Here’s How To Trade This Market Drop – Watch For This Pattern [We’ve Seen It For 3 Weeks]

Posted 9:30 AM ET - This morning the S&P 500 will open on a weak note after Apple said that it will not meet its revenue projections due to the Coronavirus. They did not make any adjustments to their guidance related to the virus when they reported earnings so this news should have been expected. The overnight selling has not been too heavy and previous Coronavirus dips have been bought. We've seen them the last few weeks and Mondays have rebounded nicely.

The market bid is extremely strong and the impact from Coronavirus has been completely discounted. It is a temporary event, but it will impact earnings. With stocks priced for perfection (forward P/E of 18) there is not much room for error.

Central banks are dovish and interest rates are at historic lows. Bond yields are not keeping pace with inflation (negative real returns) and investors are forced to own equities to generate returns. They are willing to ride out any virus related speedbump. Corporations have been issuing cheap debt and using the proceeds to buy back shares. Less shares and stable demand mean that prices go higher. This is an incredibly powerful force and it will take a credit crisis to rattle investors. I monitor credit markets very closely and I don't see any cause for concern at the moment.

The economic releases will be very light this week and flash PMI's on Friday will be the next significant news.

Earnings season is winding down and Walmart posted a soft number this morning. Retailers will dominate the earnings scene this week and we can expect mixed results.

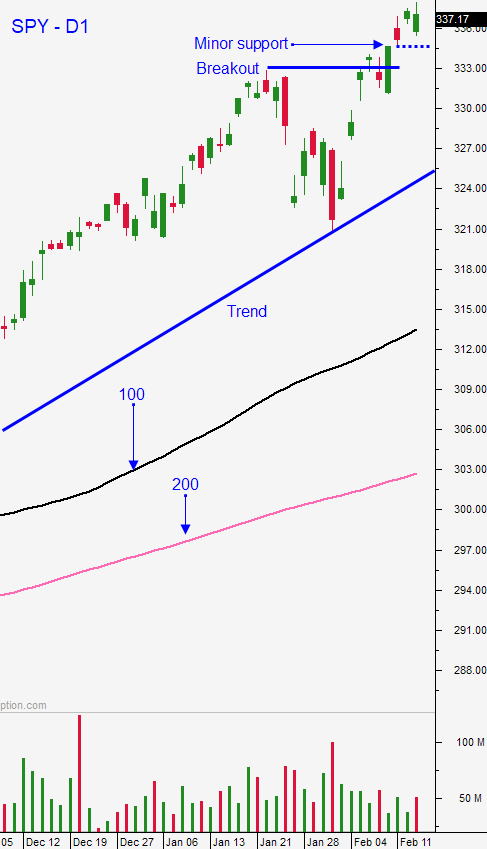

Swing traders should focus on selling out of the money bullish put spreads with an allocation of 75%. This strategy allows us to distance ourselves from the action and to take advantage of time decay. Small speed bumps like the one we are seeing this morning don't pose much of a problem. We have been focusing on stocks with relative strength, heavy volume and strong technical support. We have been selling out of the money bullish put spreads below that technical support and we have been focusing on spreads that expire inside of three weeks with most of them expiring in two weeks or less. This tight timetable has allowed us to reevaluate market conditions constantly and to take advantage of new earnings releases and accelerated time decay. Today we want SPY $333 to hold and we don't want a new market low after two hours of trading. Ideally, buyers will step in and support this dip like they have the last few weeks. We can expect more earnings warnings in the next few weeks.

Day traders should watch for an early bounce. We need to see consecutive long green candles closing on their high on a five minute chart. This would be a sign that the gap down this morning will be filled during the course of the day. We have not seen decent intraday directional moves in the last few weeks with one exception - gaps down. Typically these moves probe for support during the first hour and then the market gradually regains its footing and we grind higher the rest of the day. I know that additional earnings warnings will be coming, but the market doesn't seem to care. Look for strong stocks that gap down with the market and that have two consecutive long green candles closing on their high. Also watch for heavy volume and relative strength. The Heavy Buying and Relative Strength 30 searches in Option Stalker will provide excellent day trading prospects today.

In the unlikely event that the market makes a new low after two hours of trading, curb your bullish day trades and focus on the short side. Intraday shorts will help to hedge your bullish put spreads and a new low after two hours of trading would be a sign that we will close on a soft note.

.

.

Daily Bulletin Continues...