Long Term Market Direction Will Be Determined In the Next 3 Weeks [New Treatment For CV-19]

Posted 9:30 AM ET - Yesterday the market had its largest single day drop since 1987. The Coronavirus is spreading globally and the United States is shut down. On a macro basis, international travel has been banned. On a micro basis, restaurants, bars and schools have been closed. Gatherings of more than 10 people are discouraged by the CDC. People are stockpiling food and they are practicing social distancing. Global economies have come to a screeching halt and central banks are flooding the financial system with liquidity. The next few weeks will be critical.

Scientists believe that the spread of the virus needs to be contained immediately. If we can flatten the growth curve of the virus we will buy precious time. Biotech companies are scrambling to develop a vaccine and the first dose from Moderna (MRNA) was delivered yesterday. We still do not know if it is effective or if it has side effects. I read that hydroxychloroquine has been an effective treatment in China and it has also been effective in preventing infection. China has been documenting this and it is part of their treatment protocol. This drug is readily available and it costs $0.20 per pill. It has been used to prevent malaria and it can also be used to treat lupus and arthritis. People who are traveling to Third World countries have been taking it for years. If it has relatively few side effects, I'm wondering why there is not widespread distribution.

Thermo Fisher Scientific (TMO) says that it will be producing 5 million test kits per week by April. Major companies around the world are shifting production to produce antibacterial soaps and hand sanitizers. It has been incredible to see how governments and corporations are working together to combat this problem.

If the virus can be contained in the next two months the economy will have a chance to recover quickly. The government plans to offer relief to workers immediately. The actual distribution has yet to be determined, but it could be as simple as a government check that goes out every family so that they can cover bills while they are at home. McDonald's knows that franchisees will take a hit and they are considering waving their leases while this unfolds. In short, everyone is trying to figure out how to financially "bridge" this instantaneous economic shutdown.

If the spread of the virus peaks in the next few weeks and it starts to taper off, I believe that the market will regain its footing. People need to see that social distancing is working and this will provide hope. The financial and economic ramifications can be dealt with once the virus is under control.

Central banks are guaranteeing each other's currencies through swaps. They lowered interest rates in a coordinated manner and fiscal stimulus is being implemented around the world. In the US, our banks have the strongest balance sheets they've had in more than a decade.

The worst case scenario would be that the virus continues to spread at an accelerated pace for more than a few weeks. This would mean that the recovery will take much longer and that the "bridge loans" won't last long enough to prevent a credit crisis.

At this stage you can pretty much throw economic releases and earnings releases out the window. There isn't enough data to know how this is going to play out and no one has been through an event like this. The most critical thing to watch is the spread of the virus over the course of the next few weeks.

I am personally encouraged. People realize the magnitude of the situation and they are "hankering down". Governments and corporations are working together like never before. In some strange way, I believe that this virus will make us all stronger.

Swing traders need to remain in cash until we have clarity. In the next few weeks we need to monitor the spread of the virus and we need to monitor any developments related to treatments (new vaccines, hydroxychloroquine and plasma infusions). Once the virus is contained I believe that the economic recovery will be swift. Activity will not instantly return and it might take a year for us to get back to 2% GDP growth. There will be corporate casualties. Even though my outlook is optimistic, I can't let it bias my trading. Price and volume will determine my trading activity, not my opinion.

Day traders should expect volatility. Our tactic has been effective for years and we have been making great money every day without taking any overnight risk. We will continue to watch for market reversals and we will find stocks with relative strength/relative weakness. We will use these stocks as surrogate market positions and we will use the 1OP indicator to tell us when to be long or short. Option Stalker has been invaluable during these moves. Your objective should be to find two or three stocks that you like on the long side and two or three stocks that you like on the short side. Don't carry more than two or three positions at any time and always have the goal of getting back to cash as soon as possible. Trim your size so that it is easier to manage volatility. Set passive targets and take profits. Then wait for the next opportunity to set up. Repeat.

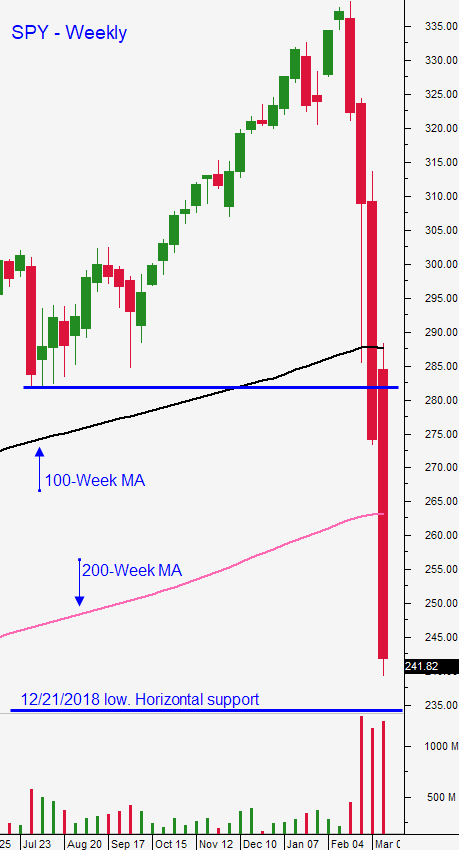

There is longer-term support at SPY $235. Yesterday the SPY found support at $240. I believe that $245 and $265 are also key levels to watch. The S&P 500 has been all over the board overnight and it is currently up 20 points. Expect lots of volatility the rest of the week. Quadruple witching is Friday and that should add to the movement.

Good luck.

.

.

Daily Bulletin Continues...