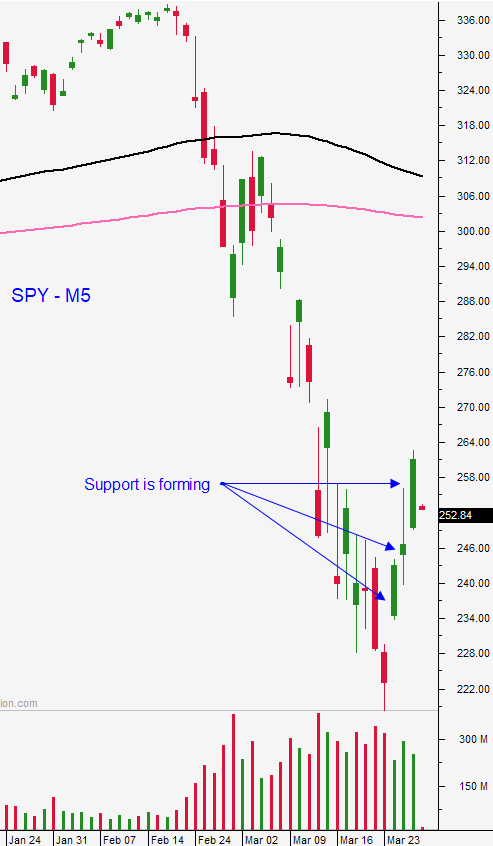

Here’s Proof That the Market Bid Is Strong – Buy Dips This Week

Posted 9:30 AM ET - Yesterday the market opened flat and that was an improvement. The prior three weeks we have seen limit down moves to start the week. As the day progressed, the bid strengthened. I believe that we will see some dire news this week as the coronavirus continues to spread in the US. Economic releases will be horrific and fear should climax in the next week or two.

China's manufacturing PMI came in at 52 and that suggests that the rebound is underway. Italy had its lowest number of new Ccoronavirus cases in almost 2 weeks and conditions are improving. The United States is likely to hit its apex in another two weeks.

Tomorrow's ADP report will be disastrous. The company processes payrolls for small and medium-size businesses and they have their finger on the pulse. I believe that almost 50 million people are currently unemployed during the shutdown.

The government will do everything in its power to avoid a financial crisis. The $2 trillion stimulus package is a starting point and the Treasury Secretary said that another $4 trillion is available if needed.

Any weakness from this point forward will present an excellent buying opportunity. I don't believe that the low from last week will be tested, but it would present an excellent entry point for the second half of our SPY position.

Swing traders have been selling naked puts on strong stocks for the last two weeks and we have eight positions that are in fantastic shape. We also have 1/2 position in SPY ($238) that we are holding without a stop. We will wait for the news and for a market dip before we add to the position. Yesterday's market rally was very telling. Sellers could have pushed stocks lower when it was announced that the death rate in the United States could eclipse 200,000 and that the shutdown needed to be extended through April. Instead, buyers continued to scoop stocks.

Day traders should look for relative strength on the open today. Once the selling pressure subsides, buy these stocks. This strategy has been working beautifully for us and I believe that buyers are engaged. Set targets and take profits along the way. Your goal should be to get to cash as often as possible. That will allow you to objectively evaluate the market and you can wait for the next window of opportunity.

Look for some selling pressure over the course of the next few days as dire economic releases hit the newswires. Swing traders should be prepared to buy a dip this week once support is established.

.

.

Daily Bulletin Continues...