Sell This Bullish Put Spread – How To Find Earnings Trades Before the Release

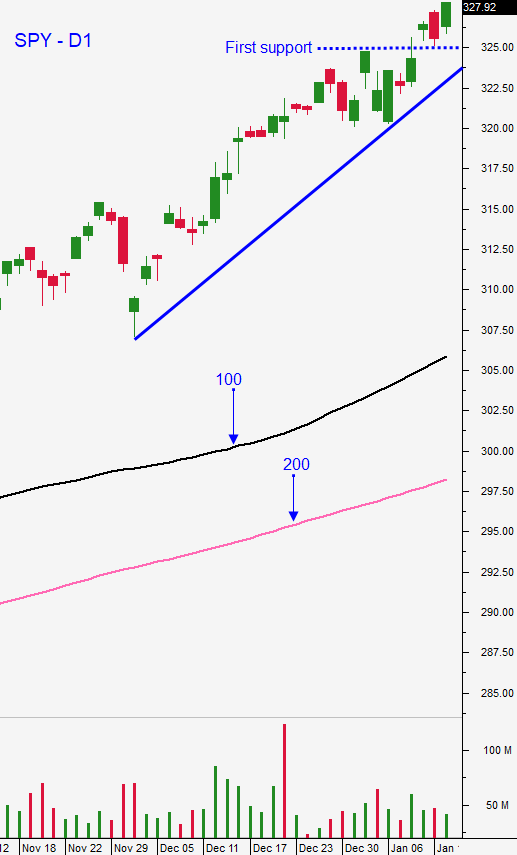

Posted 9:30 AM ET - Yesterday the market staged an impressive rebound from a light round of profit taking on Friday. Stocks closed at an all-time high and the bid is strong. Earnings season will begin today and major banks dominate the early scene. Most companies will start reporting in a week. There will be excellent pre-earnings and post earnings opportunities. I am expecting a relatively flat market for the next month and earnings plays will be the key to making money.

The Phase 1 deal with China will be signed tomorrow. Democrats support the USMCA and that trade deal will be signed shortly. Boris Johnson has gained support after the last election and a Brexit agreement is likely in the next few weeks. These are all positive developments on a global basis.

Central banks have been printing money and accommodative policies have pushed global interest rates to a historic low. That is providing a safety net for the market and investors are buying stocks to generate a reasonable rate of return. Bond yields don't keep pace with inflation so they generate negative real returns. Corporations are also taking advantage of this low interest rate environment and they're issuing cheap debt and using the proceeds to repurchase shares. This is an incredibly powerful force and it ensures that dips will be shallow and brief.

Economic releases will be light this week.

A news vacuum favors the current upward momentum and we can expect a slight upward bias into earnings season.

I don't believe that the market will hit any major speed bumps in the next month. Many stocks are over-extended and excellent earnings reports could spark profit taking. We will be waiting for those opportunities and we will be selling out of the money bullish put spreads once support is established. Option Stalker will help us find these opportunities. I am also looking for pre-earnings plays. Option Stalker has a database of stocks that have rallied into the earnings announcement more than 75% of the time during the last twelve quarters. This is a huge statistical edge. We will use this search to find stocks that are likely to tread water or move higher into the number and we will sell bullish put spreads below technical support. This morning I recorded a video and it describes how to find these trades before earnings. It also has an excellent bullish put spread that you can take advantage of. You can find these trades in a few minutes. In general, swing traders should only have 25% of their account allocated to bullish put spreads at this time. We want to wait for the earnings announcements and we want to take advantage of pullbacks after the number.

CLICK HERE TO SEE 3 GREAT EARNINGS TRADES - VIDEO JUST POSTED THIS MORNING

Day traders should expect an early test of the bid and a rally later in the day. Spend the first half hour looking for stocks with heavy volume and relative strength. On the chart I also look for long green candles closing on their high. When 2 or more of these are stacked together it is a strong indication that the stock will move higher. The S&P 500 is flat before the open and I'm expecting a relatively quiet day.

The news cycle is light the rest of the week. Expect tight daily trading ranges and small gaps higher overnight.

.

.

Daily Bulletin Continues...