New Data Suggests That Coronavirus Impact Will Be Great – Don’t Buy This Market Bounce

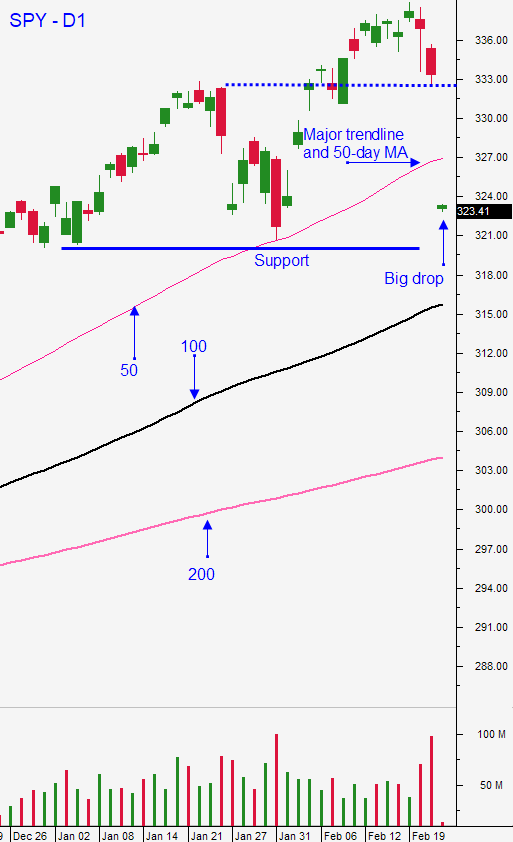

Posted 9:30 AM ET - Yesterday the S&P 500 fell more than 100 points, taking out major technical support levels on heavy volume. The Coronavirus is spreading to other countries and the economic impact could be greater than expected. At a forward P/E of 18, stocks are priced for perfection. This event could have a dramatic impact on earnings and investors are taking profits after a big market run-up the last few years.

The growth rate of Coronavirus in China is starting to decrease, but the recovery is slow. Coal demand for power plants was down 45% year-over-year on February 20th. Traffic levels remain low and by some estimates only 25% of the workers have returned to their jobs. The port authority in Los Angeles logged 25% fewer shipments from China and steel supplies in China are extremely high. Many producers are close to shutting down blast furnaces (expensive process). Schools in Hong Kong will not open until April 20th (at earliest).

The outbreak in South Korea is growing quickly and they have over 1000 new cases. Coronavirus has spread to Italy and Austria has stopped train travel between the two countries. Iran has reported 15 deaths from the Coronavirus (the most outside of China).

Companies are lowering or withdrawing their 2020 guidance as a result of the virus. Apple did that last week and MasterCard and United Airlines joined the list.

The economic news is fairly light this week. Fed Chairman Powell said that he does not see a need to cut interest rates because of the Coronavirus at this time.

The S&P 500 is up 17 points before the open this morning. Once this early bounce stalls we are likely to see additional selling. Stocks are pricey at a forward P/E of 18 and we are likely to see another leg lower. I believe that SPY $320 will be tested in the next week. Wall Street is still trying to quantify the economic impact of the virus and based on some of the statistics that I'm seeing, the aftermath will be substantial.

Swing traders should remain in cash. The market rally has been extremely strong and global interest rates are near historic lows. I don't see any credit issues... yet. Market drops will be extremely difficult to time and the snapback rallies will be violent. I believe this will be a three steps lower two steps backwards process as we probe for support. This will ultimately present a fantastic buying opportunity, but we need to be patient. It may take a few days or a couple of months. There is a lot of uncertainty and cash is king.

Day traders should wait for the early bounce to stall. I believe there will be a nice shorting opportunity. In previous weeks we've seen rebounds Monday morning, but the selling was steady yesterday. We have new evidence of the economic impact and I believe that this bounce will not gain traction. Once the selling pressure begins we should be able to test the low from yesterday. If I have misjudged the selling pressure I will know it early in the day when I see consecutive long green candles stacked one on top of the other. This pattern would tell me that the market bid is still extremely strong and that we might recover some of the losses from yesterday. I would only give this scenario a 25% likelihood of playing out today.

Swing traders - stay in cash. Day traders - look for shorting opportunity after this early bounce stalls. Long red candles closing on their low will be a sign to get short especially if today’s low of the day fails. Support is at SPY $321.20, $320 and $316.

.

.

Daily Bulletin Continues...