Market Will Test 200-Day MA – Here Is How To Trade This Move [Options Strategy]

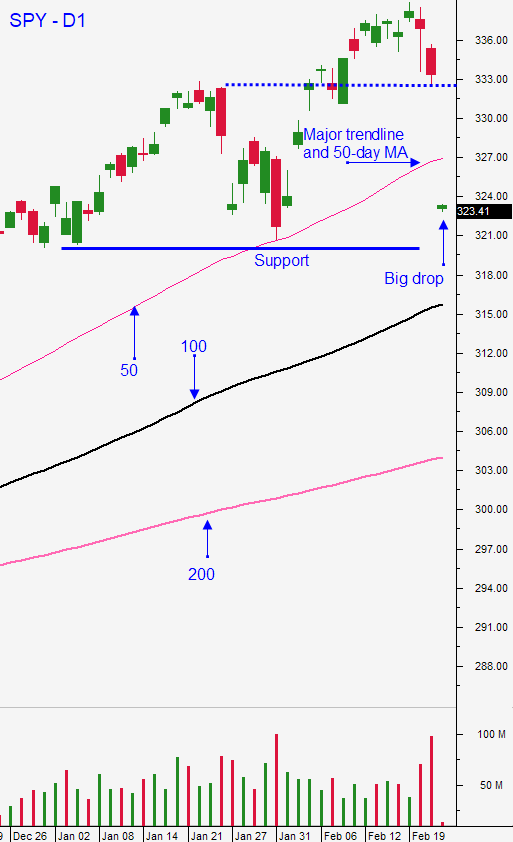

Posted 9:30 AM ET - Yesterday the market closed on its low, but the selling pressure was rather subdued compared to the prior four days. This morning the S&P 500 is down 40 points before the open and panic selling is setting in. Coronavirus seems to be the only thing hitting the headlines right now. I believe that the S&P 500 is going to test the 200-day moving average today or tomorrow. Buyers should be willing to scoop stocks at that level and I plan to sell out of the money bullish put spreads on this next leg lower.

The CDC warned that the virus is going to spread globally and that countries should prepare. It is difficult to detect and it can be passed by carriers who show no symptoms for up to two weeks. Biotech companies are scrambling to find a solution and a few of them believe that they will have a vaccine ready for testing in the next month. China has an antibiotic "cocktail" that they have been using and it seems to be effective. The greatest danger at this juncture is that the virus mutates.

Fear is spreading and the travel/entertainment industry is taking a hit. Airlines, cruise ships, hotels, sporting events and amusement parks are in a freefall. Many of these companies have very high fixed costs and there could be credit concerns.

I am not discounting the Coronavirus or its potential economic impact. I have been way ahead of the curve and I've been warning everyone the last few weeks. However, I believe that this market decline is an over-reaction at this stage and it will present a buying opportunity. Part of the fear has been caused by the sharp market decline. When investors see this type of freefall they assume that things are worse than expected and that the "smart money" is getting out. A huge part of this decline has been caused by extreme bullish sentiment. Speculators are getting flushed out and Asset Managers were over-allocated/under-hedged.

Do you remember the market freefall when Trump said he was going to impose tariffs on China? This was going to destroy global economic growth and the market tanked. With each passing month investors saw that this was not the case. Eventually, it didn't matter what he was going to do with regards to China trade. I know that this is a virus and I know it will have a long-lasting economic impact. The mortality rate is 2% and it is particularly nasty. However, China is recovering and I believe that calmer minds will see this as a buying opportunity.

On a swing trading basis I posted four new bullish put spreads that we will try to enter today. They are way out of the money and they are on very strong stocks that will not be impacted by the Coronavirus. These bullish put spreads will be sold way below technical support and we need this market pullback today to get filled. These bullish put spreads will expire on March 6th and we won't be in the trades very long. I want to take advantage of this last leg of the market drop. I'm expecting the 200-day moving average on the SPY to be breached briefly and we should see selling into the close Friday. Official PMI's will be released next week and investors will breathe easy. China might post its number and if they do I'm sure it will be "padded". The PMI's from Europe, Japan and the US will be decent because the virus has not had an impact in these geographic areas yet. There will be a pause to all of this selling. Risk has been adjusted in the last few days and bullish speculators have been flushed out. That selling pressure will be gone and some Asset Managers will start to nibble. For the strategy I've outlined to work, we need to test the 200-day moving average and tread water for a week. I see that is a very likely scenario and the possibility of a bounce exists. Swing traders should not buy puts and they should not buy calls. Option implied volatilities are extremely high and you must be nimble. Trades can look great one minute and horrible the next. For the most part you should stay on the sidelines and wait for clarity. I am only swing trading if I get an extreme move and if I can get in at an incredible price level.

Day traders need to watch for a test of the 200-day moving average this week. Trade stock - not options. If you do trade options make sure that you are selling bullish put spreads and bearish call spreads. I did this effectively yesterday on the SPY. I traded the February 26th expiration so that I could take advantage of declining IVs and time decay. If you use this strategy, focus on options that expire Feb 28th. I would like to see us test the 200-day moving average and I would like to see a sharp intraday reversal off of that low. If we get it and we close on the high of the day and we close above the 200-day moving average, I will take overnight bullish positions (not long calls).

Swing traders take a deep breath and let's see if we can get into some of these spreads at incredible prices. Day traders, look for consecutive long green candles closing on their high or long red candles closing on their low in the first half hour of trading. That would be an indication of a strong directional move.

Stay calm, you are in control.

Daily Bulletin Continues...