The Market Is Finding Support – Keep Scaling In and Use This Options Trading Strategy

Posted 9:30 AM ET - Yesterday the S&P 500 showed some signs of life. The market checked the bid early in the day and the damage was relatively contained. A strong 150 point S&P 500 rally ensued and stocks were off to the races. A good chunk of those gains were erased in the last 20 minutes on news that the Senate was not able to pass the stimulus bill. They did so last night and now it rests with the House. The S&P 500 is down 35 points before the open this morning.

The Coronavirus is making its way around the globe. From the date that the first infections are recorded, the virus typically takes 43 days to climax. Conditions are improving and Italy, but worsening in other parts of the world. The US is less than two weeks from hitting that apex and according to Governor Cuomo, New York is heading in the right direction in the last 24 hours. It's important to note that the spread rate is not increasing as dramatically as the media is reporting. We weren't testing coronavirus weeks ago and now we are. That baseline has to be established before we can calculate the spread rate. The news will be "heavy" for another two weeks, but then we will see improvement and fear will start to subside.

The “cocktail” of hydroxychloroquin and Z-Pack is being mass produced by Teva Pharmaceuticals and Mylan Labs. Clinical data for this treatment is very promising and Oracle will crunch the numbers nationwide.

We should expect shockingly poor economic releases. Activity has come to a screeching halt like never before. Initial jobless claims came in at 3.28 million and we’ve never seen anything remotely close to this. We should expect dismal results for the next few months.

The spread curve for the virus needs to be smashed down in the next two weeks and I believe social distancing will accomplish that. If these lockdowns last more than a couple of weeks, the credit wheels will start to wobble. Yesterday, Treasury Secretary Mnuchin said that $4 trillion worth of asset purchases is still available after the $2 trillion package is signed by Congress in the next few days. That is an incredible war chest and it demonstrates that the Fed will do everything in its power to prevent even a hint of a credit crisis in the next two months.

The virus dominates the headlines and it will soon run its course. We will deal with the economic aftermath for the rest of the year. For the next month, economic releases won't mean much and companies will pull earnings guidance.

China was the first to emerge from the virus and they are getting back on track very quickly. Restaurants have reopened and the epicenter (Hubei Province) has lifted travel restrictions. I believe that Chinese companies might present excellent buying opportunities. Two weeks ago Alibaba reported that its food packaging and food delivery service were fully staffed.

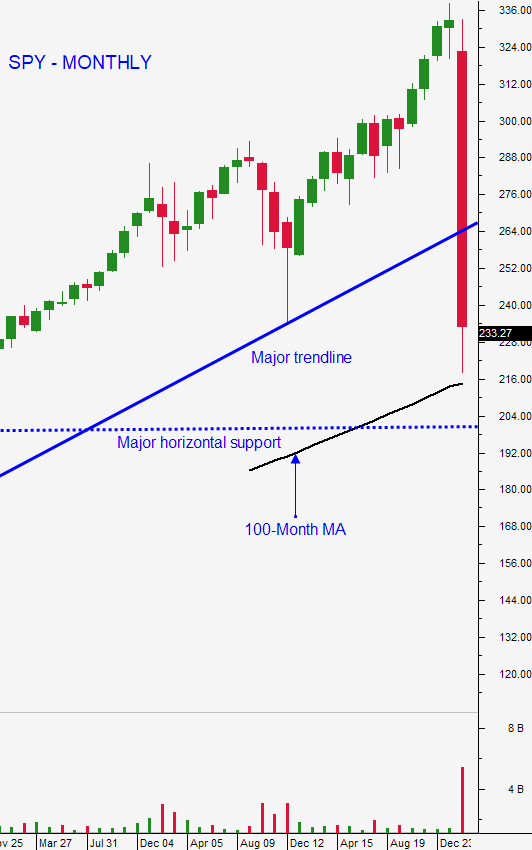

Swing traders are long 1/2 position of SPY at $238 from earlier in the week. That is a longer-term entry point for us and we have been selling out of the money naked puts on stocks that we want to buy at deep discounts (35% below the current price of the stock). We have eight positions on and each will generate a 10% return in the next few weeks if we are not assigned. Option implied volatilities are stratospheric and we are taking advantage of that condition. I believe that the market bid is strengthening. Asset Managers are forward-looking and they will not wait for the spread rate to decline in two weeks, they are starting to buy now. Option implied volatilities are starting to decrease. This bottoming process will take time and I don't believe that we will see a "V" bottom. We will continue to look for put writing opportunities and we will be ready to add the second half of our SPY position.

Day traders should focus on the long side. The market will be soft on the open and the bid will be checked. As I noted in yesterday's video, this is when you need to look for relative strength. Have your three or four excellent candidates loaded and ready to go. As the market starts to find support, start buying those stocks. As soon as the market releases, these stocks will fly and you should have your targets already set. The first round of profits should come within the first 60 to 90 minutes of trading. The goal is to get back to a cash position so that you can objectively evaluate the market. After that first run we will have to wait for the next window of opportunity. This is the tactic we have used with fantastic success this week and Option Stalker is helping us find the stocks.

Use the opening decline is an opportunity to find stocks with relative strength. During the course of the next few days the market bid will strengthen and the Coronavirus news will gradually improve.

Support is at SPY $245 and $235 and resistance is at $255 and $265.

.

.

Daily Bulletin Continues...