This News Is Creating Hope and That Is Why the Market Is Up Today

Posted 9:30 Am ET - Yesterday the market showed some signs of stabilization and I noticed two-sided activity. In recent weeks we have seen every bounce faded and that seemed to change yesterday. There are signs that buyers are nibbling and the S&P 500 is up 25 points before the open. We can still expect more downside as the Coronavirus continues to spread, but there are signs that the bid is returning.

Analysts are citing full-out government stimulus and monetary easing as the reason for the rally this morning. Although those measures are critically important, I attribute the stabilization to a possible treatment. Hope is what we need and there isn't any amount of government stimulus that will matter if people are afraid they will die.

In early February when I warned of the Coronavirus, I also cited a treatment discovered by a university in China. It was a cocktail of antibiotics and now the recipe is known. It combines a common antibiotic called "Z-Pack" and the generic drug called hydroxychloroquine. In controlled studies it has been nearly 100% effective. China did not have any new cases of Coronavirus yesterday (if you believe their news). Both of these drugs are readily available and inexpensive. Mylan labs and Teva Pharmaceuticals are ramping up production along with other big drug companies. If I knew about this a month ago, why weren't we producing the heck out of it and distributing it ahead of time?

If there is a treatment that can be mass-produced, conditions will change immediately. This "cocktail" eliminates the virus in five days. People can go back to work and the economy can gradually get back on its feet. Scientists will have time to develop a vaccine.

Unfortunately, much of the damage has been done. I read this morning that half of China's retailers don't have enough cash to survive the next six months. This is also likely to play out in the US especially for small companies and "brick-and-mortar" businesses.

News outlets claim that the virus is spreading dramatically. That's not actually true. The virus has been here for a long time, we are just now determining how broad-based it is through testing. In the next week the number of incidents will jump and then we will be able to accurately gauge the spread rate. Fear will climax in the next week or two.

Swing traders were able to sell the out of the money naked puts on the stocks we highlighted Wednesday evening. This is the first time we dipped our toe in the water and I think these are going to be fantastic trades. They will allow us to take advantage of extreme option implied volatilities and to generate income. We sold the Google April (17) $650 puts for $6. Can you imagine buying Google at a net price of $644? If these options expire worthless we will generate a 5% return in a month (60% annualized). I will take that bet any day of the week. The stock would have to drop 50% in the next month for us to get assigned (unlikely). We will be looking for more opportunities like this so that we can deploy our cash. The key is to find strong companies that will marginally be impacted by the Coronavirus.

Day traders need to focus on stocks with relative strength and relative weakness. This is how we trade market reversals. Don't trade the S&P 500. Yesterday I went on a rant in the chat room. There is no edge to trading the S&P 500 and we can only do this when we have strong directional movement intraday. The market is going to be transitioning and trading the S&P 500 is going to be extremely difficult. Yesterday I went 11-0 day trading stocks. There is lots of sector rotation and we are seeing steady directional price movement in underlying stocks. This is our edge.

.

.

HERE IS THE PATTERN WE TRADE AND HOW WE FIND IT - CLICK HERE TO WATCH THE VIDEO

.

.

.

Today is quadruple witching and we should see excellent movement. I will be looking for possible lotto trades late in the day, but option liquidity might prevent me from finding good lotto opportunities.

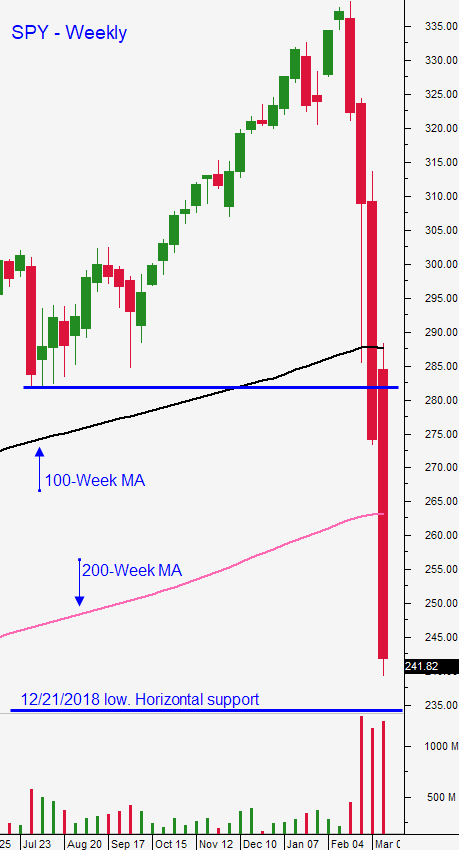

Expect more market downside with signs of bottoming in the next week or two.

.

.

Daily Bulletin Continues...