Option Lottery Trades Possible Today – Watch For This Pattern On Fridays

Posted 9:30 AM ET - Yesterday the market dropped on a report from Goldman Sachs that the impact of the Coronavirus earnings impact could be worse than investors expect and that caution is needed. The market S&P 500 dropped 50 points from its high and it was able to recover half of those losses. This morning we are seeing a little selling before the open. Fridays have recently been soft.

The overnight flash PMI's from Europe were generally good. The manufacturing flash PMI came in at 49.1 (still in contraction territory) and the services flash PMI came in at 52.8. Japan's manufacturing PMI fell to 47.6 and that is the biggest drop in seven years. Japan is definitely feeling more of the impact from the Coronavirus.

China believes that the rate of increase for the spread of the virus is starting to decline and their market has firmed up. Fed Chairman Jerome Powell agrees and he does not see the need for a Coronavirus related rate cut.

The economic calendar is pretty light and we will be in a news vacuum next week. The market lacks momentum and we could chop in a range for the next week.

Yesterday I released my new weekly swing trading video. Our bullish put spread picks raced higher on the open and we were only able to fill one of them. After the first 90 minutes of trading I could see that the market was headed for trouble and I posted a bulletin to hold off on the new bullish put spreads. The one trade that we did put on (DIS Feb (28) $139/138 bullish put spread for $.21 credit) was closed for a loss. After a fantastic run for five months I believe that it is time to let our current bullish put spreads expire. Let's reevaluate the market action for a couple of weeks and see if we have more clarity on the economic impact of the Coronavirus. Some of our bullish put spreads will expire today and we have quite a few of them that will expire next week. Yesterday also suggested buying VXX for protection 90 minutes after the open and that position is trading higher. Over the last 30 years I've learned that my biggest losers came after my biggest winners. This has been a great run and it would be prudent to take a short break - the market momentum has stalled. If we get a nice market dip we can reload with confidence instead of trying to manage losing trades. I am still bullish and I feel the bid is very strong. At a forward P/E of 18, stocks are pricing in excellent news. Companies will be evaluating the revenue impact from Coronavirus in the next few weeks and we are likely to get more Q1 earnings warnings.

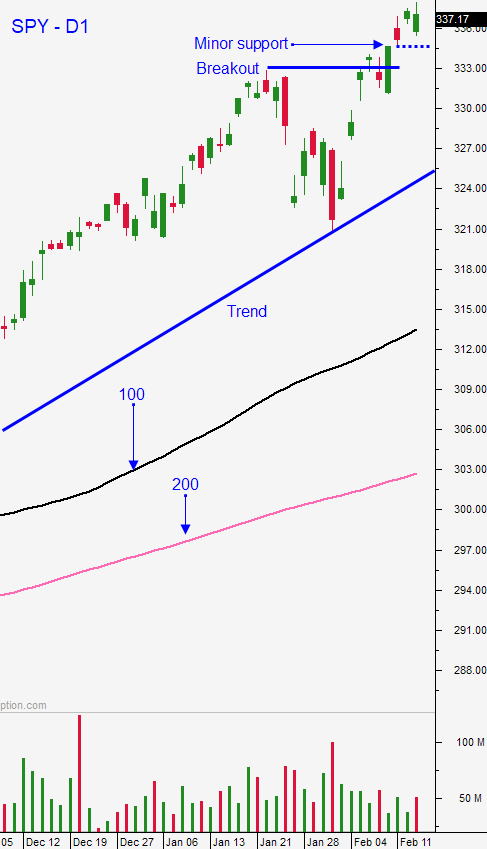

Day traders should look for two-sided price action. I still prefer to buy dips, but Fridays have tended to be weak so I will use a balance approach today. Asset Managers are passive heading into weekends and the bid is softer on Fridays. Traders are looking to reduce risk and we have seen selling on the last trading day of the week. During the weekend the news is evaluated and the bid returns Monday. Stocks gradually rebound during the first two days of the week. This pattern has been present four weeks in a row and we need to be mindful of it. Today is expiration Friday and I will be looking for option lottery plays in the last half hour of trading. In order for this trade to set up, I do need clear directional movement from the market and I don't know that I will get it. Try to identify strong stocks in the first 15 minutes of trading and jump on them early. This is when the "lion's share" of the gains happen. The rest of the day could be dull.

The market has been compressing in a tight range for the last week and we are in a news vacuum. Look for choppy trading conditions.

.

.

Daily Bulletin Continues...