Here’s How To Trade Earnings – Use This Options Trading Strategy Now

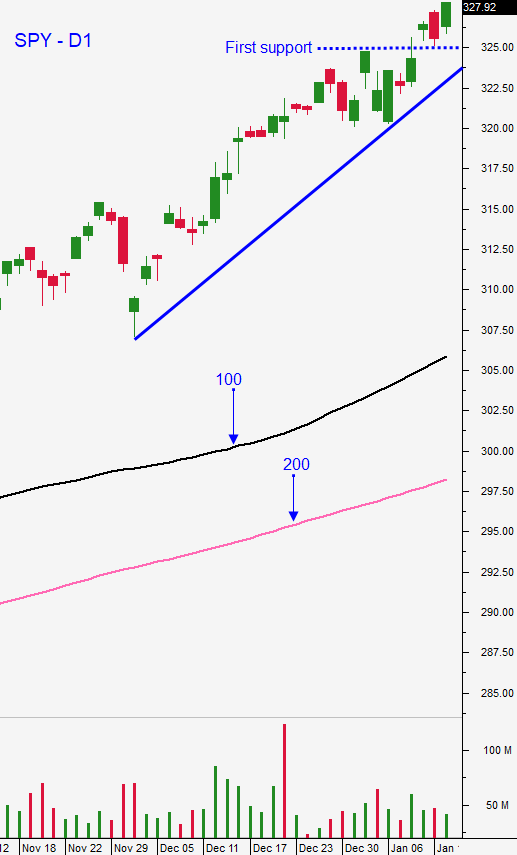

Posted 9:30 AM ET - PRE-OPEN MARKET COMMENTS WEDNESDAY - Yesterday the market rallied to a new all-time high and it pulled back on recycled news. The S&P 500 closed right where it started (doji) and you can see the tiny candle on a daily chart. We can expect stiff headwinds with stocks trading at the upper end of their valuation range. The news cycle is light this week, but it will improve next week as earnings season unfolds.

The US/China Phase 1 deal will be signed today and there will not be any new negotiations before the November elections. This will reduce market volatility. Yesterday Bloomberg released an article saying that the 7.5% tariffs on Chinese goods will remain intact. That was not new, but it sparked selling. That move demonstrates that the market is vulnerable to profit taking.

USMCA has Democratic support and it should be passed in the next few weeks.

Boris Johnson has the support he needs to pass a Brexit deal and we should expect it in the next few weeks.

As I've been mentioning in my comments, historically low interest rates are providing a safety net for the market. Dips will be shallow and brief.

Swing traders should only have 25% of their accounts allocated to bullish put spreads. Those positions should be in nice shape and we started entering them last week. The remaining 75% will be used to sell bullish put spreads on strong stocks that report fantastic earnings. In many cases the stock prices are “rich” and we will see pullbacks after the announcements. We will wait for support and we will sell out of the money bullish put spreads on these stocks. This is how we will generate income during the next 2 months.

Day traders should look for stocks with heavy volume , relative strength and technical breakouts through resistance. Recently we've been trading short squeezes and stocks like TLRY, BYND and SHAK are providing excellent day trading opportunities. The market will not help or hinder stock moves so patiently wait for dips on the 5 minute chart and take profits when the move stalls.

Look for choppy conditions in a light news environment with a slight upward bias. Shorting is difficult and the best tactic is to patiently wait for dips to buy.

.

.

Daily Bulletin Continues...