Fear Has Not Peaked – Swing Traders Start Selling Naked Puts On Stocks You Like [Way OTM]

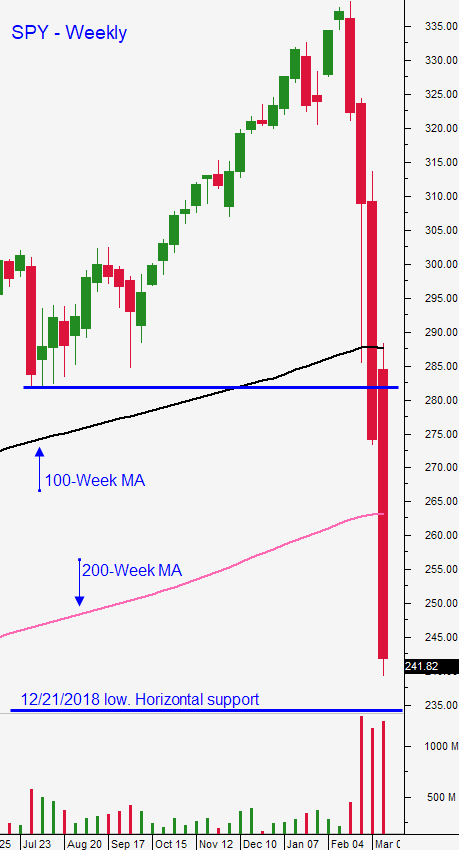

Posted 9:30 AM ET - Yesterday the SPY traded below horizontal support at $235. That was the low from December 21, 2018. Stocks were able to bounce off of that level late in the day. Central banks are flooding the market with liquidity as the Coronavirus spreads. Governments are planning "helicopter drops" of money to keep people calm and at home. A full out global effort is underway to try and knock this virus down. The next few weeks will be critical.

I'm not going to add much to the commentary today because anything that can be done is being done from a fiscal and monetary standpoint. The ECB launched a €750 billion bond buying program to support the eurozone economy. Australia lowered its rates by .25% and it is attempting quantitative easing for the first time.

We can expect more liquidity, more travel restrictions, more business closings and more Coronavirus cases in the next few weeks. Fear is already high, but it will not peak for another couple of weeks.

Countries don't even know how widespread the virus is. No one has been testing for it until recently. These new tests will reveal that it is everywhere. People will panic assuming that the increase is a sign that it is spreading quickly. That is simply not the case. It's been here and we are just trying to establish a base so that we can calculate how fast it spreading. According to studies in China and South Korea, the virus spread tends to taper off after 30 days (the starting point is when 100 official cases have been identified). We are probably at the two week mark in the US.

It's important to note that not everyone who has Coronavirus will die. The mortality rate is somewhere between 1% and 3%. The variance is huge because we can't trust China's numbers. South Korea has been much more successful at battling this than Italy and Iran.

When a virus that kills a few hundred thousand people turns the world's financial system upside down, you know that this is a house of cards. Debt levels from the consumer all the way up to central banks is at extreme levels. The only recourse is to flood the system with money and the printing presses are running full tilt.

I expect to see more selling in the next two weeks. The only chance for a reprieve at this stage is a decline in the virus spread rate. If it happens in the next few weeks the fear level will subside and life will gradually return to normal. If the spread continues to accelerate and the global shutdown has to continue for more than a month the "wheels will start to wobble".

I personally believe that we've done everything possible in the US and that the spread will be contained. The recovery will take a long time. Biotech companies are racing against time and they know the stakes are high. I believe that treatments will be available in a few months and that a vaccine will be developed in the next six months (distribution is another matter).

Swing traders can dip their toe in the water. Last night I released my Weekly Swing Trading Video. We are going to sell far out of the money naked puts on stocks that we want to own. Option implied volatilities are ridiculous and I would jump at the chance to buy these stocks at the strike price we are selling. The key to this strategy is selecting good stocks. We are not going overboard; we are just trying to generate some income while we wait for clarity. Apart from these trades, you should remain in cash. We will continue to use this strategy and we will gradually deploy some of our cash.

Day traders need to keep doing what is working. Identify stocks with relative strength and relative weakness and use those as surrogate market positions. We have been trading intraday market reversals with great success. The S&P 500 was extremely volatile yesterday and it was much easier for us to hanker down in individual stocks.

Quadruple witching is tomorrow and that might add to some of the volatility.

The S&P 500 is only down 35 points before the open. It's laughable, but it almost feels like the market is flat. These are unusual times.

SPY support is $216 and $233. Resistance is at $245 and $260.

.

.

Daily Bulletin Continues...