New Bullish Put Spread Pick – Market Will Move Higher – Use This Option Strategy

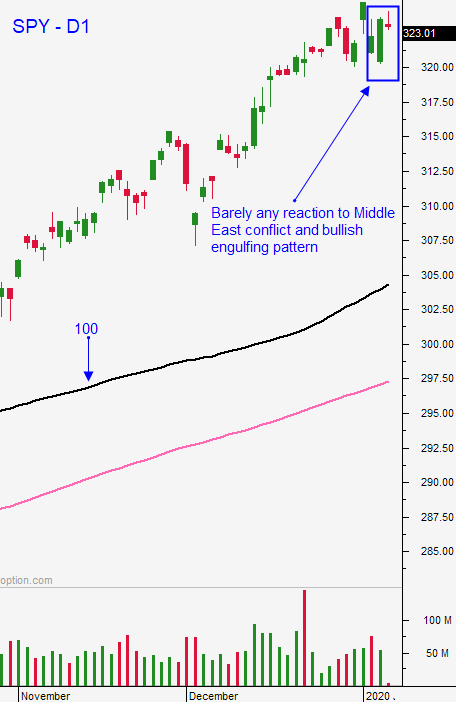

Posted 9:30 AM ET - The market doesn't care about rising tensions in the Middle East. Perhaps that's because we've had a military presence there for more than 15 years. The price action yesterday was very telling. Stocks opened on their low and instantly bounced. Buyers scooped this dip and the S&P 500 closed on its high of the day resulting in a bullish engulfing pattern. We have been waiting for a dip and that might've been it.

The Phase 1 deal with China will be signed in a week in Washington DC. Democrats support the USMCA and it will be signed shortly. Boris Johnson will push Brexit through before the end of the month. These are all positive developments.

Last week's FOMC minutes were dovish and the Fed will remain accommodative through 2020. We do have some "Fed Speak" this week, but I'm not expecting any surprises. Historically low global interest rates have resulted in a very strong market bid. Corporations are issuing cheap debt and using the proceeds to buy back shares. Investors have to own equities because bond yields don't keep pace with inflation (negative real returns).

Economic data points have been solid and ISM services will be released a half an hour after the open today. ADP will report employment numbers tomorrow and the jobs report will be released Friday. These numbers should be market friendly.

Earnings season will begin in two weeks and buyers are typically engaged through mega cap tech announcements. At a forward P/E of 18, stocks are a little rich and they will need time to grow into current valuations.

Swing traders should have sold VXX yesterday for a tiny loss when it did not close above $16. This is a good time to start selling bullish put spreads. I suggest allocating half of your capital this week and provided that market conditions remain stable, we will add the second half next week. Option Stalker has a search called "Buy into Earnings". It finds stocks that will report in the next two weeks and that have rallied more than 75% of the time two weeks ahead of earnings during the last twelve quarters. This is a huge statistical edge and I will be using this search to find bullish put spreads. Stocks that are not making new highs and that are just above major technical support will be my primary targets especially if they have shown relative strength in the last few days. Sell your bullish put spreads below technical support and buy the spreads back if that support is breached. Make sure your bullish put spreads expire before the earnings announcement. Option Stalker charts indicate the next earnings release date making it easier to structure these trades.

HEW BULLISH PUT SPREAD POSTED - CLICK HERE TO VIEW

Day traders should focus on the long side. The bullish engulfing pattern yesterday suggests that we will move higher. Option Stalker searches like Heavy Buying, Relative Strength 30, Bull Run and PopBull will have excellent day trading candidates. Support is at SPY $323 and that should be a good level to get long if we test it.

The fact that the market was able to shoulder the news so well the last few days tells me that profit taking is minimal and that buyers are engaged. We will grind higher from here and dips will be brief and shallow.

.

.

Daily Bulletin Continues...