This Market Pattern I Showed You Tuesday Worked Again [4 Weeks In A Row]

Posted 9:30 AM ET - The S&P 500 will open nine points higher this morning and all of the losses from Monday morning will be erased. As I mentioned in my comments this pattern has repeated four weeks in a row. Asset Managers are passive on Fridays and the market finishes on a cautious note heading into the weekend. Traders monitor the spread of the Coronavirus and the bid returns Monday morning. Tiny bodied candles (dojis) can be seen on the daily chart and that is an indication that intraday ranges are very compressed. I don't believe we will see much movement either way.

Stocks need time to grow into their current valuations. After a big run up, the S&P 500 is trading at a forward P/E of 18. No one is worried that they will miss the next big rally at this level and buyers are only aggressive on declines. The Coronavirus has largely been discounted as a temporary event and investors are not worried about this speedbump.

Yesterday, Apple said that it will miss its revenues due to the virus. It did not give any specifics and we can expect similar warnings from other companies. Until there is a concrete number (revenue or earnings) associated with this outbreak, there won't be any sustained selling. Asset Managers will error on the side of being long.

This afternoon we will get the FOMC minutes and I'm not expecting any surprises. Last week, Jerome Powell testified before Congress for two days and we had plenty of "Fed speak". The message is clear and the Fed is happy with current interest-rate policy. They are prepared to ease if the economic impact of the Coronavirus is worse than expected.

Historically low interest rates are keeping a very strong bid to the market. Investors feel that riding out a few market speed bumps is better than generating negative real returns in bonds. Corporate buybacks are also keeping a strong bid to the market.

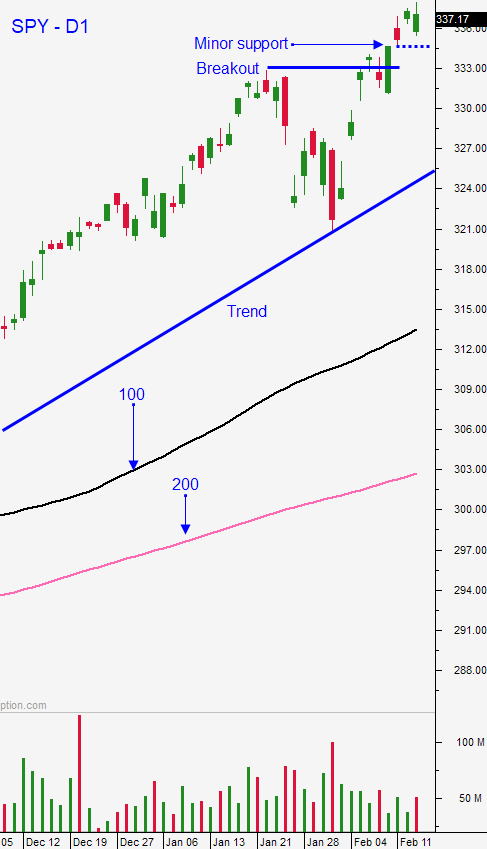

Swing traders should be selling out of the money bullish put spreads. This strategy has been extremely successful for the last six months and you should have 75% allocation at this time. Two weeks ago we went eight for eight in our weekly swing trading video and all eight swing trades that were highlighted last week are doing great. Tonight I will try to keep the ball rolling in this week’s swing trading video. We are focusing on strong stocks that reported good earnings and that have relative strength and heavy volume. Option Stalker helps us find the stocks and we are selling bullish put spreads below technical support. Most of our spreads expire in less than two weeks and we’re taking advantage of accelerated time decay. By staying very short-term with our bullish put spreads we are able to constantly evaluate the market. The SPY can move around, but we want support at $333 to hold. If that support level fails we will buy VXX for protection.

Day traders should try to focus on strong stocks where they can hold positions overnight. We have seen a series of opening gaps higher followed by choppy trading. The dojis I mentioned earlier reflect equilibrium and there is 2-sided trading. I will not be day trading S&P 500 futures/SPY options until I see sustained directional intraday moves. Fortunately, stocks are providing us with plenty of action in the chat room. There is a huge edge to trading stock and this is what I prefer to trade anyway. The key is to jump on these movers right out of the gate. Most of the movement happens in the first hour and these are the searches I'm using: Heavy Buying, Relative Strength 30, After Earnings, and PopBull. After the first hour of trading I'm using custom searches that look for volume spikes, relative strength and momentum. Try to focus on day trades that you also like on a swing basis so that you can hold a few positions overnight. Most of the move is coming on overnight gaps higher. The market has not had any major dips so the risk of holding overnight is fairly low on a relative basis. When the market has dipped buyers have been there to scoop stocks up so the pain is brief. Day traders should also be selling bullish put spreads using weekly options.

In the last week the market has not been able to advance and I believe we are going to see flat trading during this news vacuum.

.

.

Daily Bulletin Continues...