Market Rally Should Continue – Here Is the First Target [We Could Reach It Next Week]

Posted 9:30 AM ET - As expected, the coronavirus news is improving globally. The spread rate is declining and the number of new deaths is also decreasing. In the US we are likely to hit the apex in the next few days. Only a week or two ago the models suggested a death toll between 100,000 - 220,000. Now scientists believe it will be closer to 60,000 in the US and fear is subsiding.

The initial market bounce will be related to the virus. We can't start an economic recovery until it is contained. Businesses need to promptly resume operations when the lockdown ends on April 30th. The government will forgive loans taken by small businesses that retain their employees and this program is a transfer payment to workers. This $2 trillion stimulus program has never been tried before and Treasury Secretary Mnuchin said that another $4 trillion is available if needed. Governments around the globe are printing money like mad.

In the next few months we will be able to assess the economic damage. Consumers will evaluate job security before they start spending and this economic recovery is going to take a year or more. Credit concerns will be elevated and we should expect some corporate casualties. Brick-and-mortar retailers, airlines, cruise ships, hotels, theme parks and car manufacturers are in the crosshairs.

The initial reaction to the Coronavirus was violent and we saw the largest market decline since the Great Depression. This was an overreaction and we are likely to see a nice bounce to horizontal resistance in the next few weeks. The market will spend some time digesting earnings guidance and economic data points. We are likely to see choppy trading in a wide range this summer.

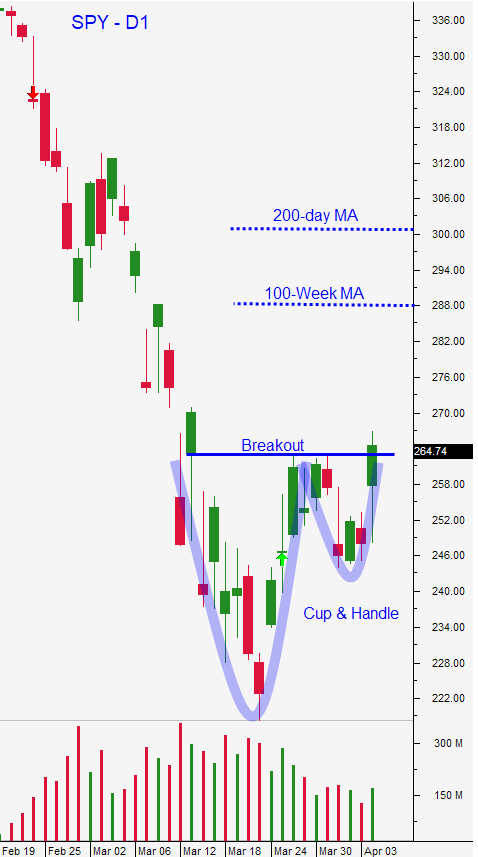

I am short-term bullish and I want to raise our target for the SPY position to $288. That is the 100-week moving average and I believe we can get that high. The next resistance level is SPY $300 and that is the 200-day moving average. Option implied volatilities remain elevated and premium selling strategies are the best way to generate income during this time of uncertainty. We are selecting strong companies with rock solid balance sheets and we are selling out of the money naked puts. On average these trades are generating a 10% per month return. Last night I recorded my Weekly Swing Trading Video and I highlighted four new candidates. We are buying back the naked puts that we sold a few weeks ago for a couple of pennies so that we can release that margin and sell new naked puts. We will continue using this strategy until the dust settles.

Day traders should focus on the long side. The market momentum is very strong and your windows of opportunity will come during market dips. They may not last long, but this is your chance to find relative strength. Get your wish list ready and start buying these stocks when the market finds support. Option Stalker searches like Heavy Buying, Relative Strength 30 and Bull Run make it easy to find these stocks. Keep clicking through the lists and focus on the top 10 prospects. After you enter the trade, immediately place a limit order to sell at your target price. When the market bounces these stocks will shoot higher and you will take profits on strength. Once you get back to a cash position, wait for the next market dip and repeat the process. Full-time traders using the combination of our swing and day trading strategies are making great money and we are going to stick to this game plan.

The trading range may be fairly compressed today ahead of a holiday. Look for light volume conditions. I believe that the market bid will be fairly strong for another week. Earnings season starts next week.

Happy Easter!

.

.

Daily Bulletin Continues...