Nailed the Market Bounce – Now What? [Here’s the Game Plan]

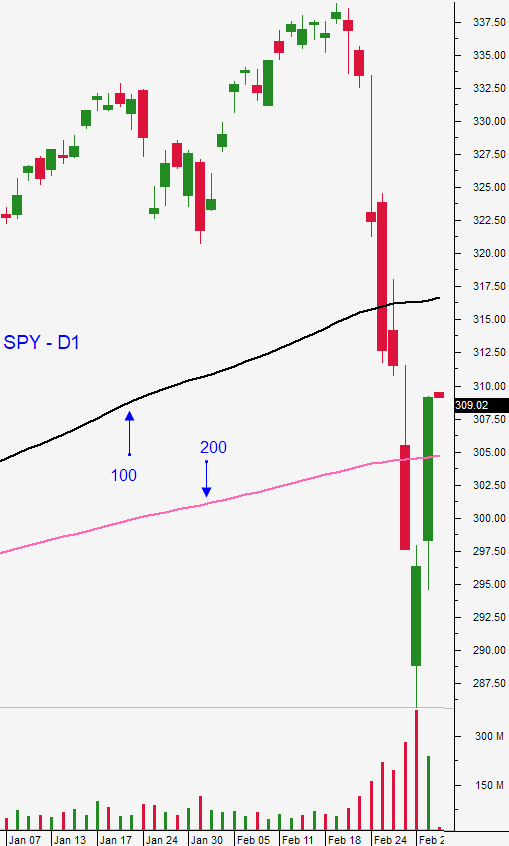

Posted 9:30 AM ET - Yesterday, the market opened a little higher and it filled the gap. The move higher was rather tenuous and the bid was tested mid-day. During the last hour of trading buyers came in full force and the S&P 500 rallied 100 points, closing on its high of the day and blowing through the 200-day moving average. Stocks are up before the open and it looks like we will see follow-through buying today. We got the bounce we were expecting and we are positioned for this move.

When most of the gains were maintained yesterday afternoon I told members that this was a bullish sign. Buyers would gain confidence and Asset Managers would lift some of their hedges feeling that the panic selling had run its course. We aggressively took long positions an hour before the close and we captured the entire move. We also sold bullish put spreads early in the day and our bullish put spreads from last week are way out of the money with only days left until expiration.

I don't know the impact of Coronavirus will have on economic growth, but I know panic selling when I see it. As I've been explaining, bullish sentiment and under-hedged Asset Managers had as much to do with the selloff as the virus. Once sell programs kick in they are relentless and one triggers the other.

Central banks around the world are easing and a 50 basis point rate cut is expected from the Fed in two weeks. With interest rates near 0%, loose central bank policies pack no punch. I don't believe easing will have any material impact on consumer behavior.

Many scientists believe that the Coronavirus has been in the US for a couple of months. Chances are it went undetected in January and it has already been spreading. Healthcare facilities did not test for it and that explains why it is popping up in areas with no known source. The good news is that it does not infect everyone and most people have a strong enough immune systems to fight it off. The Coronavirus has taken 9,000 lives and by comparison, the flu has taken 22,000 lives in the month of February. I'm not a doctor or scientist, but this sure feels like much to do about nothing. New cases in China are decreasing at a rapid rate and it's possible that the virus will go dormant when warm weather arrives.

The dramatic market selloff we saw last week is likely to impact the extent of this rally. Now that we are clearly through the 200-day moving average I believe we could float up to the 100-day moving average. Stocks should find some resistance at that level and buyers will wait for some clarity.

Swing traders need to be patient. These are violent moves and they are sparked by news events. I believe that with each passing day the fear of a pandemic will decrease, but we need to wait and see. We don't need a full-blown outbreak to impact consumer behavior. If enough people are worried about the virus they will cancel vacations and avoid crowded places like restaurants and malls. That economic impact will play out in the next few months. We have some bullish put spreads that will expire worthless this week and that will generate nice income for us. Tonight I will be releasing my Weekly Swing Trading Video and I will be looking for opportunities to sell inflated option premium on both sides. With each subsequent market drop I plan to be more aggressive with my bullish put spreads and I expect to see higher lows. This is a week-to-week environment and we will sell very short term spreads to control risk and to maximize time decay and a volatility collapse. THIS IS NOT A TIME TO BUY OPTIONS.

Day traders should look for early follow-through buying. I am not expecting a straight shot higher and there will be opportunities on both sides. I am favoring the long side and I will be looking for stocks with relative strength that are rebounding from deep lows. Use the 200-day moving average as your guide. The 100-day moving average will provide overhead resistance.

We did not swing trade during the market drop, but we day traded from the short side. That was very profitable for us and we started selling out of the money bullish put spreads late last week. Yesterday we captured almost the entire drop and bounce. This has been an incredible stretch for us and it's time to let the dust settle.

.

.

Daily Bulletin Continues...