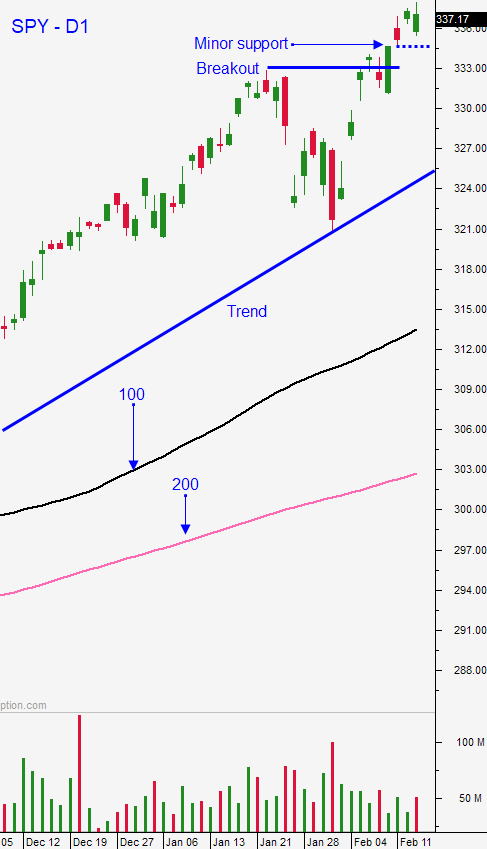

This Powerful Force Is Keeping Buyers Engaged – Market Will Tread Water the Rest of the Month

Posted 9:30 AM ET - Yesterday the market gapped higher and it was able to hold most of the gains. The market bid is still strong and Asset Managers are ignoring the potential impact of the Coronavirus. Loose central bank monetary policy is providing a safety net for the market. I believe stocks will tread water at this level for the next few weeks.

China lowered its prime rate by 10 basis points from 4.15% to 4.05% overnight. The Fed has also referenced Coronavirus and they are ready to ease if needed.

Apple warned that it will miss revenues because of the virus, but the market shrugged off the news. Until there is a way for Asset Managers to quantify the impact on profits, the market will discount the virus. We can expect earnings warnings from many other companies in coming weeks. The Coronavirus could not have hit at a worse time (Chinese lunar New Year).

Although this is a temporary event, it could cause short-term credit crunches. China might have to take over troubled HNA Group Co. and there are reports that companies are having a difficult time meeting payrolls. When the tide goes out you can see who the skinny dippers are.

At a forward P/E of 18, stocks are priced for perfection. Europe and Japan are both teetering on recessions. The backdrop is not currently perfect and surprise favors the downside.

Swing traders need to distance themselves from the action and focus on selling out of the money bullish put spreads. We are going to try and stay within a two-week window so that we can take advantage of accelerated time premium decay and so that we are able to constantly reevaluate risk. We are selling out of the money bullish put spreads on companies that have announced strong guidance and that are strong relative to the market. Heavy volume and major technical support are two other criteria we are using to increase our probability of success. I don't believe that companies will provide concrete numbers on the impact of Coronavirus for a few weeks. That still gives us time to sell some spreads. In the last two weeks our spreads are positioned to go 16 for 16. Last night I posted my weekly swing trading video to members and it includes six bullish put spreads and five bearish call spreads. I believe the market will tread water for the next few weeks.

Day traders need to have some overnight risk exposure. We are seeing opening gaps higher and that is when the majority of the move is taking place. Consider selling some weekly bullish put spreads that expire in a few days or holding stock positions overnight. The intraday price action has been pretty choppy and I am not currently trading S&P 500 futures during the day. On the other hand, stocks are providing us with plenty of action. It's important to nail these prospects in the first 20 minutes of trading and to get on board quickly. Ride the momentum and exit when the stock stalls. Heavy Buying, Relative Strength 30 and PopBull are my go to searches on the open.

The market will probe for support early this morning. Use the first 20 minutes to look for relative strength and buy the stocks when the market find support. This opening dip will provide an opportunity for us to sell this week's out of the money bullish put spreads. Wait for market support and watch the stocks for relative strength.

.

.

Daily Bulletin Continues...