What Happens In the Next Few Weeks Will Determine How the Next Year Plays Out

Posted 9:30 AM ET - Yesterday the market was able to hold the low from Monday and it finished in positive territory after government officials promised to drop money from a helicopter. Anything that can be done will be done from a fiscal and monetary standpoint. Corporate bailouts and checks to Americans are on the table. Global economic activity has come to a screeching halt as the Coronavirus spreads. The next few weeks are critical and they will determine how the next year plays out.

Countries are closing their borders and restricting travel domestically and abroad. In the United States the CDC wants people to limit meetings to fewer than 10 people. Grocery stores, gas stations and pharmacies are the only retail businesses that are open. The plan is to limit social interaction so that the spread of the virus is contained. Scientists feel that if we can knock down the spread for two or three weeks, we have a chance to knock down the growth curve. This would by us valuable time to develop a vaccine.

Two or three weeks of inactivity might be plausible, but I believe that is about the limit. In a month people will be financially strapped and there won't be any future "helicopter drops". The current measures have to work or the whole system could be in peril.

Countries are guaranteeing each other's currencies through swaps. Central banks have lowered interest rates in a coordinated manner and today the FOMC statement will be released. I can't remember the last time that an FOMC statement was a non-event. With interest rates at 0%, $1.5 trillion in liquidity injections during the last week and a $700 billion quantitative easing program, there is not much more they can say or do. Fortunately, banks have strong balance sheets and they should be able to weather the next few weeks.

In a best case scenario the virus stops spreading in a few weeks and there is light at the end of the tunnel. People will gradually return to work in the next two months and the economy will try to crawl out of this hole. This will all take time and the market will stabilize in May.

Biotech companies are scrambling to provide test kits and they are already testing vaccines. Unfortunately, it will be at least 6 to 8 months before there is a vaccine and this timeline would require fast tracking by the FDA.

In a worst-case scenario the virus is still spreading at a rapid pace a month from now and credit concerns surface.

China has been hiding facts and there is still much that we don't know about Coronavirus. We don't know how long it survives on hard surfaces, how it spreads or what treatments are effective. China knew about this virus back in November and they tried to cover it up. We can't really trust their data so we will have to rely on what is happening in South Korea and Italy. It does appear that the virus has a steep curve and that it flattens out in 3 to 4 weeks.

I believe that national healthcare officials are rightfully trying to scare the heck out of everyone so that they stay home. These drastic measures suggest that this is not your run-of-the-mill virus.

Swing traders should wait patiently on the sidelines. We have not seen this type of market volatility since 1929 and this is a great time to be in cash. I will be posting my Weekly Swing Trading Video tonight. We will be looking for strong stocks that are poised to lead the recovery when it happens. Option bid/ask spreads are unbelievably wide and that is another sign to stay in cash.

Day traders should relish the moment. We've gone through periods with extremely tight intraday ranges during the last two years. There is incredible movement and 30 point five-minute bars on the S&P 500 are common - be very careful. It is critical to wait for the right window of opportunity and to make sure that all of the technicals are in place. The last two days we've had some incredible gains trading the S&P 500/SPY and we have also been able to make money trading stocks with relative strength/weakness. We will keep doing what is working. Reduce your size and try not to have more than two or three open positions at any time. Your goal is to set targets and to get back to a cash position. I don’t like the reason for this volatility, but it is comforting to know that we can thrive under the most challenging market conditions. Quadruple witching is Friday and we can expect lots of volatility.

Time is the key right now. In the next two or three weeks we will know if social distancing is working and we need to see that the spread of the virus has peaked (number of new cases decreasing). I have been saying for weeks that I believe the virus has been here for a long time. These test kits will confirm that and the numbers will scare people initially. They will assume that the virus is spreading when it has actually been here for a while. Once everyone realizes that we've been walking around with it and for the most part fighting it off, they will breathe a little easier (pardon the pun). We need to gauge how widespread it is and we need to see that this plan of action is working. Only then will all of the fiscal and monetary actions have significance.

The next two weeks will be gut wrenching, but I believe fear will climax.

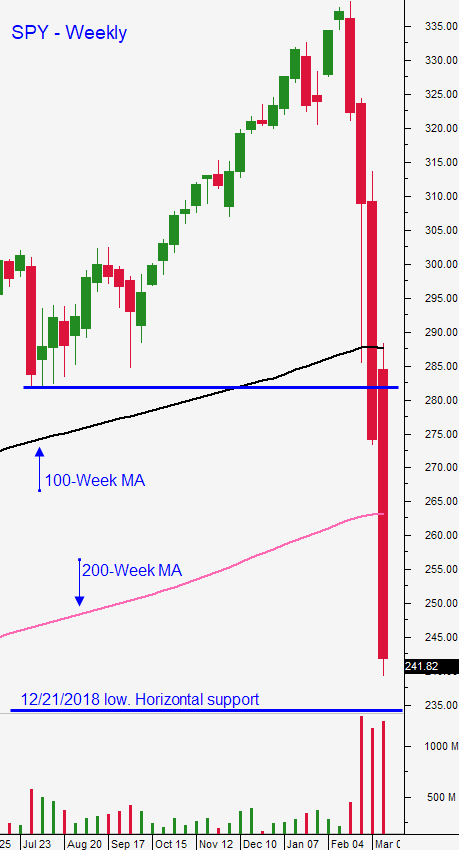

Support is at $245 and $235. Resistance is at $265.

Stay home - stay healthy.

.

.

Daily Bulletin Continues...