Buy the SPY This Morning – Use This Approach [Stock Pick For Naked Puts]

Posted 9:30 AM ET - This morning the market is going to open higher and it will erase the losses from Monday. Investors were disappointed when Congress did not pass the stimulus bill and it will be passed in the next day or two. The Fed has pulled out all of the stops and it will engage in relentless asset purchases if needed. The backstop is in place and the virus will soon run its course. An excellent buying opportunity is setting up.

Investors will continue to panic during the next two weeks as people are being tested for the Coronavirus. Now that we are testing for it, the baseline will be established and we will realize that the infection is widespread. In the next week we will have that baseline and we will be able to gauge how quickly it is spreading.

The number of new cases and the number of new deaths has declined for two straight days in Italy. That is exactly 43 days after the start and this is the same pattern we saw in South Korea. That puts the US 14 days from reaching the apex.

The number of new cases in China has been zero for at least a week. They are now opening the Hubei province where it all started. A friend of mine in Shanghai reported that people are quickly returning to work and that restaurants have reopened. The recovery has been brisk.

President Trump wants Z-Pack and hydroxychloroquine production increased so that the “cocktail” is readily available. Mylan Labs and Teva Pharmaceuticals are ramping up production. In a relatively small clinical trial this treatment was 100% effective. Both drugs are FDA approved for other uses and the side effects are minimal.

Flash PMI's in Europe plunged to 31.4 and a reading below 50 indicates economic contraction. China's GDP is expected to drop 10% in Q1. We can expect horrible economic data points during the next few months as the recovery starts to take root.

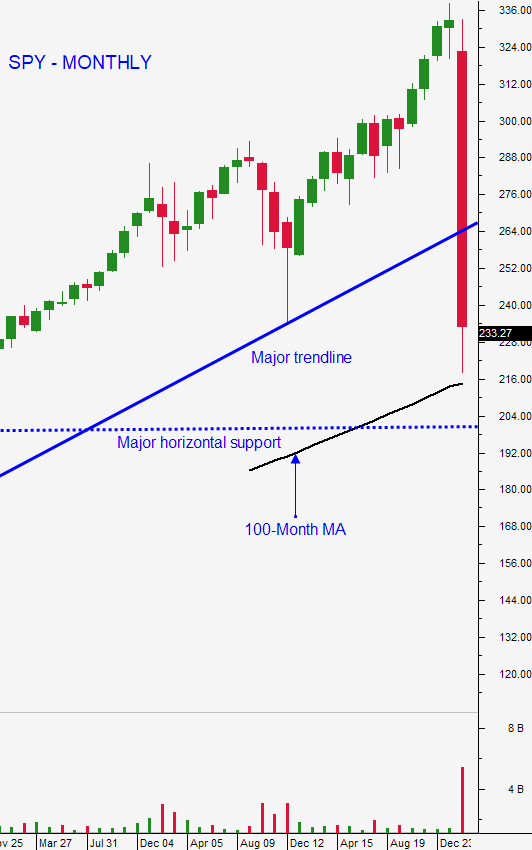

Swing traders should buy 1/2 position of the SPY 60 minutes after the open. We were not able to buy yesterday at our price, but we got close. Expect to take heat on this position. We are going to see lots of pullbacks and bounces. Consider this a longer-term investment and not a trade. For those of you who are more nimble, I still prefer selling out of the money puts (naked) on strong stocks. I have been producing videos that highlight the stocks and this strategy. It is a great way to distance yourself from the action and to generate income. We are taking advantage of time decay and incredibly high option implied volatilities. I've been telling you for the last 60 days that there is a lot of pain ahead, now it is time to start deploying some of that cash. Major support is at SPY $215.

.

.

.

GREAT STOCK FOR SELLING NAKED OUT OF THE MONEY PUTS - 4 MINUTE VIDEO

.

.

.

Day traders should expect this early bounce to be tested. Sellers will check the strength of the bid early and you should see a slight retracement. If that process is brief and the dip is shallow it would be a sign that buyers are fairly aggressive. If the pullback is fairly lengthy and the market makes a new low after one hour of trading it will be a sign that buyers are still fairly passive. The stimulus bill will be passed and I believe that event is already priced into the market. When it actually happens, we should get a "sugar high" rally. I am only trading from the long side. The price action has been much more consistent and I'm able to stick with the positions during some of this market chop. When the market finally starts to rebound this will be like "shooting fish in the barrel". We will rely heavily on Option Stalker searches.

I am expecting to see market support during the next week and a long-term low will be established (we may have seen it yesterday).

.

.

Daily Bulletin Continues...