Market Limit Up – Don’t Trust the Bounce – [Day Trading Video]

Posted 9:30 AM ET - This morning the S&P 500 is poised to open 5% higher after its largest single day loss since 1987. Central banks are pumping liquidity into the system to avoid a credit crisis as global activity screeches to a halt. The Coronavirus is spreading and people are afraid. We should expect market volatility for the next month.

Sporting events have been canceled along with concerts and festivals. People are being urged to practice social distancing. There is no vaccine for the Coronavirus and doctors want to prevent its spread during this critical stage. If it gets out of control, hospitals won't have enough beds for patients.

Test kits are being distributed and people will realize that Coronavirus is everywhere. The level of fear will escalate for the rest of the month and then it will subside. People will realize that this is not a death sentence when people they know survive it.

The practice of social distancing will have a dramatic economic impact. Businesses will need bridge loans and the recovery will be gradual. Time is the key component. Scientists are scrambling for a vaccine and most believe that in a best case scenario one will not be ready for another six months.

For those who become sick I have heard that there is an effective treatment where plasma from patients who have recovered from the virus is infused. This procedure has been used for many years and it should increase the survival rates. From everything that I've read, the key is to contain the virus while scientists develop a vaccine.

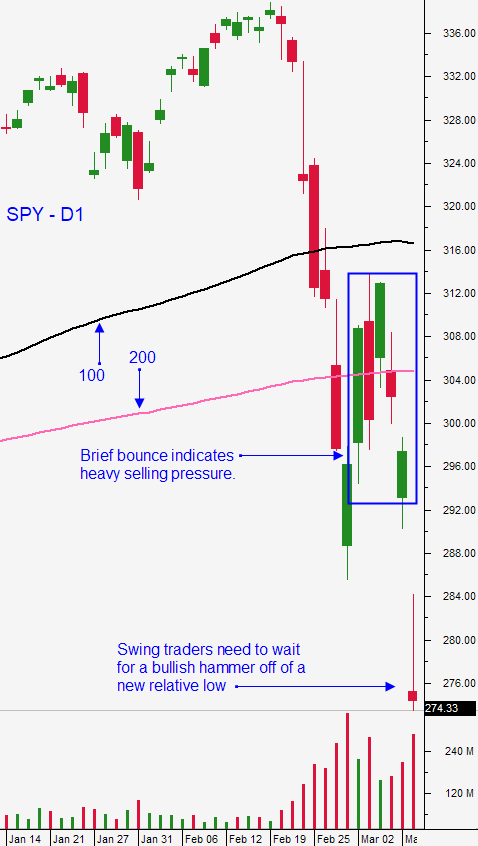

I wouldn't trust the bounce this morning, but I'm happy to see it. The bottoming process will take a long time and we can expect more selling and new relative lows. This is a good day trading environment, but it is not a good swing trading environment. There will be violent moves in both directions during the next month. Q1 earnings season will start shortly and guidance will be critical. One example of a company that will struggle is Disney. Their cruise line will be shut down temporarily along with their amusement parks. People are not going to go to the movies to avoid crowds and they just canceled their release of Mulan. The NBA canceled it season and baseball/soccer seasons have been postponed. Disney owns ESPN. What will they cover? Many large companies will be faced with similar problems as people practice social distancing.

The Coronavirus is a tsunami and it will take time to recover. There will be corporate credit concerns along the way and there could be some casualties. This crisis struck quickly and strong balance sheets will be favored over top line growth.

Swing traders need to remain patient. I urge you not to buy the first dip. As I've been mentioning, this is a bottoming process and it will take a long time to identify "bargains". Stocks have fallen dramatically, but that doesn't mean they are cheap. Earnings will decline dramatically and there will be a price discovery process. Sometimes the best trade you can do is no trade - this is one of those times. Stay in cash and wait for clarity. Soon we will begin to bargain hunt.

Day traders should watch for intraday reversals. This is been a target rich environment and it should last for at least a couple more months. When the market is rallying you should be looking for stocks with relative weakness. When the market rally stalls those will be your best shorts. When the market is declining you should be monitoring your shorts and you should start looking for stocks with relative strength. When the market bottoms those will be your longs. Option Stalker makes it easy to find these stocks and we are using the 1OP indicator to tell us when to be long and when to be short. When I enter a position I am almost immediately placing a target where I would be happy to exit. Sometimes these market moves don't last long and having that target out there really helps. It forces you to take profits and to work towards "a clean slate". When you have very few positions on you can focus on opportunities instead of babysitting positions. I suggest that you keep your open position count down. Have a few good longs and a few good shorts in mind at all times. I think you will enjoy this video and I hope you watch. Please post comments on the video and share your insights.

.

.

WHAT IS DAY TRADING - CLICK HERE TO WATCH THE VIDEO

.

.

I know that massive market moves like this take a toll. If you have survived this move you are likely to be a successful trader. Typically after huge market run ups like the one we have seen for the last 2 years, everyone knows how to make money on the long side - that's the only way they know how to trade. Strong rallies breed bad habits and traders can recover because the momentum is so strong. If you've been able to hold your ground during this period you have given the market the amount of respect that it deserves. You are seeing "both sides" of the coin and you should be proud.

For those of you who have fallen victim to this market drop, I'm sorry for your losses. I've been there. In my 30 years of trading I've never met a successful trader who hasn't been humbled. It is part of the process and only then will you have true respect for the market. Most of you will not recover and you will not trade again. For those who are passionate about this, learn from your mistakes. The road back is long and hard, but not impossible.

Look for a bounce this morning and view it with a skeptical eye. We are likely to see wild moves in both directions during the next month.

.

.

Daily Bulletin Continues...