We Bought SPY and We Continue To Use This Options Trading Strategy [Swing Trading]

Posted 9:30 AM ET - Yesterday the S&P 500 closed 250 points above its low for Monday. Stocks were able to hold the opening gap higher and they rallied late in the day. We should not assume that we will be off to the races, but this is a sign that the bid is strengthening. We still have a couple of very bad news weeks ahead before fear subsides.

The Coronavirus continues to spread, but the domestic rate is still unknown because we are establishing a baseline. People were not being tested previously and now they are. We won't be able to gauge the spread rate until that baseline is established. Until then, people will associate the number of new cases as the spread rate and these numbers are inflated. New York City is a "hotspot" because of the population density.

In my opinion the virus has been around for a long time and is much more widespread than we know. Fortunately, the vast majority of people fight it off and many are not aware they even had it.

Yesterday MFA failed to meet margin calls and this residential/commercial mortgage-backed lender in New York looks like it will be a casualty. This was a relatively small market capitalization company of $3 billion, but it is a warning sign. Credit is the big concern and the government plans to do everything it can to provide much-needed liquidity. If this all out shutdown only lasts two more weeks, we should be able to recover. Anything longer than a few weeks could pose serious credit issues. We've had to deal with economic declines of 5% before, but nothing on this scale. No one really knows how this will all play out because we've never seen anything like it before.

On a positive note, China seems to be getting back on track. Their statistics are exaggerated, but the epicenter in Hubei province is getting back on its feet. Israel is producing 400 million doses of hydroxychloroquine and this treatment will be readily available in coming weeks. This drug is been around for 70 years and the side effects are almost nonexistent given that treatment ends in five days.

Politicians are haggling over the $2 trillion stimulus bill in typical fashion, but it will be signed. The market is pricing this in.

Many companies are pulling guidance. Target was the most recent company to do so. Nike posted excellent results overnight and the stock is up 10%. Facebook cited that traffic is up, but advertising is down. Square Inc. lowered revenue guidance and the stock is up 1.5% after the news (better than feared). Amazon has six distributions with a Coronavirus incident.

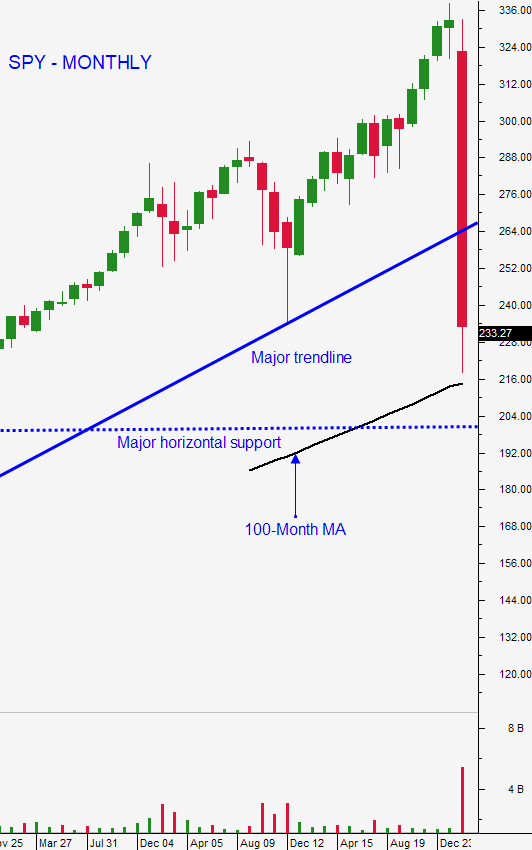

Swing traders bought a 1/2 position of SPY at $238 an hour after the open yesterday. We are starting to deploy cash and we can expect to take some heat on this position. I believe this is an excellent long-term entry point. We have also been selling out of the money naked puts on strong stocks. Last night I recorded my Weekly Swing Trading Video a day early because I did not want to miss this opportunity. Option implied volatilities are starting to decline rapidly and I did not want to wait another day. In this week's video I highlighted five excellent candidates and the market decline on the open this morning should help us get filled. These stocks would have to decline dramatically in the next few weeks for us to get assigned. By the way, if we do get assigned I want to buy the stocks at those depressed levels. If we don't get assigned, we will generate a 10% return on margin per trade in a month. The risk/reward is exceptional. I don't believe that the market will be off to the races, but I am expecting a bid at this level and I am expecting the low from Monday to hold through April 17th. If the market retests that low, these stocks will hold up better than the rest and I do not expect them to get close to our short strike price.

Day traders need to be careful on the open. The big rally yesterday will be vulnerable and the bid will be tested early this morning. I still like trading from the long side and I will be looking for stocks with relative strength on the open. I suggest tracking the five stocks I highlighted in my video last night. These are excellent candidates and they have shown relative strength during the last week of trading. Use the 1OP indicator as a guide and start buying stocks when it is in a deep trough. Start taking profits on long positions when it is spiking. Every time I buy a stock trade I place a sell order for at least ½ of the position a target price. My goal is to continually lock in profits and to get back to cash so that I have maximum flexibility and objectivity.

Watch for the bid to strengthen in the next two weeks. Given the Coronavirus curve in other countries, the US still has two horrible weeks ahead before the spread rate starts to taper. The market is forward looking and that is why the bid is strengthening now.

.

.

Daily Bulletin Continues...