Dull Week Ahead – That Is Perfect For This Options Trading Strategy – Keep It Light

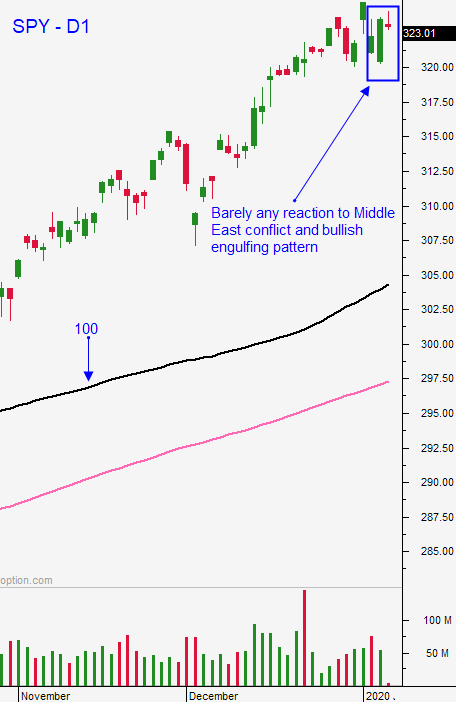

Posted 9:30 AM ET - PRE-OPEN MARKET COMMENTS MONDAY - Last week the market continued to rally and it set a new record high. The economic data points we're good and increased tension in the Middle East did not deter buyers. Earnings season will begin this week, but it won’t crank up another 10 days. I expect the S&P 500 to gradually establish the trading range in January.

The Phase 1 deal with China and USMCA will keep buyers engaged. Brexit continues to move forward and England should have an agreement with the EU by the end of the month.

Central bank money-printing is providing a safety net for investors. They are forced to own equities to generate a reasonable rate of return. Bond yields are not keeping pace with inflation (negative real returns). Corporations are issuing cheap debt and using the proceeds to buy back shares. Historically low interest rates have created this powerful market force. As long as there are no credit concerns, Asset Managers will buy dips.

The Unemployment Report was a little light and this will keep the Fed on its current path (dovish). ISM services was strong at 55.

Swing traders should have 25% of their account allocated to bullish put spreads. We do not want to increase our exposure when the S&P 500 is at the upper end of its valuation range. I expect profit-taking after strong earnings releases. The market won't provide us with a substantial pull back, but there will be opportunities on individual stocks. We will wait for robust earnings and profit-taking. Once these stocks establish support we will sell out-of-the-money bullish put spreads.

Day traders should look for two-sided action. Last Friday we saw profit-taking late in the day and it was not sparked by news. Friday's candlestick was almost a bearish engulfing pattern at the all-time high and it suggests resistance. This was the first decent selling I have seen in weeks and I think there will be a shorting opportunity on the open today. The bid will be checked this morning and we will fill some of the opening gap before we see a bounce. Find stocks with relative strength and monitor them as the market probes for support. I will be watching for signs of profit-taking and I will start looking for intraday shorts if I notice more selling pressure today. Late day selling would be a warning sign. Although there will be some selling early, you should generally favor the long side. The upward momentum is still strong.

The calendar is fairly light this week and banks don't typically move the needle much. JPMorgan Chase, Wells Fargo, Bank of America, Goldman Sachs and Morgan Stanley will report. This will be a relatively quiet week.

Be patient and wait for earnings releases. We will have plenty of opportunities in another week.

.

.

Daily Bulletin Continues...