If This Happens This Week I Will Know It Is Time To Buy Stocks [Pick]

Posted 9:30 AM ET - A week ago the market established a new three-year low when it traded below SPY $220. Stocks rebounded the rest of the week and the bid has strengthened. Amid concerning Coronavirus headlines, the S&P 500 is up 10 points before the open. This is the first time in three weeks that we are not opening "limit down". The headlines will be very "heavy" this week and we could see market weakness.

The United States now has the most confirmed Coronavirus cases in the world. President Trump extended the shutdown through April and the market is taking the news pretty well. Healthcare advisors were concerned that the Easter timeline was too aggressive and new data suggests that the country needs to continue social distancing for a few more weeks. This will have an incredible economic impact. President Trump said that without any mitigation efforts the death toll could have been greater than 2 million people in the US. The goal now is to keep that number around 100,000.

The media likes to report the number of new confirmed Coronavirus cases and to compare them to the previous number. This implies that the virus is spreading quickly and that is not accurate. We were not testing for Coronavirus previously and we are establishing a base. Abbott Labs announced that it has a new test that will only take five minutes. The good news is that we will be able to quickly determine the base. The bad news is that it will seem like the virus is spreading quickly if you don’t understand the process and you just read the headlines.

Major economic releases are slated this week and they include official PMI's, ISM services, ISM manufacturing, ADP and the Unemployment Report. ADP could be the most devastating report since the company process payrolls for medium and small size businesses. They have their finger on the pulse and I believe it will be representative of current conditions. The roads are empty and so are the parking lots. We should expect that tens of millions of people are out of work.

The $2 trillion stimulus package last week was critical and it will help us bridge the gap. Treasury Secretary Mnuchin said that another $4 trillion worth of stimulus is possible. Anything that can be done - will be done to avoid a credit crisis. Monthly rents/leases will be due this week and lenders will be stressed. Fortunately, our financial institutions have the strongest balance sheets they've had in a decade. Most banks will relax current policies during this catastrophic event and the government will back the banks.

This same scenario is playing out around the world.

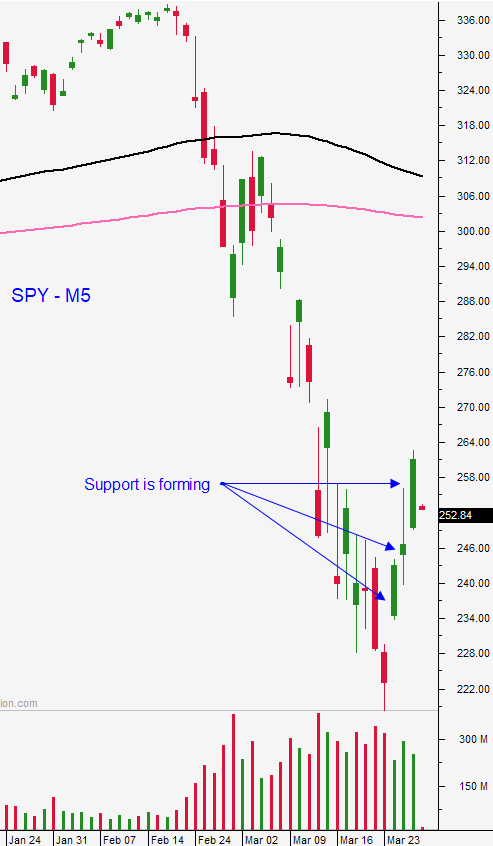

Swing traders are long 1/2 position of SPY. Place an order to buy half a position of SPY at $220. We will hold without a stop. In the last two weeks we have been selling out of the money naked puts on strong stocks. Our short strike price is more than 30% below the current stock price and it would take a dramatic decline for us to get assigned. If we do get assigned, we will gladly buy these stocks at these incredible prices. The game plan will be to sell "rich" calls against the stock. A drop of this magnitude would create a spike in option implied volatilities. Once we sell the calls we will have additional downside protection. When the stock rallies it will be called away and our gain will be the put and the call premium we collected. I see this scenario is extremely unlikely, but it would produce fantastic returns. A more likely scenario is that the naked puts expire and that we generate a 10% return on margin for these trades. This is the strategy we need to use. We can expect more selling and we are likely to take some heat on our SPY position. A few months from now we will look back at this price and recognize it as an excellent entry point.

.

.

.

.

THIS IS A GREAT NAKED PUT TO WRITE - CLICK TO WATCH THE VIDEO

.

.

.

Day traders should find stocks with relative strengths early in the day. Wait for the market to come in and be ready to buy. Once we get the first rally off of the low have your targets placed and take profits. The objective is to continually get back to a cash position so that we can objectively evaluate the market. We might get two of these excellent windows each day and you have to be patient. I prefer to trade from the long side because I'm finding that the price action is much more orderly and the moves are sustained. Option Stalker searches have made it easy to find these stocks (Bull Run, Heavy Buying and Relative Strength 30).

The news was pretty frightening over the weekend and the economic data points this week will be dire. I am expecting to see some selling this week and we could test the lows from last Monday. I'll be watching the price action and if SPY $220 is able to hold, I will view that as bullish. It will be a sign that buyers are lining up even as conditions deteriorate.

We have two more weeks of horrible news and then conditions should gradually start to improve.

.

.

Daily Bulletin Continues...