Buy Stocks and Hold Them Over the Weekend If You See This Pattern [Use This Options Strategy]

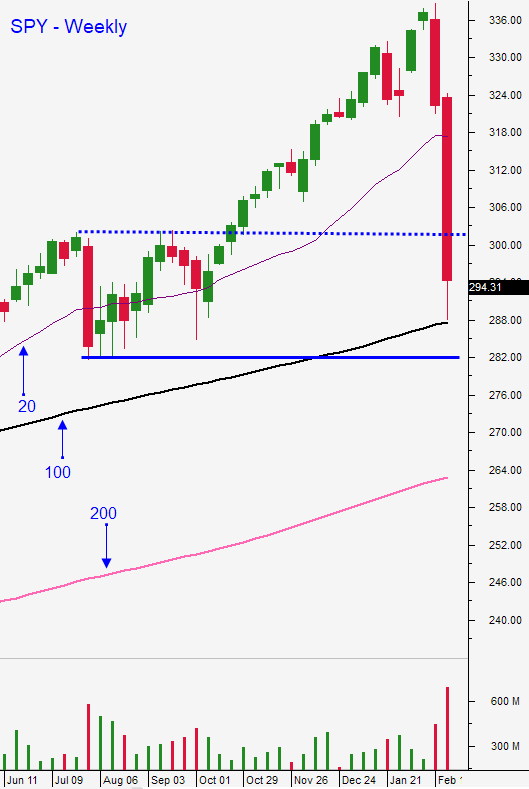

Posted 9:30 AM ET - It's never a good sign when you have to go to a weekly chart to find the next technical support level. The S&P 500 is in a freefall and panic selling has set in. Coronavirus is officially on everyone's radar now and it is getting the attention it deserves. I'm not going to get into the details of the outbreak because you can't escape the minute-to-minute updates on major media outlets.

Friday's have typically been soft even before the panic selling. Traders are not going to want to go home long and I expect to see weakness today. The S&P 500 blew through the 200-day moving average yesterday after a news report revealed that 8400 potential cases are being reviewed in California.

There will be a shortage of respirators and President Trump has ordered manufacturers to shift production from breathers (masks for dust, pollen and pollution) to respirators (masks to filter bacteria). It also appears that there is a shortage of testing kits for the virus. This virus incubates for up to two weeks and carriers are contagious without showing any symptoms. This makes it extremely difficult to detect or control.

The greatest threat to the market is that consumers change their behavior. If everyone stays home, economic activity will come to a screeching halt. Companies with huge overhead expenses and heavy debt (i.e. airlines) rely on cash flow and this could cause a credit crisis. Most central banks have a zero interest rate policies and they are painted into a corner. Sovereign money printing will be used to temporarily fend off a credit crunch.

The media is all over this outbreak and there's nothing like a global crisis to fuel ratings. It's hard to escape the updates so I won't be providing any here.

There are some slivers of light. Every week that we delay the spread of the virus we are one step closer to a vaccine. Biotech companies are working feverishly (pardon the pun) to find a treatment. Many believe that they are 4 to 6 weeks away from testing. China has an antibiotic "cocktail" that seems to be effective and the growth rate of new cases is subsiding. While it's true that the mortality rate is 2.5%, not everyone will be infected. In the last two months, 80,000 people in China have contracted it. When you divide the number of deaths (2800) by the population of China you can calculate your chances of dying from it.

I'm not discounting the economic impact of the Coronavirus and I'm not diminishing the loss of human life. I'm just trying to put this into perspective. This is a race against time and scientists know that they have to find a cure before it mutates.

Swing traders should largely be in cash. Yesterday we entered four bullish put spreads that expire March 6th and we used half of our normal trading size. We selected strong stocks that should be unaffected by the Coronavirus and we sold the spreads below major technical support. The spreads moved against us yesterday, but they are still out of the money. We wanted to take advantage of inflated option applied volatilities and accelerated time decay. I felt that the 200-day moving average on the SPY would hold yesterday and I was wrong. I still feel that the spreads will be fine and I don't want to adjust them. We've had 20 positions on that any one time in the last five months and this is a very minor holding for us. If by chance all of the spreads lose money it should only represent about 10% of our capital and it will mean that the next buying opportunity will be that much better when we rebound. I am not writing the spreads off and I still feel that the stocks will weather the storm better than the rest and that they will finish out of the money. I also expect to take some heat on them today. Option implied volatilities are extremely high and there is no assignment risk.

Day traders should watch the early action. If you are trading options, make sure you are selling out of the money spreads that expire today. Do not buy option premium. In general, option bid/ask spreads are very wide and you should trade the underlying stock. I would also suggest trading S&P 500 futures and not SPY options. The moves are huge so trade 1/3 of your normal size. I will primarily be trading stock today. In the early part of the session I will select a couple of longs that I really like and a couple of shorts that I really like. I will use those stocks as surrogate market positions. Relative strength/weakness is a powerful edge and I will work it all day long. Option Stalker will help us find the best stocks. Support is at SPY $287.50 (100-week MA)

If I had to guess how the day will play out I can envision an early low, a midday bounce and selling into the close.

It's important to note that this type of selling feeds on itself early in the cycle. In recent weeks I've been mentioning extreme bullish sentiment and historically low option implied volatility. This is the perfect storm for a monster market decline. This week those factors have come into play and they are exaggerating the move. Bullish speculators have been flushed out and Asset Managers are hedged now. That process creates selling pressure and that impetus is gone. Now it is just a matter of investors heading for the exits and funds having to liquidate to meet redemptions. Many investors will be reluctant to sell below this point feeling that they already "missed the boat". I do believe that at very least the market decline will pause next week.

If by chance the market plummets this morning and it establishes a very deep early low, look for consecutive long green candles closing on their high off of that low. That would be a sign that a capitulation low has formed and buyers will aggressively get behind it. In this scenario the market will close on its high of the day heading into the weekend and we can expect a gap higher on Monday (perhaps through the 200-day moving average). If by chance we see this price pattern, buy and hold over the weekend. You will be glad you did. I will be selling March 6th expiration out of the money bullish put spreads like mad if I see it.

.

.

Daily Bulletin Continues...