How To Trade Options This Week – Market Stable – Earnings Opportunities

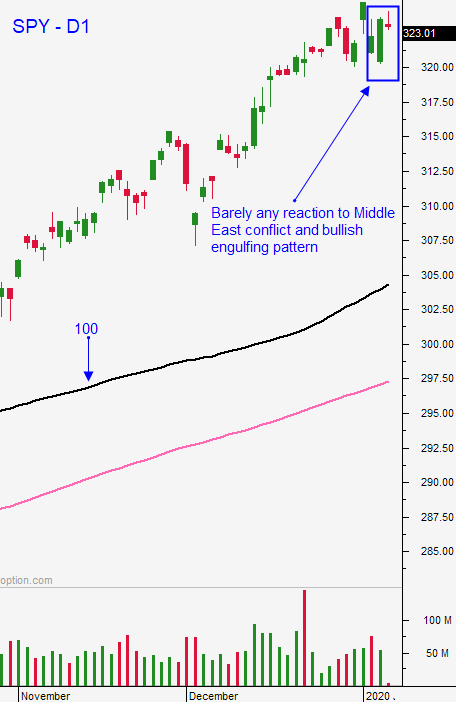

Posted 9:30 AM ET - Stocks continue to float higher ahead of earnings season and the market made a new all-time high yesterday. Valuations are stretched and that could provide a headwind in coming weeks. I believe that the best strategy is to wait for earnings announcements and to buy stocks that pullback after reporting record profits.

Trade deals, solid economic activity and historically low interest rates are keeping buyers engaged.

The Unemployment Report was a little lighter than expected this morning and 146,000 new jobs were created in December. This number should keep the Fed on its current dovish path. ADP was strong and so was ISM services this week.

Impeachment is a non-event and the market has been numb to escalating conflict in the Middle East.

Swing traders should be allocating 25% of their capital to bullish put spreads this week. We are going to leave most of our powder dry for earnings season. Stock valuations are stretched and excellent earnings could be met with profit-taking. Option Stalker will help us find those set-ups and we will sell out of the money bullish put spreads below technical support when we see it. I believe that the macro backdrop for the market is favorable and that the S&P 500 will fall into a trading range during Q1.

TRY OUR OPTION TRADING RESEARCH FOR JUST $29 FOR THE FIRST MONTH - CLICK HERE

Day traders should patiently wait for a dip this morning. The bid is tested and confirmed in the first hour each day and then the market grinds to high of the day. This is a nice opportunity to get long. The rest of the day is spent in a trading range and sometimes we get a closing move that pokes through to a new high. When that happens there is a trading opportunity on the long side. I will be watching for lotto plays on weekly options today. Option Stalker searches find the best stocks and I'm looking for relative strength and heavy volume late in the day. It has been difficult to short intraday. If the market feels over-extended I suggest taking profits and going to the sidelines. Don’t short - wait for a dip and reaload. Given the strong momentum I prefer to trade from the long side right now.

Look for a gradual float higher next week. I don't see any speed bumps and I believe we will have an opportunity to scoop strong stocks after they report earnings.

.

.

Daily Bulletin Continues...