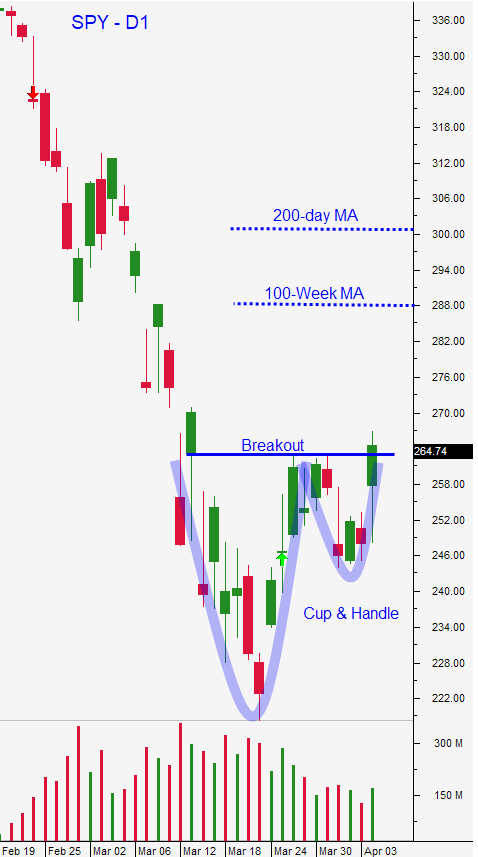

If the Market Holds This Critical Support Level It Will Rally Next Week

Posted 9:30 AM ET - Monday the S&P 500 staged an impressive rally and it broke through a cup and handle formation. Buyers rushed in Tuesday morning, but the opening gap higher failed. This is a sign that sellers are still nearby and they will be aggressive when the market gets ahead of itself. As I've been saying for many weeks, this market bottoming process will take months. The S&P 500 is up 30 points before the open and it looks like support at SPY $262.50 will hold.

The Coronavirus continues to spread and the death toll in the United States is climbing. The rate of increase will start to decline and buyers are anticipating better news from this point forward. Interest rates are at 0% and that will keep a bid to the market. Money is being printed at record levels by central banks around the world. Buyers are hoping that fiscal and monetary policies will facilitate a speedy economic recovery.

If the lockdown ends in April, credit risk will remain relatively low. Businesses will tap government loans and employment conditions should improve by Memorial Day. Every additional week of lockdown will have an exponential impact on the recovery and a credit crisis is possible if it lasts through Memorial Day (unlikely).

Consumers will remain cautious until they know that their jobs are secure. Stimulus checks could take months to reach consumers who don't have direct deposit information with the IRS. Spending will take months to recover.

The FOMC minutes will be released this afternoon and I'm not expecting any news. The Fed is doing everything possible.

Swing traders should place an order to sell our half position of SPY at $278. If we hit that target today we will take profits. The market would really have to reach for that level to take us out. The longer we stay above SPY $262.50 the better and we will raise our target to $288 on Thursday. Our out of the money naked puts are in incredible shape and we are generating an average return of 10% per month on these positions. Tonight I will release this week's Swing Trading Video and I will focus on the same strategy.

Day traders should look for two-sided action. The market is well off of its lows and we will have attractive logs and shorts at this level. Expect nice trading ranges that visit both extremes during the day. I still prefer to trade from the long side and I look for stocks with relative strength during market dips. Once the selling momentum wanes, I buy these stocks and I immediately set targets. When the market bounces these targets are hit and I return to cash. This is been the daily routine and sometimes we get two nice windows of opportunity. I suggest trading half of your size in the afternoon. Late day moves tend to be less consistent. Make your money early in the day and fight to keep it the rest of the day. Avoid the last 15 minutes of trading - volatility has been extreme and unpredictable in the final minutes of the trading day.

This is a holiday shortened week and we could see lighter trading volumes and tighter ranges. Earnings season will begin next week and that will provide new opportunities.

.

.

Daily Bulletin Continues...