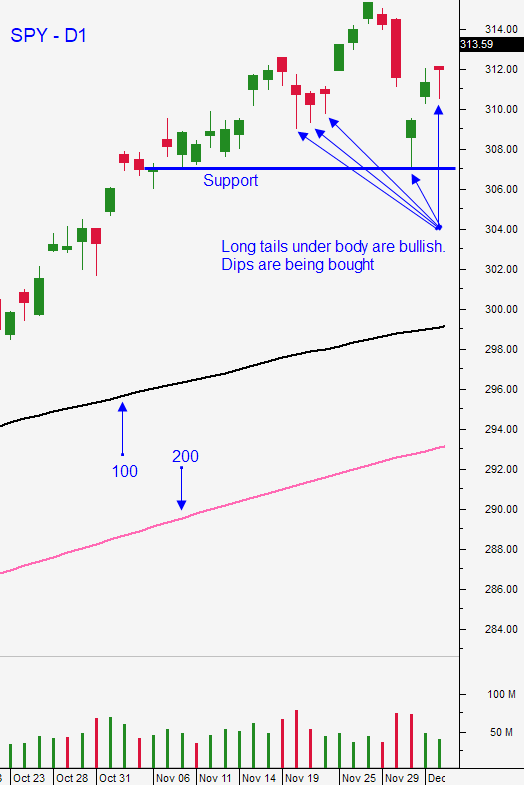

Posted 9:30 AM ET - PRE-OPEN MARKET COMMENTS WEDNESDAY - The market continues to float higher and the dark clouds have parted. We are likely to see small gaps higher overnight and compressed intraday trading ranges. Six out of the last seven trading days have small bodied candles (dojis). The closing price has been very close to the opening price and we are likely to see a similar pattern today.

A Brexit agreement is likely, a trade truce with China will be signed, the USMCA will be passed, the US budget will be extended and the Fed will maintain a low interest-rate environment through 2020. These issues have been resolved in the last week and they removed market uncertainty. Asset Managers will ride stocks higher into year-end and we have a "sellers boycott". Any large market spike will attract profit-taking.

This is a very light news cycle and that favors the upward momentum. Earnings season has ended and the economic releases are light through year-end.

I don't see any spoilers for the next few weeks, but we can expect an “ugly day” in here somewhere.

Swing traders are long a half position of SPY. Set a target of $324. You should also have a nice basket of bullish put spreads that are about to expire this Friday. If the stocks have made large moves higher don't roll the position. If the stocks have been very steady and have had small gains, roll the positions out to January. I am going to be reducing my overnight exposure into year-end. I want to reload on a market pullback like we did on December 3rd. Weak stocks are joining the party and that is typically a sign that the rally is maturing - "the dogs are barking". I'm not bearish, I just want to reload at better levels and I feel that bullish speculators might be a little overextended. Option premiums are at a 52-week low (VXX). I do like selling bullish put spreads on stocks that have upward momentum and that have recently broken through technical resistance. I prefer stocks that are not making a new high and I want to see heavy volume. I am using Option Stalker searches to find them and I will be releasing my weekly Swing Trading Video tonight.

WATCH LAST WEEK'S SWING TRADING VIDEO - SEE HOW WE DID

Day traders should keep intraday activity to a minimum unless we can breakout of the first hour range. Support is at every dollar increment on the way down starting with SPY $319. I believe we've reached the point where intraday shorts might present a better day trading opportunity. Make sure that the market is neutral so that you don't have to "swim upstream". Stocks that have rallied hard are the most vulnerable to profit-taking. Once the intraday momentum sets in, it tends to continue and the price action is fairly steady. I am not going to do much day trading and if I do it will probably be on the short side. As trading activity decreases, option bid/ask spreads tend to widen. You might find it difficult to trade options on a short-term basis the next two weeks. Given the small overnight gaps higher I suggest you focus on bullish put spreads using weekly options. Use slightly longer term time frames than you do for day trading and take more of a swing trading approach.

I don't see any speed bumps ahead and I expect to see small overnight gains and tight daily ranges.

.

.

Daily Bulletin Continues...