Too Many Jobs Spark Big Market Decline [Here’s Why]

Posted 9:30 AM ET - It's unusual to see robust job growth and a 100 point S&P 500 decline. Of course job growth is not the source of the selling. After scouring the news this morning I was tired of reading headlines peppered with Coronavirus and panic so I tried to add a little levity to a gloomy day.

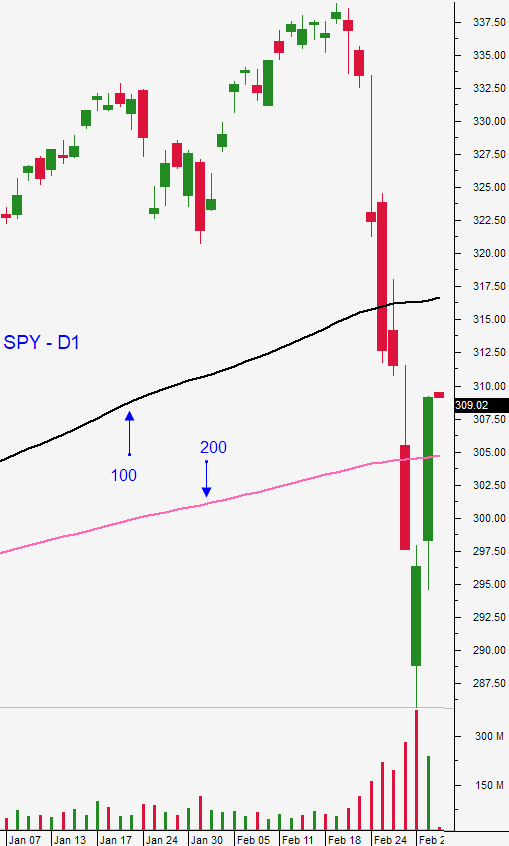

Panic selling is hitting full stride and the S&P 500 is likely to test the lows from last Friday. Stocks tried to bounce this week, but the selling pressure was heavy as the Coronavirus continues to spread. Corporations are imposing travel bands and in many cases they are asking their employees to work from home. Conferences and conventions are being canceled, but the 2020 Tokyo Olympics will go on. The best thing for swing traders to do is to watch from the sidelines.

Typically when the market (or any asset) drops like it did a week ago, there will be aftershocks and new lows. I expected us to tread water for a week at the 200-day moving average and that is unlikely. Panic is always difficult to gauge and there are reports of people hoarding food on the West Coast and reports of price gouging for everyday items like hand sanitizer.

Central banks around the globe cut interest rates this week in a coordinated fashion. This was meant to instill investor confidence, but instead it created more fear. Many central banks already have a zero interest rate policies and they are painted into a corner.

It's important to note that not everyone is infected by the Coronavirus and it is not transmitted as easily as the flu. Of the people that contract it, 80% fight it off without any signs or symptoms. Of the remaining 20% the mortality rate is 3.5% and that statistic is the one that everyone is focused on. You can't watch TV, listen to the radio or read a newspaper without hearing about the virus.

As consumers and corporations "shut down", the economic impact cascades. Many corporations depend on cash flow and this abrupt contraction could ignite credit issues.

This morning we learned that 273,000 new jobs were added in February. Analysts know that the "hurt" is coming and this number is meaningless in this environment.

Swing traders need to watch from the sidelines. We have four bullish put spreads that will expire today and we would have to see the market take out the low from last week in order for them to even be close to the money. This is a small position for us and we traded half size, but I will breathe easy when the closing bell rings.

Day traders need to be cautious. We have been able to find some intraday opportunities, but we have to focus on stocks, not the S&P 500. The futures are so volatile that many five-minute bars have a 20 point range. Stocks are much less volatile and we can lean on relative strength/weakness. Don't trade options. The bid/ask spreads are a mile wide and there is too much slippage. Just trade the underlying stock.

Asset Managers have been passive on Fridays and no one wants to hold positions over the weekend. If people are hoarding food, they are in a full-blown panic and they will sell their stock holdings as well.

If you are a long-term buy-and-hold investor, brace yourself. There is more pain ahead. If you are in cash, know that there will be a buying opportunity. Don't try to catch a falling knife. We need multiple signs of support before we can dip our toe in the water. Scientists are scrambling to develop a vaccine and these viruses are typically more dormant in warm weather.

Take a deep breath. Calm minds will prevail.

.

.

Daily Bulletin Continues...