S&P 500 Limit Down – Use This Day Trading Tactic [No Options]

Posted 9:30 AM ET - This morning the S&P 500 futures are "limit down" and the 5% down rule will trigger on the open. Once the bell rings, only orders above the threshold are allowed. Trading will be halted for 15 minutes and then the next trigger is at -7% (2764). That will be in force until the last hour of trading. There will be another 15 minute pause if the market falls 13% (2586). If the market falls by 20% (2378) the market will close for the day. I doubt we will hit many of these targets, but panic selling on a global level is taking place. Credit concerns are flaring up overnight.

The Coronavirus is the catalyst. Countries are shutting down travel and they are advising citizens to stay home in an effort to contain the spread of the virus. Many companies and industries depend on cash flow and they can't shoulder having it completely turned off in an instant. Airlines and cruiselines are a classic example.

Italy is a sovereign example. For many years they have been teetering on a credit crisis, but it has been masked by global growth. Now they have restricted travel for 1/4 of their population. Italy is extremely dependent on tourism (15% of GDP) and this will dramatically impact their economy.

As the coronavirus spreads these travel restrictions are also spreading. Global demand for oil is plunging and OPEC could not agree on production cuts. Saudi Arabia is going to flood the market with oil and that could put higher cost producers out of business. When these companies go bankrupt, it impacts the banks that financed their operations. Low oil prices also reduce a well-paid workforce.

China reported that exports were down 17% in February year-over-year. We knew that their economy was going to take a hit and their fate could spread globally.

US treasuries have traded below .5% overnight and there is a flight to safety.

Credit levels have been extreme for many years and the "house of cards" will be tested. This problem exists from the consumer, to corporations, to banks and even it even reaches sovereign heights (governments). It's almost impossible to predict "black swan" events, but this has all of the right characteristics. An instantaneous global economic shutdown could be disastrous. Hopefully calm minds will prevail.

I believe that the number of coronavirus cases will explode in the next few weeks as test kits are widely distributed. That could cause another wave of panic, but ultimately that fear will subside. I believe that the virus has been here for a while and that it is widespread. That would explain why it is popping up everywhere without any known source. Not everyone contracts Coronavirus and it is much less efficient at spreading than the flu. More than 80% of the people who have it never show any symptoms. Their immune system fights it off. The 20% who do get it have a high mortality rate of 3% and that is what everyone is focused on. That is what sparks panic and 3% of the population is NOT going to die from it. If the public gets used to the idea that they might've already been exposed to it they will calm down.

I'm not here to candy coat anything or to tell you that everything's going to be just fine. There is a world of hurt coming and I don't know how this plays out. If credit concerns start to escalate there is often a chain reaction and it's almost impossible to stop. Governments are trying to get ahead of this and they are flooding the market with money. That's why you saw a coordinated effort by central banks last week to lower interest rates. This week we are likely to hear about bridge loans to hard-hit industries.

Swing traders need to be on the sidelines. Last week our remaining bullish put spreads expired worthless (SPOT, NVDA, AMZN, MSFT, TWTR, GOOG, V).

Many of these spreads were way out of the money, yet they held a lot of premium right to the closing bell and you could not buy them back on the cheap. The options were $0.20 bid offered at $0.50 and we can expect similar pricing in this environment. Once you put the spread on you have to hold it until the very end to make the credit. At the money call options that expired last Friday on a relatively stable stock like McDonald's were $.50 bid offered at $1.50 with less than 1/2 an hour of trading to go. I know because I was looking for option lottery plays. They didn't exist because of the option premiums. We have to stay on the sidelines and wait for the market to settle down. This is a very low probability trading environment and I know that everyone thinks there are fortunes to be made on the short side. If you bought puts with a few months of life a couple of weeks ago and you have not sold them, yes you could make a lot of money. However, who is not going to lock in a profit like that?

Day traders need to focus on relative strength and relative weakness. Don't trade options, trade stock. Reduce your size and your trade count. It's very important to pick your windows of opportunity. We will be looking for reversals and we will be trading stocks in the chat room today.

If you are an investor and you are in it for the "long-haul" you need to be prepared for a rough ride. I mentioned in my comments two weeks ago that if you are "nervous" that is a sign of overexposure and you should reduce your risk (sell some stocks). At this juncture you have missed that opportunity.

I have not seen any huge credit issues as of yet, but we are very early in the game. As the virus spreads and as economic growth contracts, these issues will surface. I will be very watchful and I know they can escalate at any minute. The next few weeks will be critical.

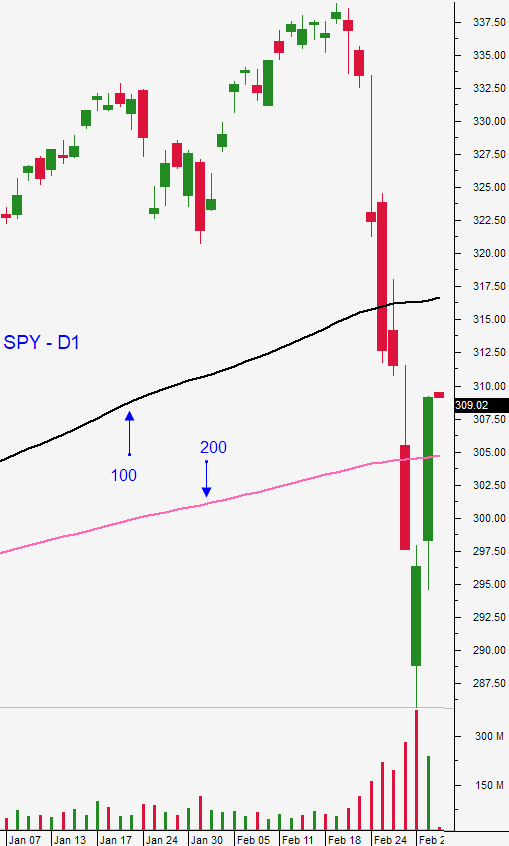

Support is at SPY $285, $275 and $235.

.

.

Daily Bulletin Continues...