Bullish Put Spread Strategy Has Been Updated – Market Is Strong – Make This Adjustment

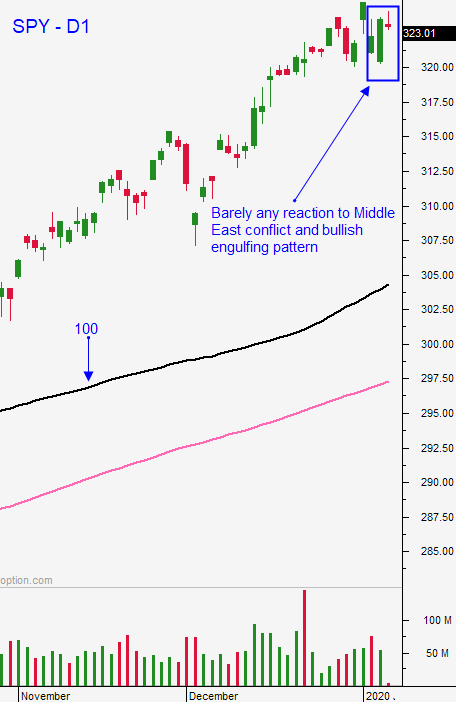

Posted (:30 AM ET - Yesterday the market broke out to a new all-time high and the buying was heavy late in the day. Just before the close, headlines crossed the wire that there were explosions in Baghdad and stocks dropped on the news. That late date dip is being reversed this morning and the S&P 500 is poised to open 10 points higher. Buyers will remain engaged as long as earnings releases during the next few weeks justify current valuations.

From a macro perspective, trade deals and central bank easing are providing a strong tailwind. Economic conditions are strong and there are not currently any credit concerns.

ISM services was better than expected (55) and ADP reported that 202,000 new jobs were created in the private sector during the month of December (better than expected). These are market friendly numbers and tomorrow's jobs report should also be good.

The market is over-extended from a technical, fundamental and emotional standpoint, but it can stay that way for a prolonged period of time.

From a technical perspective the market is above an upward sloping trading channel on a daily, weekly and monthly basis. AAPL, MSFT, FB, GOOG are also through the upper end of their trading channels on a daily basis. Pick almost any technical indicator (i.e. Bollinger Bands, RSI…) and the market is over-extended. On a fundamental basis the S&P 500 is trading at a forward P/E of 18 and that is at the upper end of the range. Bullish sentiment is at a 52-week high and the VIX is at a 52-week low suggesting complacency. As I mentioned earlier these conditions can persist for an extended period of time and it does not mean that the market is going to immediately drop.

From a trading standpoint, current market conditions tell us that we need to be more cautious. Last night it took me an hour to find a handful of bullish put spreads that I liked. A month ago, that process took less than 10 minutes and I had dozens of candidates to choose from. This in and of itself is a warning sign for me. I believe that waiting for earnings results will be the best approach. Companies that meet expectations are likely to drop and those that miss expectations will be severely punished. In many cases the company will have to "knock the cover off of the ball" for the stock to tread water.

Swing traders need to make a slight adjustment. Yesterday I suggested allocating 50% of your trading capital to bullish put spreads this week. I want to adjust that down to 25%. As earnings season unfolds we will look for stocks that posted fantastic results and that declined on the number because the expectations were too high. This will be our trading strategy for the next month. I believe the market will retrace at some point and earnings season could be the catalyst. Once we get that drop support will be established and we will spend time in that trading range for the first quarter of 2020.

Day traders should focus on heavy volume and relative strength. Yesterday was an incredible day in the chat room and it was a feeding frenzy with stocks breaking out left and right. I was able to find two call trades on SPY that collectively gained more than 100%. I will patiently be looking for similar opportunities today using the 1OP indicator in Option Stalker. The market is going to march right up to the high from yesterday. The bid will be tested early each day and I suggest keeping your powder dry for the first 30 minutes. Spend that time finding the strongest candidates. The price action feels very bullish.

Keep your swing trading light and wait for earnings releases. Day traders should focus on stocks with strong momentum, heavy volume and technical breakouts.

.

.

Daily Bulletin Continues...