Market Is Likely To Bounce Today – Watch For This Pattern [Hold Overnight If You See This]

Posted 9:30 AM ET - We haven't seen a market drop like this since the 2008 financial crash. Panic selling sparked by the coronavirus accelerated as bullish speculators dumped stocks. Under-hedged Asset Managers scrambled to add protection and that fueled the move. The S&P 500 has been down 40 points and up 40 points in the overnight session. Where do we go next?

I believe that the market will find its footing this week and that the selling will abate. Last Friday we saw a 70 point S&P 500 rally in the last 15 minutes of trading. That was caused by end-of-month fund rebalancing. Their models place a specific percentage in equities and in bonds. Bonds have rallied and stocks have tanked so those percentages were out of whack. They had to sell bonds and buy stocks. We will also see some end-of-month/beginning-of-the-month fund buying the next few days.

China reported that there were 200 new Coronavirus cases. If you believe their number, that growth rate is down substantially over the last two weeks. The virus is spreading globally and it will have an economic impact as consumers change their behavior.

Since China has had to deal with this crisis for two months, I would like to focus on their situation. Gaming revenues in Macau were down 87%. China's manufacturing PMI fell to 35.7 and the Caixin PMI fell to 40.3. These big drops were expected since two thirds of the country was shut down. Coal consumption for energy production is down 45% and traffic counts are only 25% of normal. The good news is that workers are returning. Apple and Starbucks are starting to reopen stores. Approximately 80,000 people have contracted the Coronavirus in China and that is a relatively small number given their population. The mortality rate is 2.5%, but not everyone is infected.

I've read a number of articles over the weekend and there are mixed opinions on how devastating this virus might be from a humanitarian standpoint. Scientists seem to agree that even if a vaccine is developed it would take at least 4 to 5 months to ramp up production and to distribute it to the public. Viruses tend to be more dormant during the summer and that could buy precious time.

From an economic standpoint the virus will impact travel and entertainment stocks the most. Airlines, hotels, cruise lines, concerts, sporting events and conventions will suffer. These were the hardest hit stocks and some of them are showing signs of support. If plants close down due to the virus it will impact supply chains. This could have a chain reaction as workers are forced to take time off and it could impact consumer spending. Most global growth projections have been lowered considerably and there are still many unanswered questions.

ISM manufacturing will be posted this morning (10 AM ET) and we will see if there are signs of domestic manufacturing deceleration. As a survey, this data is forward-looking. ISM services will be posted Wednesday along with ADP. The Beige Book will also be posted Wednesday and it will give us some insight on regional economic growth in the US. I don't believe that these numbers will have much of a bearing on the market. If they are strong, traders will take them with a grain of salt knowing that the "hurt" is coming. If the numbers are soft, traders will expect Fed easing.

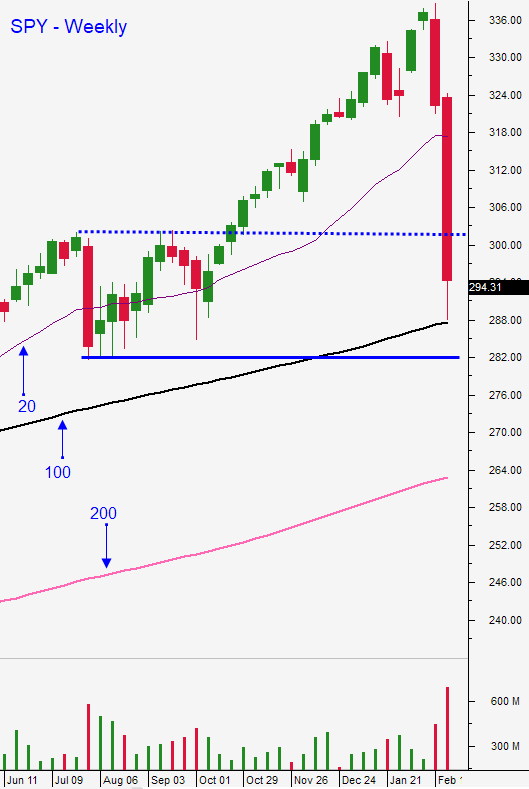

I don't know where the market is going to go for the next month, but I do believe that we will see a selling pause this week. Swing traders should be in cash and we have four bullish put spreads on. We are trying to take advantage of inflated option implied volatilities and we sold these bullish put spreads on strong stocks. I liked the price action on all of the stocks last week and I think we will be in good shape. All of the spreads expire this Friday. I am likely to sell more bullish put spreads this week if I see this pattern. I want to see hard selling this morning and I want to see buying before we challenge Friday’s low. If the low today yields a bullish hammer or a bullish engulfing pattern I will be ready to buy. I want to see that low followed by consecutive long green candles closing on their high. If this happens and the market closes on its high of the day I will hold positions overnight. With this pattern I would expect the SPY to easily get through the 200- day moving average this week (SPY $304.40). I feel that this is the most likely scenario, but it does not mean that I am long-term bullish. I'm simply looking at a short-term trading opportunity. The heavy selling we saw last week tells me that the low will be tested again in the next few weeks. We need to go through a bottoming process before we can hold longer-term bullish overnight positions with confidence. This might take a month or more to form. During that time we will have clarity and that doesn't necessarily mean that the news will be good.

Day traders need to let the market come in and they need to watch for that "hard low". If the reversal off of that low has mixed candles and if it is tenuous, we need to play that move as a bounce that will run out of steam today. When that bounce runs its course, take profits. If that low produces a series of long green candles closing on their high we can get long and we will try to hang onto those long positions. If the market closes on its high of the day I suggest carrying some overnight positions. I am not interested in trading the short side today. There's too much risk of a short covering bounce and rallies from this low level could be violent. If I see a compression near the low of the day on the S&P 500 and it lasts for more than 30 minutes with "tails under body" I will start to buy stocks with relative strength.

I am expecting support to be established this week and for a grind back to the 200-day moving average.

.

.

Daily Bulletin Continues...