Take Profits On Short Positions – Here Is My Plan Today [Watch For This Pattern]

Posted 9:30 AM ET - The S&P 500 is down almost 300 points from its all-time high five days ago. Coronavirus has sparked panic selling, but the magnitude of the drop has been influenced by other factors as well. This is a great time for swing traders to sit on the sidelines and to wait for clarity. Cash is king and we will be ready to jump on this buying opportunity when support is established. Day traders, fasten your seatbelts.

I've been mentioning for the last few weeks that the Coronavirus is not getting the respect it deserves. Investors have been shrugging this event off on the notion that they will "weather the storm". That conviction often changes when the floodwaters reached the doorstep.

Coronavirus is spreading and the CDC said that the United States should prepare for an outbreak. This will be a global pandemic and it will have lasting economic implications. People are quarantined and the virus incubates for 14 days. Carriers don't show signs or symptoms and that makes the spread extremely difficult to control. As the virus spreads we are seeing geographic shutdowns and activity comes to a screeching halt. From a purely financial perspective (non-humanitarian) my greatest concern is that this could lead to a credit crisis. I am watching for the warning signs and I am not seeing any yet.

China says that it is getting back on track, but the data points I cited yesterday paint a different picture. This recovery will be slow. Economic growth forecasts for Q1 are at 3.3%, down from 4.6% a few weeks ago. Hong Kong has been hit particularly hard by the riots in Q4 and now by the coronavirus. They are considering a $15 billion stimulus package for each resident receives approximately $1300.

Japan may cancel the 2020 Olympics if the virus is not contained.

The statistics go on and on and I will conclude by saying that this will get worse before it gets better. Gilead Sciences (GILD) believes that it will be testing a vaccine in the next six weeks. China has an antibiotic "cocktail" that seems to be effective. It is likely that scientists will find an effective vaccine in the next few months, but time is of essence. Containing the spread right now is critically important because the virus can mutate.

I've been stating for the last few weeks that a "perfect storm" has been brewing. Global economic conditions have been improving and central banks have been providing a safety net for the market. Bullish speculators have piled into this powerful market rally and bullish sentiment was extreme. Asset Managers were also complacent. If they had been hedging recent gains, option implied volatilities would not be at historic lows because they would've been buying protective puts. Bullish speculators bailed on losing positions while Asset Managers scrambled to buy protection. Sell programs kicked in and the market tanked.

Where do we go from here? I don't know. As a trader - I don't guess. I watch price and volume. When I see particular patterns set up I know that my probability of success is extremely high. At this juncture I believe the market will rest for at least a few days while it digests news. Reality is sinking in and the "fluff" has been taken out of the market. I don't know if the Coronavirus will spark a credit crisis or if it will mutate. Fortunately, the "smart money" will know and they will leave a trail of breadcrumbs for us to follow.

Swing traders need to stay on the sidelines. We had a two bullish put spreads that we needed to hedge during this downturn so we bought VXX last Thursday. That hedge more than offset any losses and you should remove the hedge. There is a chance that the market could spring back and perhaps those two bullish put spreads will finish out of the money (unlikely, but we have already shouldered the loss). We are in cash and we have complete control over what happens next. I will be looking for situations where "the baby has been thrown out with the bathwater". These would be strong companies that will be unaffected by the virus and in some cases these companies will benefit from it. Clorox (CLX) is a good example. People use bleach to disinfect surfaces. There are many other examples and I will be looking for opportunities to sell expensive put premium on strong stocks when I release my weekly swing trading video tonight.

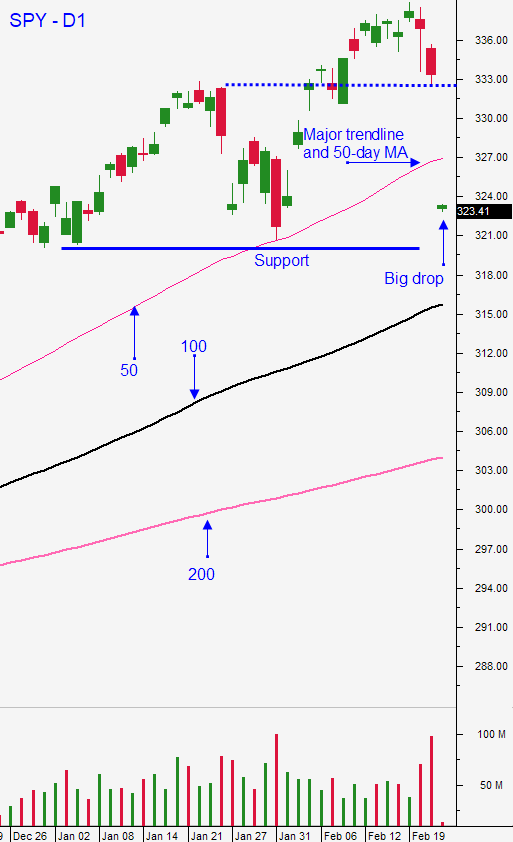

Day traders should look for a choppy day today. I will be watching for consecutive long green candles closing on their high in the first 30 minutes of trading. If I see them I will know that we are going to bounce today and that we might challenge the 100-day moving average. That is the most likely scenario and we will use Option Stalker searches to look for relative strength and heavy volume. I also believe that this could be a choppy resting day (wide range but a close near the open) for the market. I don't think that we will follow up with another massive sell-off today.

Support is at the 200-day moving average and resistance is at the 100-day moving average.

.

.

Daily Bulletin Continues...