Market Gap Higher Will Be Tested Early [Here’s How To Trade It]

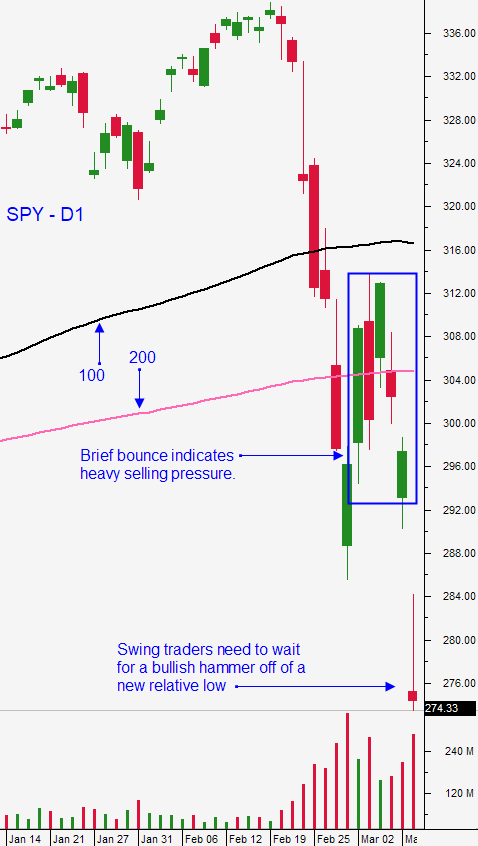

Posted 9:30 AM ET - Yesterday the market plunged over 7% and it triggered trading limits. The action was halted for the first 15 minutes and the market closed near key support at SPY $275. Panic selling has been widespread and we are seeing a small bounce from a deeply oversold condition this morning. The opening gap higher will be tested early in the day and that test will set the tone for the rest of the day. If the market is able to hold the gap, stocks will try to drift higher. If we see long red candles closing on their low and they take out the low of the day, we will try to fill some of the gap. This is a good market to day trade, but it is still too early to swing trade.

Capitulation lows are usually formed from a very deep, gut wrenching intraday drop. Once support is formed the buying is relentless and we see a series of long green candles closing on their high. There is no wavering and the move is on a steady path higher. The market closes on its high of the day and a bullish hammer on the daily chart marks the low. We need to see this reversal pattern before we enter bullish swing trades and I feel we are two or three weeks away from seeing it.

The overnight news is encouraging. China's new Coronavirus cases drop below 100. The temporary hospitals that were built are being closed and Xi is making his first visit to Wuhan. Laborers are returning to work and Alibaba said that its food service packaging/delivery is fully staff. Travel restrictions in the Hubei province have been lifted in low risk areas.

President Trump said that he will discuss a payroll tax cut with Congress and there are fiscal stimulus plans being discussed.

Russia and Saudi Arabia will continue oil production talks. From what I'm hearing Saudi Arabia is likely to backpedal. Oil futures are up 8% this morning and that will help energy stocks. I personally feel that there are some bargains in this sector and that the demand for oil will rebound in the next two months. The current supply needs to be worked off and then prices will start to climb.

After an incredible round of selling the last few weeks it would be foolish to buy the first bounce. The Coronavirus is still spreading and it will have a dramatic impact on global economic activity. It will take at least three weeks to climax and perhaps more. I believe that the initial shock factor will start to wear off in the next few weeks when people get a feel for the threat. Italy and South Korea will be litmus tests for the rest of the world. Those two countries are battling the virus and they will be a good indication of how long it might take to recover from its impact.

Swing traders need to be patient. The Coronavirus continues to spread and it will continue to affect consumer spending. Corporations are canceling conventions and people will avoid large gatherings (sporting events, concerts and festivals). After such heavy selling the last few weeks there will be aftershocks. We need to see the capitulation low that I referenced earlier and a higher low. That could take many weeks to form, but when we have it there will be an excellent buying opportunity. I am looking at selectively selling some out of the money bullish put spreads in the energy sector.

Day traders need to watch the early action. I'm always skeptical of an opening gap higher after a deep drop. These gaps are typically faded in the first hour of trading. If the gains hold up relatively well, we are likely to grind higher. If the gains are easily given back, we are likely to drift lower and fill in some of this gap. We have to take the day minute-by-minute. We are buying stocks that are strong relative to the market and shorting stocks with relative weakness. In the chat room yesterday we were primarily short financial stocks. That sector is extremely weak. I suggest trimming your size and trading stock. Option bid/ask spreads are a mile wide and option implied volatility is extremely high. There's too much slippage trading options and with 4:1 intraday leverage you should trade stocks. Stocks are much more liquid and it is easier to enter and exit the trade.

Look for choppy conditions while all this plays out in the next few weeks.

.

.

Daily Bulletin Continues...