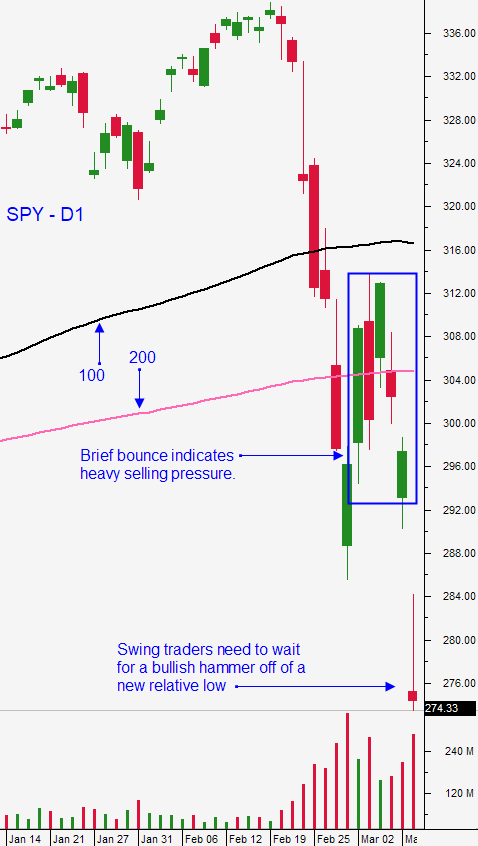

Market Finding Support At This Key Level – Another Bounce Could Attract Buyers

Posted 9:30 AM ET - Yesterday the market tested the low for Monday and that support at SPY $275 held. Later in the day buyers emerged and stocks rallied well off of their low. The resulting pattern on a daily chart was a bullish hammer. Typically, off of a deep low we would see follow-through buying the next day. That is not the case and the S&P 500 is poised to open 80 points lower this morning on news that the Coronavirus is spreading in the US. This should be expected for at least a few weeks and it will take time for fear to subside.

New York Mayor de Blasio said that they can't keep up with the new cases reported. As I mentioned yesterday, test kits are available and many more people will be tested. This is likely to reveal that the virus is widespread and that it has been here for quite a while. John's Hopkins University says that US coronavirus cases exceed 1000. Google is asking its employees to work from home and many other corporations are taking similar actions. There have also been a number of school closings and events are being cancelled.

Italy is completely shut down and there are travel restrictions across the entire country. Hopefully they will recover before the summer travel season. More than 15% of Italy's GDP is derived from tourism and a decline in tourism would put serious pressure on an already fragile credit rating.

If China is any indication of what we can expect, this will take two months to climax and to taper off. China's President Xi visited Wuhan yesterday and all of the temporary hospitals have been closed. Laborers are returning to work and companies are anxious to get operations back on track. Allibaba said that its food service/packaging business is fully staffed.

The Coronavirus is all that matters and it is the complete focus. It will get worse before it gets better. Central banks lowered interest rates in a coordinated effort to add liquidity and we are likely to see cross currency swaps where sovereigns back each other. Central banks don't want this to turn into a credit crisis and they are doing everything they can to buy a few months of extra time.

Corporations are going to feel immediate pain as consumers slam on the brakes. Cash flow will be immediately disrupted and high-growth companies with weak balance sheets will be impacted the most.

As the Coronavirus spreads and as more people are exposed to it I believe that the fear level will subside. Not everyone catches it and it is less contagious than the flu. Of the people who contract it, 80% will show little if any symptoms and their immune systems will fight it off. I don't want to diminish the loss of human life, but I want to put this crisis into perspective. Out of a population of 1.4 billion people in China, 80,000 have contracted the virus. Of the people who contracted the virus there are roughly 3200 deaths. That means that one out of every 430,000 citizens in China has died from this virus so far. China claims that the death rate was much higher initially because it took time to identify the virus and to provide the proper treatment to early victims.

The biggest factor right now is fear. Consumers and corporations are changing their behavior and that will have an economic impact. It will also translate into lower profits for corporations and into slower growth in the US. Politicians are doing what they can to keep this from cascading. Tax cuts and stimulus programs are likely.

Swing traders need to stay in cash until all of this subsides. There will be an excellent buying opportunity and I don't feel that it is more than a few weeks away.

Day traders need to focus on stocks with relative strength and weakness. Yesterday we did extremely well trading this strategy and we waited for market reversals during the day. The price action yesterday prompted me to hold overnight long positions in SPY and a short position in VXX. I liked the fact that we bounced off of the low Monday and we rallied hard all day and closed on the high Tuesday. I felt that we would see overnight strength and I was wrong. I will be taking some heat on my overnight trades this morning and I first order of business will be to contain the damage. There is no reward for being early. I have avoided overnight risk so far, but today I'm going to take a hit. We did see support yesterday and I feel that buyers will dip their toe in the water at SPY $275. I will wait to see how the early action plays out and if I need to take my losses… I will. I plan to focus on day trading until the number of new coronavirus cases globally starts to subside.

SPY $275 must hold. Another bounce off of that level will attract buyers.

Fasten your seatbelts; it's going to be another rough ride.

.

.

Daily Bulletin Continues...