Big Market Drop? Not On A Relative Basis [Here’s Where I Expect It To Close Fri]

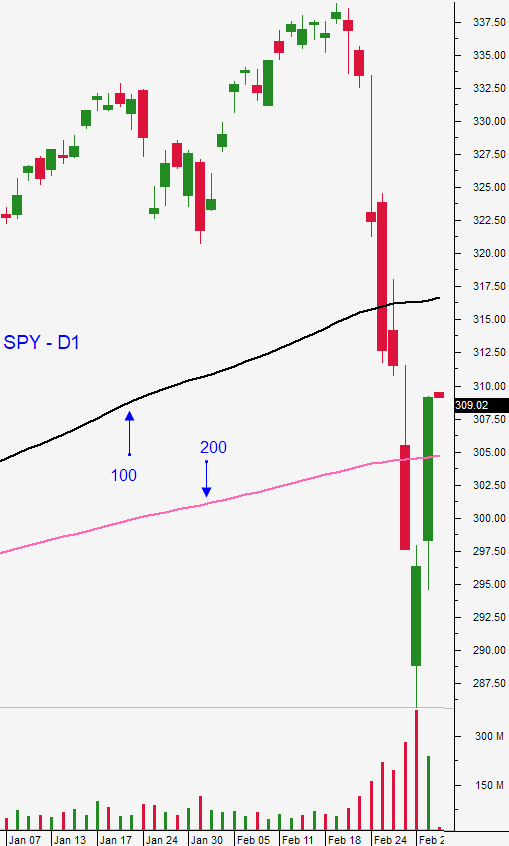

Posted 9:30 AM ET - The market continues to make wild swings and the action is driven by Coronavirus news. California has declared a state of emergency and airlines are taking a beating. Travelers are canceling flights because of fear and because of bans. This industry has extremely high fixed costs and these businesses are leveraged (lots of debt). They are dependent on cash flow and an English airline has been forced into bankruptcy. Central banks are easing in a coordinated manner and that safety net is not calming investors. I still believe the S&P 500 will close at the 200-day moving average Friday.

The S&P 500 will be down 65 points on the open this morning. That seems like a huge drop, but it is just giving back the gains from the last three hours of trading yesterday.

Central banks are cutting rates in a coordinated effort. The Fed cut rates by 50 basis points (the first time in many years), Canada cut its rates by the same amount and Australia cut rates by 25 basis points. Typically these rate cuts would have a bullish market impact, but it is actually spooking investors.

Domestic economic releases would typically grab the spotlight this week, but no one cares. Analysts know that the "hurt" is coming and GDP growth projections for 2020 are being lowered to 1.4%.

In the next few weeks we can expect profit warnings as companies adjust their projections for Q1.

Joe Biden leads Bernie Sanders after "Super Tuesday" and some analysts believe that is reducing market risk. I don't know how much of a factor this is and I would be surprised if it accounts for even 10% of the market movement. In my opinion this is all about the spread of the virus and its potential economic impact.

Swing traders should have minimal exposure. The bullish put spreads that we sold a week ago are in fantastic shape and we only have two more days to get through. The S&P 500 would have to test the lows from last week for these positions to be in trouble and I don't see that happening. We tried to place some bullish put spreads yesterday, but the market rallied and we were not able to get filled. We will cancel those orders and wait for another opportunity. I do like being short VXX and I believe that the market volatility will slow down in the next week. I am using a stop on that position of SPY $304. If the SPY is trading below that level in the last five minutes today, buy back that position. I also have a target of $22.01 and I'm trying to buy it back at that price. I still believe that the SPY will close at the 200-day moving average tomorrow. That is a natural resting point. Support is at the 200-day moving average and resistance is at the 100-day moving average. I believe that the market will start to compress within that range next week. Swing traders need to wait for more clarity. I am only interested in selling out of the money bullish put spreads if we see another big wave of selling.

Day traders need to pick their spots carefully. There are windows of opportunity during the course of the day on both sides. We are waiting for intraday reversals and we are focusing on stocks with relative strength and relative weakness. My goal in the first 30 minutes of trading is to identify a few longs and a few shorts that I will use as surrogate market positions.

Get ready for another volatile day.

.

.

Daily Bulletin Continues...