Buyers Are Engaged But Not Aggressive – Use This Options Trading Strategy For Swing Trades

Posted 9:30 AM ET - Yesterday the S&P 500 showed early strength and the market was able to get through the high from Wednesday. After compressing for four hours we saw a massive buy program five minutes before the close that sparked a 70 point S&P 500 rally. Those gains will be given back this morning on the open. Conditions will remain volatile, but a market bid is building.

The Coronavirus is a wildfire that is spreading across the globe. We have areas with scorched-earth where the recovery has begun (China and South Korea), we have areas that are a blasé (US and Europe) and we have new areas where there is smoke (Africa and Mexico). From the time the first 100 cases are confirmed, the virus hits its peak at the 43 day mark. The US is less than two weeks from hitting that apex and fear will continue to grow for one more week.

It's likely that some parts of the country will be able to gradually resume to normal lifestyles in the next few weeks as the virus spread decelerates. Other areas with dense populations are likely to struggle for more than a month and there could be some interstate travel restrictions imposed to isolate the problem.

Teva Pharmaceuticals and Mylan Labs are producing as much hydroxychloroquine and Z-Pack as they can. This is a safe "cocktail" and it is an effective treatment. These drugs have been around for decades. There are many clinical trials being conducted on this combination and Oracle is centralizing the data.

There will be some good things that come from this pandemic. The government and large corporations are working together like never before. Online education at the K-12 level will be developed and we are likely to see increased online learning. This will give students in underserved areas a chance to get excellent interactive education. The US will also identify key products that need to be manufactured domestically for national security reasons. We've had the wool pulled over our eyes for far too long and this crisis removed the blinders.

The $200 trillion stimulus bill will be passed this weekend. We are six months out from an election and neither party wants to look bad. It is already priced into the market. Treasury Secretary Mnuchin said that they have a $4 trillion war chest that they can unleash on this economy to prevent a financial crisis and anything that can be done, will be done. This will keep a bid to the market, but there will be many aftershocks as we try to recover from this economic shutdown.

Yesterday we learned that there were 3.2 million new jobless claims filed. It would've been multiples of that number if people had been able to get through. The website was inundated with new applications and they couldn't process them. The streets are empty, the parking lots are empty and most of the nation is at home obeying the lockdown. These claims will skyrocket in the next month with half of the workforce at home.

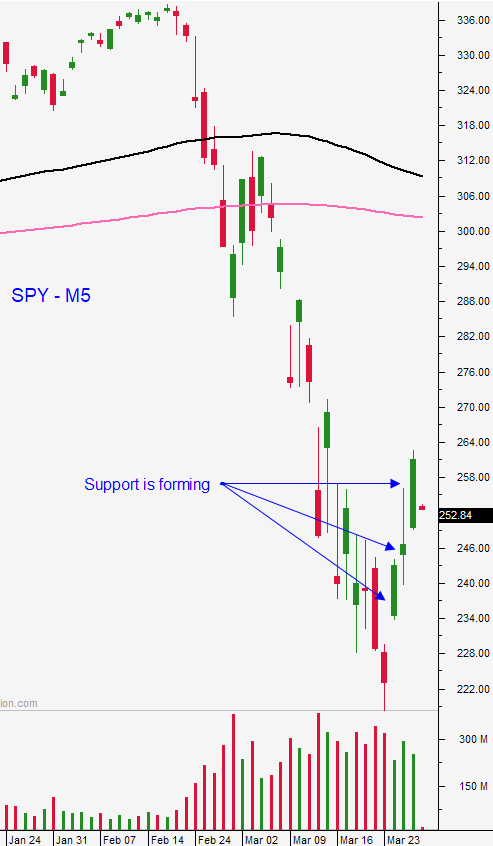

Swing traders are long SPY at $238 from earlier in the week. Set a target to exit at $288. We are miles from that, but anything can happen in this crazy environment. We have been selling out of the money naked puts and we have eight positions on. They will expire April 17th and they will generate a 10% return in a month on average. Alternatively, we will be assigned on very strong stocks 30-50% below their current price. We want to get assigned, but that is unlikely. Either scenario works for me. The market bid is growing, but we should expect many aftershocks and a bottoming process that will take months. I believe that we have one more horrific news week ahead of us and then the headlines should start to improve.

Day traders should keep doing what's working. As the market pulls back this morning we will be looking for relative strength. We will have our handful of stocks ready to go when market support is established. We will buy the stocks and we will set targets. Once the market bounces the stocks will take off and we will take profits when we hit our targets. The majority of our money has been made in the first two hours of trading and the goal is always to get back to cash. After that first bounce we will wait for the next opportunity. This allows us to reduce our risk and to objectively monitor the market. When the next market dip runs its course we will repeat this process. I prefer to trade from the long side and I'm finding much better price action for stocks that have been pounded and that are starting to bounce. The short side has been much more difficult to trade. It's critically important that day traders realize that there are times when you need to be in cash. If you don't have the set-up, don't have a position on. I chose not to trade the close yesterday because the price action was very choppy and I did not have a good sense of market direction. That was a good decision because we saw a five minute bar with a 30 point S&P 500 drop and a five minute bar with a 70 point S&P 500 rally. There is no way to trade that type of price action and your best trade was no trade. Carefully select your windows of opportunity and be patient. I have outlined my game plan and you need to have yours before the open. Some of you might like trading the short side and that is fine, just make sure you outline your parameters ahead of time.

Watch for support after this early market drop. From my perspective, we are just giving back the gains from that massive by program near the close.

.

.

Daily Bulletin Continues...