Coronavirus Market Crash – Here Is How To Trade It [VIDEO]

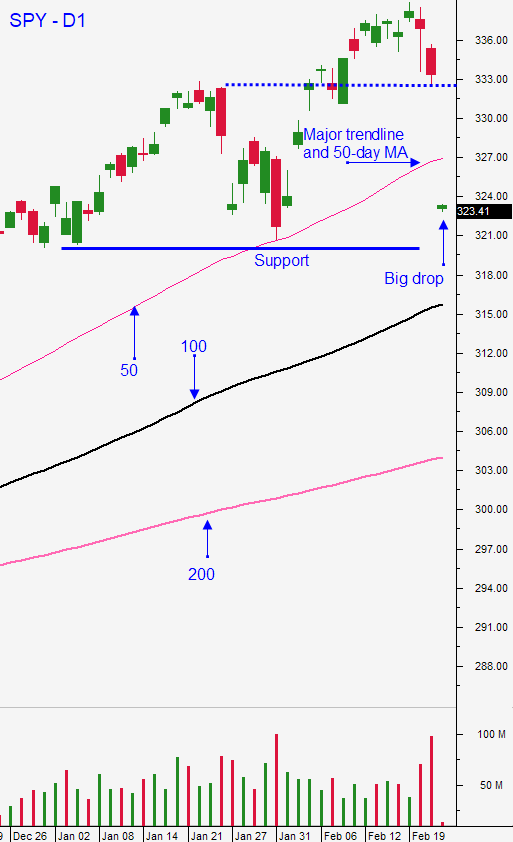

Posted 9:30 AM ET - This morning the S&P 500 is down 85 points before the open. The Coronavirus is spreading outside of China and scientists are still trying to determine the incubation period. They believe that an infected host can spread the virus for two weeks before they even show symptoms. This makes it extremely difficult to control/detect and global markets are selling off. The S&P 500 will test major technical support levels today.

If you have been following my market comments, you are in cash and you have a long position in VXX. Our two bullish put spreads will take some heat, but our risk is finite. Our long VXX position will more than offset our losses on those two bullish put spreads and we will make money on this move. It's nice to be in cash when the storm rolls in.

South Korea has the second highest number of new cases of the Coronavirus outside of China. In the last week the number of infections soared from 30 to more than 760. Their president raised the country’s infectious disease alert to the highest level for the first time since 2009.

Iran has reported 64 cases and 12 deaths.

The number of cases in Italy is also rising and Austria has stopped train travel between the two countries.

Apple said that revenues will miss guidance because of Coronavirus related supply disruptions. They have also had to close Apple stores in China. Starbucks closed 2000 of its stores during the peak. Disney closed it theme park in Shanghai. I've been pointing out my comments for a few weeks that this event is being completely discounted by the market and that any surprise favors the downside. The timing of this outbreak could not have been worse and it hit during the start of China's lunar New Year celebration.

So, what do we do now? We sit and patiently wait for this storm to pass. I don't know if the market drop will last one week or two months. It really depends on the spread of the virus and the economic impact. China is already starting to recover from it (health-wise) and it took about two months. They have a "cocktail" of antibiotics that seem to be working and scientists will find an effective treatment. Every week that passes the likelihood increases.

Unfortunately, the economic aftermath could be substantial. Stocks are priced at a forward P/E of 18 and that is at the upper end of the valuation range. This is no longer a perfect backdrop and we are going to see some profit taking after incredible gains during the last few years. Bullish speculation has been extremely high and those traders will be flushed out today. Sell programs will kick in and this decline could feed on itself. Option implied volatilities have been extremely low and this indicates complacency (option IVs would be much higher if Asset Managers had been buying protective puts). Asset Managers will scramble to add protection this morning (that will fuel some of the decline).

Swing traders might be tempted to buy puts. I would highly discourage this. On a massive market drop like this option implied volatilities will skyrocket and option bid/ask spreads will widen. This market rally has been unbelievably strong and it has been very difficult to short overnight. Historically low interest rates are keeping a bid to the market and I've explained why in recent weeks. This incredibly powerful force will keep buyers engaged and I believe the drop will be deep and swift. If you buy puts as a swing trader you run the risk of a massive intraday reversal off of a deep low. Your put position could be in fantastic shape one minute and it could be a disaster an hour later. If you can't watch the market all day, don't buy puts. Our best swing trade will come when market support has been established and I will wait for concrete evidence. I know the patterns to watch for. I told you when to go to cash and I will tell you when it's time to get long. Watch safely from the sidelines and know that fantastic buying opportunity lies ahead. I'm not going to guess the time frame, the price action will tell me when to take action.

.

.

CORONALVIRUS MARKET CRASH - CLICK HERE TO WATCH THE VIDEO FROM LAST NIGHT

.

.

.

Day traders, get ready for some fun. We have to tread very cautiously early in the day. Consecutive long green candles closing on their high or consecutive long red candles closing on their low would signal the market direction the rest of the day. We need to see a series of either in the first 30 minutes of trading. I don't think we will see it, but I am ready if we do. The market is likely to chop around and it will take time to establish a direction. A deep drop and a shallow bounce that lasts less than 20 minutes would be bearish. That would be a sign that sellers are still very aggressive and that the market still has lots of downside. If the market establishes early support and we get a bounce that lasts for more than an hour it will be a sign that buyers are still engaged and that support is fairly decent. We could make a marginal new low of the day in this scenario, but it's not likely that the bottom will fall out if the initial bounce lasts a while. I will be providing play-by-play analysis in the chat room. Trading stocks with relative strength/weakness will be much better than trading the S&P 500. These stocks will provide a cushion if you're on the wrong side of the action. There is a huge edge to the strategy that we use.

Support was at $330 and $327. Those are now resistance levels. The next support level is $320. Below that we have support at the 100 day moving average ($316).

We are prepared for the storm, let's let it pass and wait for clarity. This is going to set up an incredible trading opportunity for us. Be patient.

.

.

.

Daily Bulletin Continues...