Market Limit Down Before the Open – Time Is the Key – Use This Day Trading Tactic

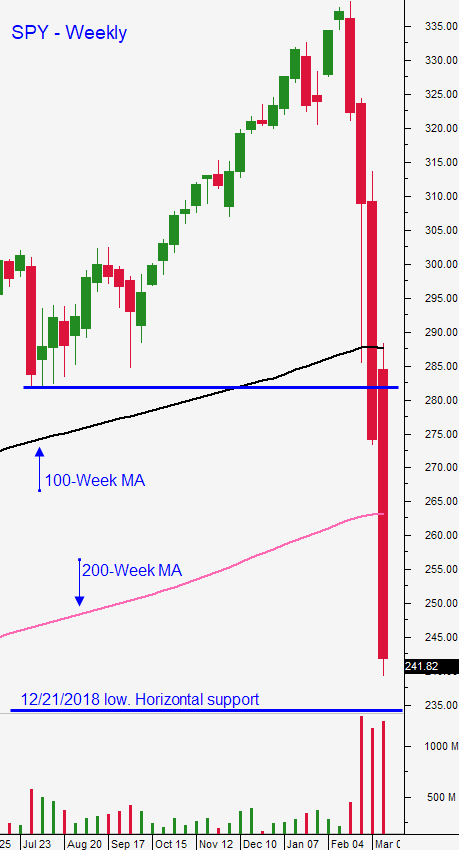

Posted 9:30 AM ET - Last week the market established a support level at SPY $245. That was approximately 28% lower than the all-time high set three weeks ago. The world is trying to contain the spread of the coronavirus through social distancing and the short-term economic impact will be devastating. Central banks are unified and they are guaranteeing each other's currencies through swaps. This event has sparked panic selling and the S&P 500 is limit down before the open.

My geographic area is a microcosm of what's happening globally. Public schools will be closed for two weeks and in some instances they plan to finish the year "virtually". Universities are doing the same thing. All restaurants and bars will be closed indefinitely in the state of Illinois and the CDC is restricting gatherings that exceed 50 people.

I went grocery shopping Saturday morning at 7 AM and the stores were already crowded. Certain items were in high demand and there were empty shelves. Fortunately, people seemed to be in good spirits and I did not notice any panic. I believe that most people are concerned that they might contract the virus and that they might need to self-quarantine for a couple of weeks. That is why they are stocking up.

I live near a massive mall and the parking lot was empty. People are avoiding crowds and they are not spending money on anything that they won't need in the next few weeks. None of us have seen anything like this in our lifetimes and it is happening on a global scale.

China is gradually emerging from this crisis. There are now more cases and deaths globally than there are in China. Industrial production tumbled by 13.5% and retail sales plunged 20.5% year-over-year in January and February. China's unemployment rate surged to 6.2% in February, the highest level ever reported. Fixed asset investment fell by almost 25% (down from 5.4% in the prior month). The rest of the world can expect similar during the next two months.

In my 30 years of trading I have seen economic contractions, but nothing close to this. The economy was roaring and we were going 80 miles an hour a few weeks ago. Now we are slamming on the brakes with both feet. Liquidity will be the greatest issue and central banks are doing everything they can to "lube the engine". US financial institutions have the strongest balance sheets they've had in a decade and we will see if they can take the punch.

Over the weekend the Fed cut interest rates to 0% and they announced a $700 billion quantitative easing program. These actions were needed, but the market is still selling off. Personally, I believe they could've waited until the FOMC meeting Wednesday. They need to save some bullets. An even better move would have been to wait until Friday just after the open. This is a quadruple witching week and that would've sparked a massive short covering rally. I've seen similar moves during the 2008 financial crisis. This type of timing keeps shorts at bay. The Fed is throwing the kitchen sink at the problem and they have made that very clear.

Central banks around the globe cut interest rates in a coordinated manner. Credit is the biggest concern and the G7 are providing cross-currency swaps (guaranteeing each other’s currencies).

Fiscal spending will increase dramatically and the government will sign a bill to provide relief to businesses and workers. President Trump is proposing a payroll tax holiday and unemployment compensation during this shutdown. He has also been calling on the largest companies in the world to help resolve this crisis. His press conference Friday sparked a 170 point S&P 500 rally in the last 20 minutes of trading.

Scientists agree that social distancing is the best way to keep the virus from spreading during this critical stage. If we can get through the next few weeks there is a chance the virus can be contained and that it will die off as temperatures rise. That reprieve will give us time to regroup and hopefully there will be a vaccine in the next six months that will help us combat it in the fall.

Nothing else matters right now. Wars, rocket launches and North Korea, earnings reports, economic data and political debates seem irrelevant to the public.

I don't believe that we are going to see a "V" bottom. We will establish support in the next few weeks and there will be short covering bounces. The aftermath from this shutdown won't be known for many months. When the number of new cases start to decline, I believe that people will gradually return to their previous lifestyle. If a vaccine becomes available (very unlikely in the next six months) we could see brisk buying.

Swing traders need to remain in cash. Yesterday I recorded a video and I highlighted the type of stock I will be looking for once support is established. Given the heavy selling I have to distance myself from the action and bullish put spreads allow me to do that. Option bid/ask spreads are a mile wide and you can't even tell where you might be filled. The only way you can trade spreads is to determine the risk/reward profile that suits you and to place an order at that price. I would only advise this for very seasoned traders and I would use very small size. Once you're in the spread it becomes a binary trade and you should expect to stay in it until the very end. It will either make money or it will lose money and you won't be able to get out before expiration because of the option bid/ask spreads. The best move is to stay sidelined and to wait for a base to form. I believe that in the next three weeks we will have some clarity on the virus and companies will be providing guidance when they release earnings in the next month.

.

.

THIS IS THE TYPE OF STOCK I AM LOOKING FOR - CLICK HERE TO WATCH

.

.

.

Day traders need to identify relative strength and relative weakness. That has been the key to our trading success in the chat room and we will keep doing what is working. As the market tanks we are looking for stocks with relative strength. Option Stalker helps us find them. Once support is established we buy those stocks knowing that they will be the first to rebound. There is a huge edge to this strategy and being in the right stocks provides cushion in the event that the market throws us a curveball. We use the same tactic during market rallies. Those moves help us identify relative weakness and we are prepared to short the stocks when the market hits resistance. Try to focus on a few longs and a few shorts during the day. Don't spread yourself too thin and reduce your size. Stocks are moving at a very fast clip and by trading smaller size you can increase your staying power (use wider stops). Trade stock (not options).

We are in for an ugly start to the week. I would like to see support at SPY $245 hold today, but I think $235 will be tested. Resistance is at SPY $265.

We are in cash we don't have any overnight positions. Your goal should be to get back to cash throughout the day. Set targets and take profits. As long as you are in cash, you are in control.

.

.

Daily Bulletin Continues...