Market Bid Is Strong – Use This Option Trading Strategy Into Earnings Season

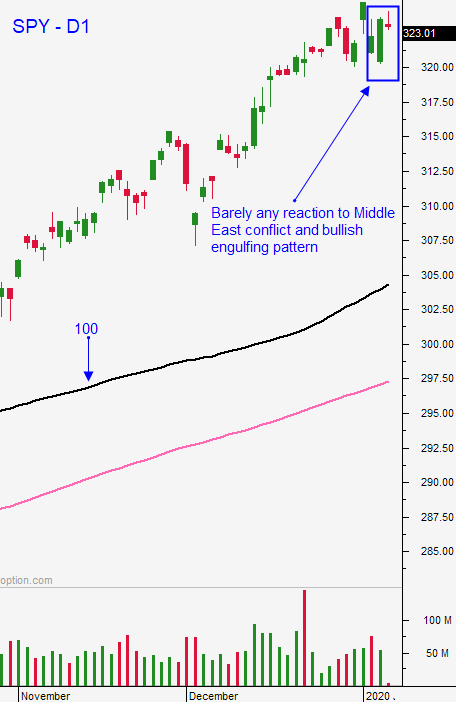

Today's stock market forecast is neutral. Traders are ignoring the conflict in the Middle East and an overnight 400 point drop in the Dow Jones reversed after the Iranian missile attacks. The impeachment hearings have not had an impact from the start. Stocks want to move higher, but the move is over-extended technically and fundamentally. Profit-taking during the first week has been minimal and the dip Friday and Monday did not even register a blip on the radar.

Rightfully, traders are focused on the USMCA and the Phase 1 deal with China. Those will have a much bigger impact on economic growth and corporate profits.

As I've been mentioning, historically low interest rates are forcing investors into equities. Bond yields are not keeping pace with inflation (negative real returns). Corporations are issuing cheap debt and they are using the proceeds to buy back shares. This is an incredibly powerful force. Effectively, central banks are providing a safety net for equities. We know from the FOMC minutes last Friday that the Fed will remain accommodative this year.

Economic data points have been good. ISM services had a robust reading of 55 in December yesterday. ADP reported that 202,000 jobs were created in the private sector during the month of December. That report was released this morning and it bodes well for Friday's jobs report.

Swing traders should be allocating half of their capital to bullish put spreads this week. It's true that the market is over-extended technically, fundamentally and emotionally. From a technical perspective the S&P 500 is above the daily, weekly and monthly trading channel. Fundamentally, stocks are trading at the upper end of their valuation range (forward P/E of 18). Emotionally, bullish sentiment is extremely high and that is reflected in miniscule option implied volatilities (VIX). All of these influences had the potential to spark profit-taking. The conflict in Iraq could have been a selling catalyst and it demonstrated strong conviction on the part of buyers. Know that over-extended markets can stay that way for a very long time. Only fools would try to pick a market top at an all-time high during a 10-year rally. I've seen lots of traders lose all of their capital trying to do this - don't be one of them. We will see plenty warning signs before the market rolls over.

For the last two weeks we've largely been on the sidelines waiting for a small dip so that we can reload our bullish put spreads. After the muted reaction to Iran Friday and Monday we know that the bid is still strong. The market will establish a trading range during the next few weeks and we will spend the first quarter in it. I am fairly neutral right now. The good news is that we don't have to fear a market meltdown anytime soon and that sets us up for excellent bullish put spread opportunities. The key is finding the right stocks and setting up and options trading game plan.

I like stocks that have recently shown relative strength and good volume. Major technical support should be close at hand and we will sell out of the money bullish put spreads below that support level. I don't like using this strategy for stocks that have run hard. Option Stalker searches are designed to find these opportunities and tonight I will be releasing my weekly swing trading video with plenty of candidates.

TRY OUR RESEARCH FOR JUST $29 FOR THE FIRST MONTH AND GET TONIGHT'S SWING TRADING VIDEO

Day traders need to be very selective. When the market falls into a trading range on a longer-term basis the intraday volatility also dries up. Be patient and expect the daily trading range to be defined in the first hour. Support is at SPY $320 and resistance is at $325. We could stay in that range for a while. Focus on stocks with heavy volume and look for consecutive long green bars closing on their high. These are the stocks that want to run. Set passive targets and don’t expect any help from the market.

.

.

Daily Bulletin Continues...