Buy SPY At This Price – Start Selling Naked Puts On Stocks Like This [Video With Pick]

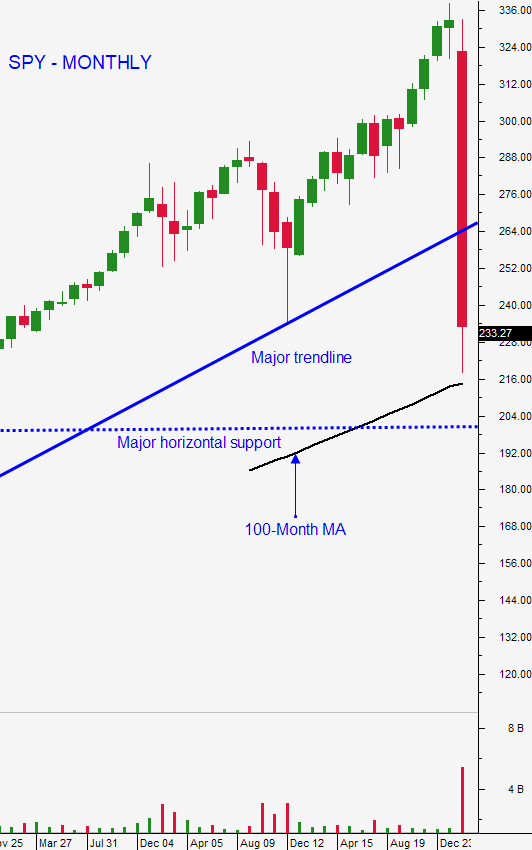

Posted 9:30 AM ET - Last week the market closed at a new three year low. Horizontal support SPY at $235 failed and the S&P 500 is down 50 points before the open. The 100-month moving average is at $215 on the SPY and there is also support at $200. If we reach that lower level it would represent a 41% decline from the high in five weeks. I've been trading for over 30 years and I have not seen market movement like this. I do believe that an excellent opportunity is setting up and we are taking advantage of it.

Everyone is on board with the Z-Pack/hydroxychloroquine "cocktail" and this morning I heard Dr. Oz talking about a trial he is personally financing. By his calculation there are enough doses for 2 million people nationally. President Trump is not waiting for the FDA; he is securing these drugs immediately. This is consistent with his "right to try" legislation and he wants this treatment available for anyone who is infected. These drugs have been approved by the FDA for other uses and the side effects are minimal. If someone is on a ventilator, why would we make them wait? The frustrating thing from my perspective is that I mentioned this "cocktail" in my blog more than a month ago. I'm not a genius and I'm not a doctor, but I do keep up with news and I conduct at least a few hours of research every day. The clinical tests have been small to this point, but the treatment has been 100% effective. Teva Pharmaceuticals and Mylan labs are producing as much of it as they can.

Before we can talk about an economic recovery, we have to tackle the spread of the virus. Test kits are being distributed nationwide and there are some new kits (CHPD) that will yield results in 45 minutes. Approximately 2 million people have been tested for CV-19 and the infection rate seems to be running at about 7%. This virus has been around for a long time and we are trying to establish a base so that we can calculate the spread rate. Now that we are testing for it, the number of new cases will explode and that will frighten people. I've been mentioning this for the last two weeks. I believe that another one to two weeks of depressing news will hit the wires and that fear will climax.

I am more concerned about credit than I am the virus. When I drive by one of the biggest shopping malls in Illinois, I see an empty parking lot and I start to wonder how long this can last. Brick-and-mortar retail has been suffering for years and this could put them over the edge. REITS like SPG could be in trouble. As I'm writing this, the S&P 500 futures have rallied 130 points on news that the Fed pledges asset purchases with no limit.

The market is waiting for Congress to pass a $1.8 trillion fiscal stimulus package. Both parties feel that they can have a deal in 24 hours.

Here's the bottom line. If we can control the spread of the Coronavirus and the growth rate starts to slow in two weeks we can get through this. The country has been on lockdown and in my geographic area (Chicago) people are staying home. According to the information I have gathered the virus growth rate starts to flatten out after 30 days and we are entering our third week in the US. I believe that the antibiotic "cocktail" will work and that we will get through this crisis.

I have a friend who lives in Shanghai and they said that life is very quickly returning to normal. Restaurants have reopened and people are going back to work. China views this as an opportunity and this conversation was encouraging. China has a six week lead on us and they are coming out of it. Make no mistake, the economic wounds are deep and the recovery will be lengthy.

Swing traders should start deploying cash. We started selling out of the money naked puts on strong stocks last week and I highlighted another stock pick in my video Sunday. We are also going to place an order buy SPY at $216. This will be a half position with no stop. We will still see more downside, but with each passing day the chance of a snapback rally increases. There will be many aftershocks and we can expect retracements. Ultimately, I feel that this is a good long-term entry point and that it is time to start nibbling.

.

.

DON'T BUY THIS STOCK - SELL NAKED PUTS [VIDEO]

.

.

.

Day traders should remain fluid. The same method we've been using for years is producing fantastic results. Use the 1OP indicator for the SPY as your guide on a five minute basis. When it spikes and crosses you should take gains on your long positions. When the indicator is declining and the market is pulling back, search for stocks with relative strength. Relative Strength 30 and Bull Run are my two favorite searches. When the 1OP indicator troughs and crosses, start scaling into long positions. In the last few days I have been focusing on the long side and that will continue today. I don't like shorting stocks in this environment. Prices are very compressed and shorts are difficult to trade. We are seeing a pattern where the stock takes three steps down and two steps backwards. This jerky price action is not orderly (like it has been in the last month) and it is difficult to stick with the short position. On the other hand, stocks that are bouncing have nice consistent buying throughout the day and they are much better prospects. From this point forward I believe longs present better day trading opportunities and we are likely to see some days where buying will be like "shooting fish in a barrel". We have been able to thrive during the most challenging market conditions in my 30 year career and I'm proud of our systematic trading approach.

Take a deep breath, the bottom is close and a fantastic opportunity is almost at our doorstep.

.

.

Daily Bulletin Continues...