Market Bid Is Holding – This Is the Key To A Market Rally In the Next Month

Posted 9:30 AM ET - Yesterday the S&P 500 found support just above the low from Wednesday and it rallied the rest of the day closing on its high. This was very close to forming a bullish engulfing pattern on a daily chart and it is a sign that buyers are engaged. The news cycle will be extremely "heavy" for another week and the selling pressure during the next few days will help us gauge the level of conviction. With global interest rates at 0%, investors have few alternatives. Money will gradually start working its way back into equities.

This morning we learned that 701,000 jobs were lost during the month of March. This is grossly understated because state unemployment offices have not been able to process applications fast enough. Furthermore, the government shutdown had barely begun when these statistics were being compiled. The Bureau of Labor Statistics stopped collecting data a couple of weeks ago. Analysts know that this number will explode next month so it has little bearing on the price action today.

ISM manufacturing came in at 49.1 on Wednesday and that was considerably higher than I expected. This is a survey and it tends to be forward-looking. ISM services will be posted this morning after the open and it will be an important number. The service sector accounts for 80% of our economic activity and we can expect a big drop. I question the reliability of these numbers after seeing the ISM manufacturing data point earlier in the week.

The Coronavirus continues to spread and the US is 7 to 10 days away from hitting the apex. We won't see a meaningful market rally until the virus is contained. Once the numbers start decreasing the focus will shift to the economy.

Extreme debt spans from personal to sovereign levels. When individuals don't have enough saved to shoulder a few weeks of unemployment it says a lot about how over-extended we are at the most basic level. As the economy starts to recover we will see if consumers are more cautious or if they return to their old spending patterns. In my opinion, this is the biggest wildcard and it will determine how quickly economic activity returns to previous levels.

Government loans to small businesses will be available in the next few weeks. Companies will be able to fund leases, payroll and other overhead expenses. As long as employees are retained the government will forgive the loans. The devil is in the details and much is still unknown. Banks are asking if they will be responsible financially for making bad loans and they won’t participate until they know. If this plan works, it could bridge the gap created by the shutdown. It will take months for the dust to settle and there will be corporate casualties.

Sovereign debt levels are skyrocketing. In the US our deficit will exceed $3.7 trillion this year. Almost every central bank is printing money like mad and we are seeing broad-based quantitative easing (money printing). As long as everyone plays nice in the sandbox, this charade can continue indefinitely. Central banks are engaging in cross currency swaps, essentially guaranteeing each other.

Credit is the biggest issue and there are many weak links in this chain. If the shutdown only lasts a few more weeks and consumers returned to their old habits we should avoid any credit catastrophes. If the business loan program works we could pick up right where we left off and be back on track early next year. There are a lot of "ifs" in this statement.

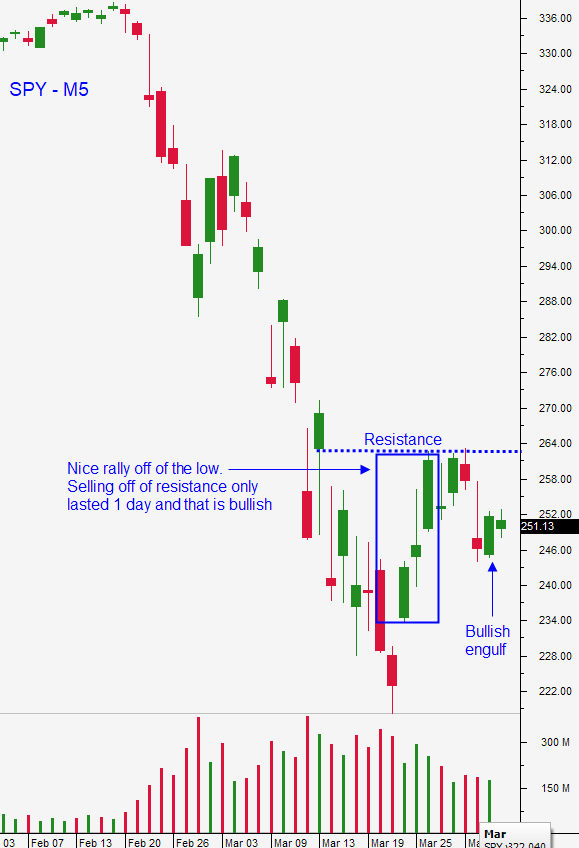

Swing traders are long a half position of the SPY at $238. We will look to add on a dip and we will look to take profits on a rip. We have been selling out of the money naked puts on strong stocks that we hope to acquire. They would have to lose more than 1/3 of their value in the next few weeks for that to happen and it is extremely unlikely. When these options expire worthless we will generate approximately a 10% return per trade. Option implied volatilities will continue to contract and it will be harder for us to generate the same level of income. The good news is that time will provide clarity and we will know how all of this is playing out. Swing traders need to be cautious for a few more weeks while the virus runs its course.

Day traders should focus on the long side. I view the immediate support that we saw yesterday as a bullish sign. The S&P 500 is only down eight points after a horrendous jobs report this morning. This week I have tried "shorts" with very limited success. My best trades have been on the long side where the price action is much more consistent and the moves are more sustained. I have been waiting for market dips and those moves reveal stocks with relative strength. I keep pounding Option Stalker searches like Relative Strength 30 and BullRun to find these stocks. I am looking for stocks that are compressing or grinding higher when the market is drifting lower. As soon as the market finds support I start buying and I immediately set targets. When the market bounces, these stocks release and my targets are reached quickly. I get back to a cash position as soon as possible and I wait for the next market decline. This systematic approach has been producing fantastic results. If I start buying stocks too early and the market continues to drift lower I am able to exit these trades at a very small loss or a scratch. This is the advantage of trading relative strength and we work this edge as hard as possible in the chat room each day.

My plan is to keep my overnight risk to a minimum by selling far out of the money naked puts on strong stocks that I want to own. If I'm not able to buy them I will generate excellent income. If I do buy them, I will sell rich at the money calls against the stock position. The second part of my approach is to generate income by day trading.

Look for very heavy news during the next week. There will be slivers of light a week from now and we should see signs that the virus has climaxed in the US.

Support is at SPY $235 and $245. Resistance is at SPY $265 and $271.

.

.

Daily Bulletin Continues...