Sellers Will Test the Market Bid Early – Here Is the Tactic You Should Use For Day Trades

Posted 9:30 AM ET - The S&P 500 is up 90 points before the start of a very "heavy" news week. The death toll from the Coronavirus will jump dramatically as the virus spreads. Scientists believe that we could be close to the global peak and there are signs that the spread rate is starting to decelerate. Buyers and sellers will be pairing off as the bottoming process for the S&P 500 begins.

Buyers feel that this is an excellent buying opportunity and that trillions of dollars of federal stimulus will "bridge" the one month income void created by the shutdown. Once the virus is contained consumers will return to work and they will resume their previous spending habits. With global interest rates at 0%, investors are forced to own equities so that they can generate a reasonable rate of return. Pent up demand will instantly reverse this economic standstill.

Sellers feel that the shutdown will force consumers to curb consumption. Uncertainty will prompt them to error on the side of caution until they know that their jobs are safe and that the companies they work for are back on track. This slow rebound will have a devastating impact on many companies and some will not survive. Credit issues could surface at the corporate level as capital-intensive industries struggle to make interest payments. In this scenario, credit issues start to surface (personal, corporate and sovereign).

I can make a case for both scenarios and it's too early to predict the outcome. The first step of the healing process is to contain the virus. If we can do that by the end of the month and if new cases decline dramatically, the country can start to recover in May. If we are still struggling to contain the virus in May the economic recovery will be exponentially more difficult. China has been reporting new Coronavirus cases the last few days and this is a reminder that the virus is very resilient.

Once the virus is contained we will have to gauge the economic rebound. We don't know if businesses will tap into the government loans and we don't know if lenders will be able to shoulder the credit risks from non-performing loans (mortgage payments, credit card payments, rent and leases).

Market declines like the one we saw in Q1 typically take 18 months to establish the trough. History suggests that this bottoming process will take a very long time. The bullish scenario would require absolute perfection. The virus would need to be squashed in the next few weeks, businesses would need to take out "bridge loans", banks would need to be willing lenders, workers would need to immediately return to work and consumers would need to resume their prior spending habits. There are many weak links in this chain.

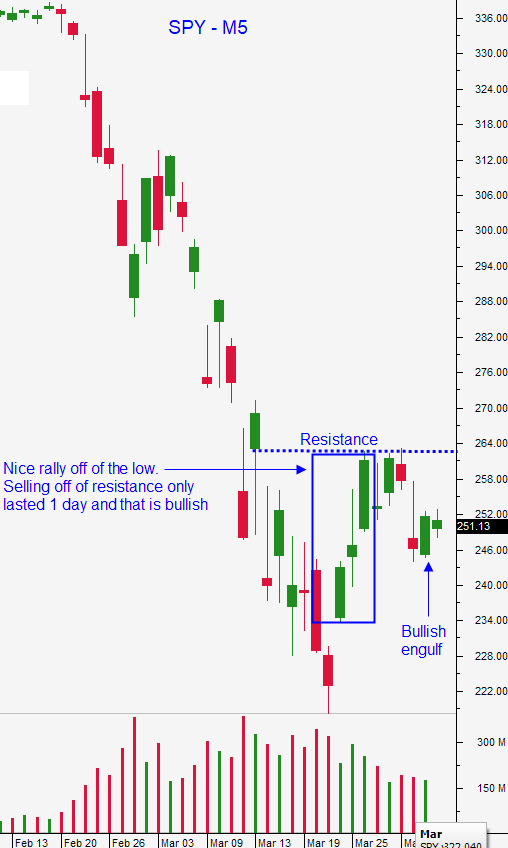

I believe that the market will hold on support at SPY $218 for the next month and that we will see back-and-forth movement with a wide range ($218 - $288). Traders will closely monitor the speed of the recovery and they will watch credit ratings very closely.

Our swing trading plan will generate income while we wait for clarity. We will take advantage of high option implied volatilities and we will attempt to buy strong stocks at much lower prices. We are selling naked puts on companies that have strong balance sheets and business models that will not be dramatically impacted by the virus. Stock selection is critical and I am leaning on my fundamental analysis skills. We will also buy SPY near the low end of the range and we will take profits when it rips higher. We currently have a half position of SPY ($238). Place a limit to exit this position at SPY $278. Our goal is to stay fairly liquid and to monitor conditions for the next few months.

Day traders need to be cautious on the open. This is a big overnight rally and the bid will be checked. I don't sense that anyone feels an urgency to dive into this market with so many unknowns. During that early probe or support, find stocks with relative strength. We want to buy them when market support is starting to form. Immediately place targets so that you are exiting these positions on market strength. Once you are back to a cash position, wait for the next market dip and repeat. This strategy has worked extremely well the last two weeks, but it did not work well Friday. That was a tough day and the selling pressure was very heavy. We did not have any market bounces and the longs eventually drifted lower with the market. Selling pressure like that will not go away easily and we should see it in the first hour today. I still feel that the price action is much more consistent on the upside and the moves are orderly and sustained. I plan to trade from the long side today, but I need to make sure that market support is firmly in place.

Look for depressing Coronavirus news this week and a gradually improving news cycle next week. Expect two-sided action. Rallies that are over-extended will cave in to selling pressure and drops that are over-extended will attract buyers. Wait for these moves to stall and trade reversals.

.

.

Daily Bulletin Continues...