Set This Target For Our SPY Long Position – We Want To Take Profits On This Bounce

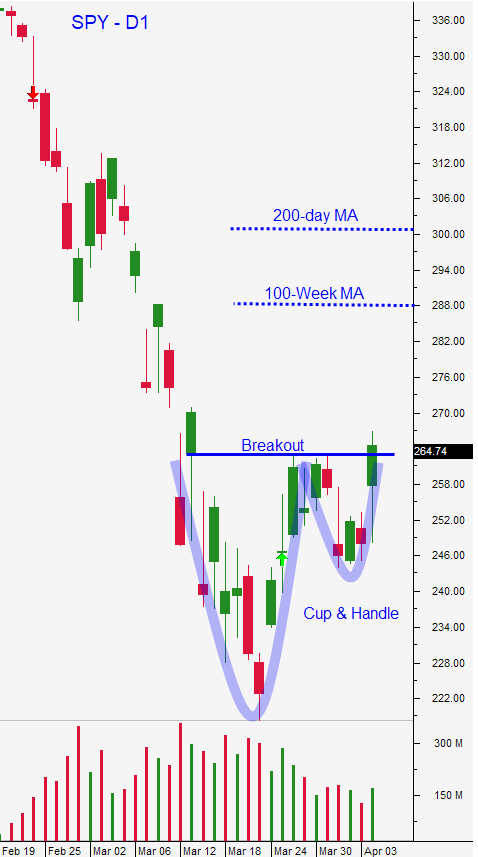

Posted 9:30 AM ET - Yesterday the S&P 500 gapped higher and it surged into the closing bell. It is through the lip of a cup and handle formation and we are gapping higher this morning. The news has been depressing, but buyers are focused on global Coronavirus improvements. As I've been mentioning for a few weeks, the virus has to be contained before meaningful market rally can unfold.

Buyers are going to error on the long side given that global interest rates are at 0%. With the virus spread decelerating they will buy stocks on the notion that massive monetary and fiscal stimulus will spark an economic recovery. If businesses are able to resume operations in the next few weeks, credit issues might be avoided. Consumer confidence is also needed and they need to resume their old spending habits.

Businesses need to apply for government loans and they need to retain employees. Banks are still trying to determine their liability for these loans. The government pledged $2 trillion to a stimulus program and the Treasury Secretary said that there is another $4 trillion in the war chest. Countries around the world are printing money like mad and everyone is going on a global spending spree.

Momentum will carry stocks higher for the next week. I believe that we could reach SPY $288. That is the 100-week moving average and it is the upper and of the trading range I outlined yesterday. We have not contained the virus yet and we are not out of the lockdown. The clarity is very low at this point and this is simply a bounce from an oversold condition. This bottoming process will take time and I don't believe that we will see a "V" bottom.

Swing traders need to place a limit order to sell SPY at $278. If we hit that level today we will gladly take profits on our half position that we bought at $238. If the recent gains hold, we will raise that limit to $288 in the next few days. The market will have to run hard today to reach our target and I am a willing seller if it gets there. Our naked puts are in fantastic shape and the threat of assignment is negligible. We will generate a 10% return on average for these trades. We were looking for a pause in the selling and we are getting one. Option implied volatilities are tanking and we are positioned for it. We did not take a larger position in SPY because there was a lack of clarity. That condition still exists and we will take profits on this rally. In the next few months we will have a chance to reload.

Day traders should watch the early action today. After a massive run yesterday it's hard to imagine that the gap higher will hold this morning. If the market grinds higher for the first 45 minutes and then reverses, we can consider short positions. The low of the day will be an excellent entry point for shorts. If it fails the market will fill in some of the gap created on the open today. I will have a difficult time getting long on the open if we rally without a dip. We need those pullbacks so that we can gauge the strength of the bid and so that we can identify stocks with relative strength. Yesterday we did not get that dip and we did not participate in the early part of the rally. My discipline won't allow me to chase stocks and I didn't want to be the chump who gets the rug pulled out from under him on a reversal. We knew that a dip late in the day would day present a buying opportunity and we jumped on it. We were able to enter excellent longs and our patience paid off. We need to use that same patience today.

After a massive market rally from the lows Friday I believe we will be looking at trades from "both sides". The momentum clearly points higher and we need to favor the long side. This will be a bottoming process over the course of the next few months and we are not "off to the races". This economic recovery will take a very long time.

.

.

Daily Bulletin Continues...