The Market Is Volatile Intraday But It Will Settle Down [Here Is Where It Will Close Friday]

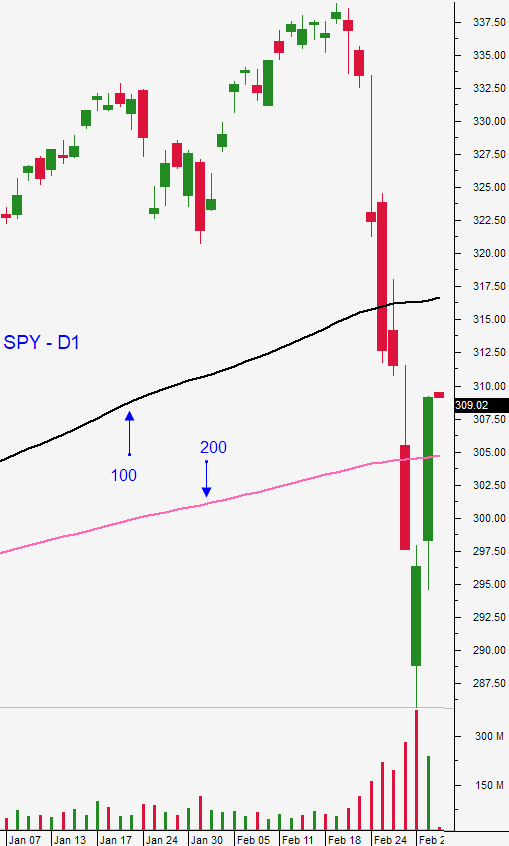

Posted 9:30 Am ET - Yesterday the S&P 500 came within striking distance of the 100-day moving average after the Fed cut interest rates by 50 basis points. That was the largest rate cut in many years and instead of instilling confidence, it spooked the market. This morning the S&P 500 is up 60 points before the open and is likely to challenge the 200-day moving average. That is where I expect us to finish the week (SPY $304.50).

The coronavirus is spreading globally and the economic impact could be substantial if consumers change their behavior. Domestic growth projections have been lowered by J.P. Morgan Chase. They now expect GDP growth of 1.4% for the year, down from 1.7% just a month ago.

The virus does not spread as efficiently as the flu, but it is more deadly (3.4% versus 1%). Companies like Google, Twitter and J.P. Morgan Chase have asked many of their employees to work from home to prevent the spread of Coronavirus. Takeda Pharmaceuticals is joining Gilead Sciences and AbbVie to develop a vaccine. It would be derived from the blood of coronavirus patients who have recovered.

The economic news this week is significant, but it is taking a backseat to the Coronavirus. Good economic numbers will be viewed skeptically since the "hurt" is coming. ISM manufacturing was better-than-expected Monday and this morning ADP reported that 183,000 new jobs were created in the private sector during the month of February. That was a good number. ISM services will be reported 30 minutes after the open this morning.

Some of the rally this morning might be attributed to Joe Biden's victory on "Super Tuesday". Bernie Sanders was viewed by investors as “market negative”.

Swing traders have a handful of bullish put spreads that will expire Friday. We just need the market to tread water for a few more days. All of our positions are way out of the money. I typically record my Weekly Swing Trading Video on Wednesday night, but this week I wanted to do it a day early. Given the market drop yesterday I thought we might see follow-through selling this morning. Last night I recorded the video and I highlighted four excellent bullish put spread candidates - it doesn't look like we'll have a chance to be filled on those because of the big opening gap higher. Market conditions are changing rapidly and… you never know. We are selling out of the money bullish put spreads on strong stocks that have firm technical support. We are focusing on the March 13th expiration and we want to stay very short-term with the spreads. Accelerated time decay and high option implied volatilities will work in our favor. This is not a time to "spread your wings" if you are a swing trader. The Coronavirus is a legitimate economic threat and we still don't know how all of this will play out. I am simply trying to take advantage of panic selling this week with the expectation that the price action will settle down and that we will finish the week close to the 200-day moving average.

Day traders need to watch the opening gap higher this morning. At some point the bid will be tested. Conditions are extremely volatile and yesterday we had many five-minute bars that had 20 point S&P 500 ranges. In the chat room we were focusing on stock trades and they were much less volatile. When the market rallied and the move stalled we shorted stocks that are weak relative to the market and we played that reversal. When the market dropped to the low end of the trading range and stalled, we bought stocks with relative strength. This is how we are playing intraday reversals and Option Stalker searches are helping us find these stocks. In the event that we are early on the trade and the market moves against us, these stocks provide us with lots of cushion and we are able to exit the trades without much (if any) losses. When the market behaves as expected, these stocks take off.

Look for volatile trading and for the SPY to finish the week around the 200-day moving average.

.

.

Daily Bulletin Continues...